Regulatory 📜 Challenges Impacting Bitcoin Businesses in Netherlands

– The cryptocurrency landscape in the Netherlands faces a unique set of regulatory challenges that impact Bitcoin businesses operating within its borders. Navigating through the intricate web of laws and regulations governing this evolving industry requires a keen understanding of the legal framework and a proactive approach to compliance. From licensing requirements to data protection regulations, Bitcoin enterprises must stay abreast of the ever-changing regulatory landscape to ensure continued operations within the Dutch market.

– As authorities grapple with the intersection of traditional financial regulations and the innovative nature of cryptocurrencies, Bitcoin businesses in the Netherlands must adapt to the evolving regulatory environment. Striking a balance between compliance and innovation is key to fostering a thriving ecosystem while addressing the concerns of regulatory bodies. Overcoming these challenges requires a comprehensive understanding of the legal landscape and a commitment to upholding the highest standards of compliance in an increasingly complex regulatory environment.

Compliance 🕵️♂️ Navigation for Bitcoin Startups in the Netherlands

Navigating the complex landscape of compliance requirements for Bitcoin startups in the Netherlands can be a daunting task. From staying updated on regulatory changes to implementing robust AML/KYC procedures, startups face a myriad of challenges in ensuring adherence to legal frameworks. Developing a comprehensive compliance strategy tailored to the Dutch market is crucial for long-term success and sustainability in the industry. By proactively addressing regulatory hurdles and fostering a culture of compliance within their organizations, Bitcoin startups can position themselves for growth while mitigating potential risks. Striking a balance between innovation and adherence to legal obligations is key to navigating the intricate regulatory environment in the Netherlands.

Aml/kyc 💳 Obligations Faced by Bitcoin Companies in the Netherlands

Navigating the complex landscape of anti-money laundering (AML) and know your customer (KYC) obligations in the Netherlands presents a crucial challenge for Bitcoin companies. Ensuring compliance with these regulations is not only a legal requirement but also essential for maintaining transparency and trust in the industry. By implementing robust AML/KYC processes, Bitcoin businesses can demonstrate their commitment to combating financial crimes such as money laundering and terrorism financing. Moreover, these obligations serve as a protective shield, safeguarding both the company and its customers from illicit activities within the digital currency realm.

Tax 💰 Implications: Bitcoin Business Compliance in the Netherlands

Tax implications are a critical aspect of compliance for Bitcoin businesses operating in the Netherlands. Navigating the intricate tax laws and regulations can be challenging for startups in the Bitcoin industry. Understanding the tax obligations and implications specific to Bitcoin operations is crucial to ensure compliance with Dutch tax authorities. Failure to comply with tax regulations can result in penalties or legal repercussions impacting the viability of the business.

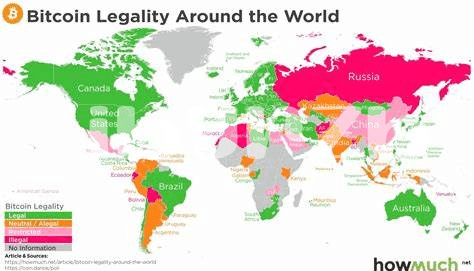

For more information on the regulatory landscape for Bitcoin and cryptocurrency, explore the regulations in Nauru and find out is bitcoin legal in Nicaragua? Visit is bitcoin legal in Nicaragua? for insights into the legal frameworks governing digital currencies in different jurisdictions.

Licensing 📝 Requirements for Bitcoin Enterprises in the Netherlands

Bitcoin businesses in the Netherlands face a set of specific requirements when it comes to obtaining the necessary licenses to operate within the legal framework. The licensing process involves detailed scrutiny to ensure compliance with regulations and safeguard consumer protection, financial stability, and the overall integrity of the market. Understanding and meeting these licensing requirements are crucial steps for Bitcoin enterprises to establish credibility, gain trust from customers, and operate legitimately in the Netherlands. Failure to adhere to these stipulations can result in penalties, suspension, or even closure of operations, highlighting the significance of diligently navigating the licensing landscape in the Bitcoin industry.

Future 🚀 Outlook for Compliance in Bitcoin Industry in Netherlands

The future outlook for compliance in the Bitcoin industry in the Netherlands is one filled with opportunities for growth and development. With the rapidly evolving regulatory landscape, businesses in the country will need to stay agile and proactive in adapting to new compliance requirements. Collaboration between industry players and regulators will be crucial in shaping a more transparent and secure environment for Bitcoin enterprises. The use of innovative technologies and advancements in compliance tools will also play a significant role in streamlining processes and ensuring adherence to regulatory standards. Overall, the future holds promise for a more robust and compliant Bitcoin industry in the Netherlands.

is bitcoin legal in nauru?