Regulatory Hurdles: Understanding Bitcoin Compliance 🚧

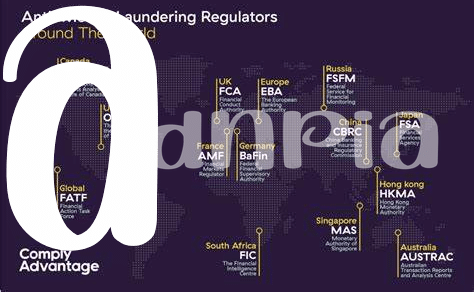

Navigating the complex web of regulations surrounding Bitcoin compliance can often feel like a daunting endeavor. From understanding the various regulatory hurdles to ensuring full compliance, businesses in Madagascar are faced with a challenging landscape. The intricate nuances of AML laws add another layer of complexity, requiring meticulous attention to detail. It is crucial for companies to grasp the intricacies of these regulations to navigate the ever-evolving world of Bitcoin compliance effectively and stay ahead of the curve.

Aml Laws in Madagascar: Key Considerations 💼

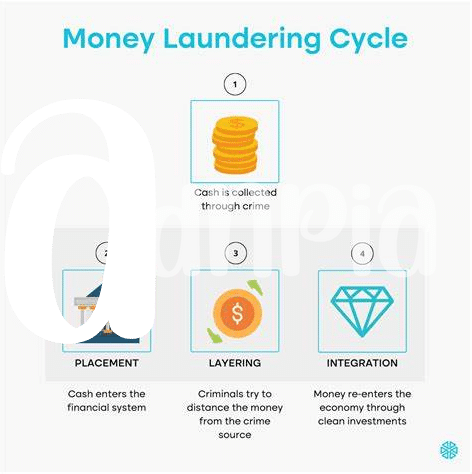

Madagascar has established key considerations for Anti-Money Laundering (AML) laws that impact businesses operating in the Bitcoin space. These regulations are designed to prevent money laundering and ensure financial transparency within the country. Understanding and complying with these AML laws is crucial for businesses utilizing Bitcoin in Madagascar to avoid legal repercussions and maintain trust with regulators. By adhering to these regulations, businesses can contribute to a more secure and accountable financial ecosystem in the region.

Adhering to Madagascar’s AML laws requires a comprehensive understanding of the regulatory landscape and a commitment to implementing robust compliance measures. Businesses must conduct thorough due diligence on their customers, monitor transactions for suspicious activities, and maintain detailed records to demonstrate compliance when required. Additionally, staying informed about any updates or changes to AML regulations in Madagascar is essential to adapting and evolving alongside the regulatory environment.

Challenges Faced by Businesses in Aml Compliance ⚠️

Facing the complex landscape of AML compliance in Madagascar, businesses encounter a myriad of challenges in navigating stringent regulations while utilizing Bitcoin. The lack of standardized guidelines specific to virtual currencies poses a major hurdle, requiring companies to interpret existing laws within the context of this emerging digital asset. Ensuring transparency and traceability of transactions in alignment with AML protocols becomes a critical task, often compounded by the decentralized nature of cryptocurrency. Additionally, the need for robust risk assessment mechanisms and compliance monitoring tools adds another layer of complexity for businesses striving to meet regulatory expectations and safeguard against financial crime risks. Balancing innovation with regulatory requirements remains a constant struggle for organizations seeking to operate successfully within the evolving AML framework.

Technology Vs. Regulation: Finding the Balance 🔗

When it comes to Bitcoin Anti-Money Laundering (AML) regulations, navigating the delicate balance between technology and regulation is crucial. As advancements in technology continue to shape the landscape of financial transactions, regulators are faced with the challenge of keeping up with these innovations while ensuring compliance and security. Finding the middle ground between harnessing the benefits of technology for efficiency and transparency, and adhering to regulatory requirements to combat illicit activities, is key in shaping the future of AML in the digital currency space. To delve deeper into effective strategies for navigating AML compliance in the realm of Bitcoin, refer to insightful resources like the one provided here: bitcoin anti-money laundering (aml) regulations in mali.

Case Studies: Lessons Learned in Bitcoin Aml 📊

Analyzing real-world case studies provides valuable insights into the challenges and successes of navigating Bitcoin AML regulations in Madagascar. By examining past experiences of businesses in the region, we can uncover practical strategies and lessons learned in compliance efforts. These case studies not only illustrate the complexities and nuances of regulatory requirements but also offer actionable takeaways for organizations seeking to enhance their AML practices within the evolving landscape of cryptocurrency compliance.

Future Outlook: Navigating Compliance in Madagascar 🌅

The future outlook for navigating compliance in Madagascar involves a proactive approach to staying abreast of evolving regulations and implementing robust AML practices. Businesses must continuously adapt to regulatory changes, leveraging technology to enhance compliance efforts. By closely monitoring developments and learning from past case studies, companies can effectively navigate the complex landscape of AML regulations in the country. Keeping a pulse on emerging trends and adopting a forward-thinking compliance strategy will be key to ensuring long-term success in the Bitcoin ecosystem.

Bitcoin anti-money laundering (AML) regulations in Liberia