Understanding Regulatory Requirements 📜

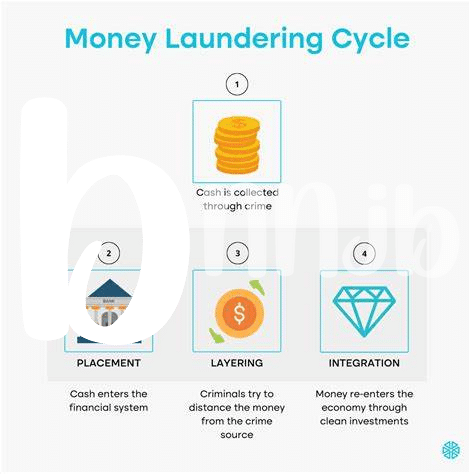

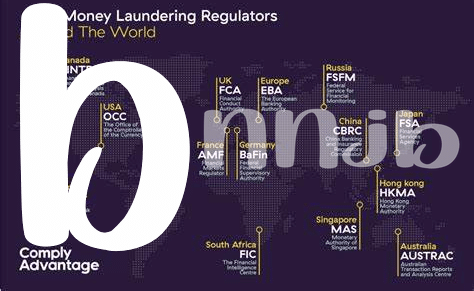

Bitcoin investors in Andorra must navigate a complex landscape of regulatory requirements to safeguard their investments. Understanding the ever-evolving rules and guidelines is crucial for compliance. This includes keeping abreast of reporting obligations, licensing requirements, and anti-money laundering protocols. Being well-versed in the regulatory framework not only ensures adherence to the law but also helps in building trust with authorities. By proactively engaging with regulatory bodies and seeking clarity on any uncertainties, investors can establish a strong foundation for their operations in Andorra’s Bitcoin industry.

Implementing Secure Storage Solutions 🔐

When it comes to safeguarding Bitcoin investments, having a robust and reliable storage solution is paramount. Ensuring the security and integrity of your digital assets is crucial in the volatile world of cryptocurrency. By implementing advanced encryption technology and multi-signature protocols, investors can significantly reduce the risk of theft and unauthorized access. Additionally, utilizing cold storage solutions and hardware wallets adds an extra layer of protection against online threats. Remember, safeguarding your Bitcoin investments is not just about securing your funds today, but also about safeguarding your financial future in the long run.

Conducting Regular Compliance Audits 📊

Regular compliance audits are essential for ensuring that your Bitcoin investments in Andorra remain secure and in accordance with the required regulations. By conducting these audits on a consistent basis, you can identify any potential issues early on and take corrective action promptly. This proactive approach not only helps to mitigate risks but also demonstrates your commitment to upholding compliance standards in the rapidly evolving cryptocurrency landscape. Consistent monitoring and evaluation through compliance audits not only protect your investments but also strengthen your overall compliance framework for long-term success.

Utilizing Encryption Technology for Protection 🔒

Encryption technology plays a crucial role in safeguarding Bitcoin investments by providing a secure layer of protection against unauthorized access. By using advanced encryption methods, such as AES and RSA, investors can ensure that their digital assets remain safe from cyber threats and hacks. Implementing encryption not only secures the data but also adds an extra level of anonymity to transactions, enhancing the overall security of the investment portfolio. Additionally, encryption can enable secure communication channels, preventing sensitive information from falling into the wrong hands. By staying up-to-date with the latest encryption technologies and best practices, investors in Andorra can fortify their Bitcoin holdings and mitigate potential risks effectively. Interested in learning more about Bitcoin AML regulations in Afghanistan? Check out this informative article on bitcoin anti-money laundering (aml) regulations in Afghanistan.

Training Staff on Compliance Protocols 🛡️

Training staff on compliance protocols is a crucial step in safeguarding Bitcoin investments in Andorra. By educating employees on regulatory requirements and security practices, companies can ensure a strong defense against potential risks. Providing regular training sessions and resources equips staff with the knowledge and skills needed to uphold compliance standards effectively. This proactive approach not only enhances security measures but also fosters a culture of responsibility and vigilance within the organization.

Staying Informed on Changing Regulations 🔄

Ensuring compliance with changing regulations is crucial in safeguarding Bitcoin investments in Andorra. By staying informed on the evolving legal landscape, businesses can adapt their practices proactively. This requires continuous monitoring of regulatory updates, seeking guidance from industry experts, and attending relevant seminars and workshops. Keeping abreast of these changes not only mitigates risks but also positions companies to capitalize on new opportunities within the cryptocurrency space.

tax implications of bitcoin trading in Zambia