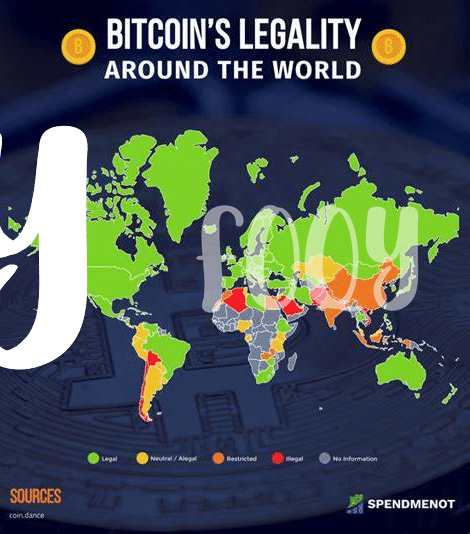

Regulatory Compliance 📝

Bitcoin investment funds operating in Cabo Verde must adhere to strict regulatory compliance standards to ensure transparency and legal accountability. By following established guidelines and regulations, these funds can operate within the boundaries of the law, instilling trust and confidence among investors. Regulatory compliance serves as the foundation for a secure and compliant investment environment, fostering a culture of integrity and accountability within the burgeoning Bitcoin investment landscape in Cabo Verde.

Custody and Security Measures 🔒

When it comes to safeguarding assets in a Bitcoin investment fund, implementing robust custody and security measures is paramount. Proactive strategies such as multi-signature wallets, hardware security modules, and cold storage solutions play a crucial role in protecting digital assets from malicious actors. Regular security audits, continuous monitoring, and adherence to industry best practices are vital components in ensuring the integrity and confidentiality of the fund’s holdings. Taking proactive steps in this area not only fosters trust with investors but also strengthens the overall resilience of the fund against potential threats.

Investor Due Diligence 🧐

Investor Due Diligence involves thoroughly assessing potential investors to ensure they meet the fund’s criteria and comply with regulations. This includes verifying identities, financial backgrounds, and investment goals. Conducting in-depth due diligence helps mitigate risks and fosters a trustworthy relationship between the fund and its investors. Diligence at this stage is crucial for making informed decisions and safeguarding the interests of all parties involved.

Reporting and Record-keeping 📊

For Reporting and Record-keeping in Bitcoin investment funds, proper documentation is essential. Keeping detailed records of transactions, investor information, and compliance measures is crucial. These records not only demonstrate adherence to regulations but also provide transparency and accountability. By maintaining accurate and organized records, investment funds can easily track and report their activities, ensuring operational efficiency and regulatory compliance.

Don’t forget to check out the best practices for compliance in Bitcoin investment funds regulated in Brunei on bitcoin investment funds regulation in canada.

Anti-money Laundering Procedures 💰

Bitcoin investment funds in Cabo Verde must adhere to robust anti-money laundering procedures to safeguard against illicit activities. Implementing thorough customer due diligence, transaction monitoring, and risk assessment measures are essential components in detecting and preventing money laundering risks. By staying vigilant and ensuring compliance with regulatory requirements, these funds can contribute to a more secure and transparent financial environment, thereby protecting both investors and the integrity of the cryptocurrency market.

Staff Training and Education 🎓

Staff Training and Education 🎓 should be a top priority for Bitcoin investment funds operating in Cabo Verde. Ensuring that staff members are knowledgeable about compliance requirements, security measures, and anti-money laundering procedures is essential for the fund’s smooth operation. Regular training sessions and educational programs should be conducted to keep the team updated with the latest developments in the cryptocurrency industry and regulatory changes.

For more information on Bitcoin investment funds regulation in Cabo Verde, please refer to the Bitcoin investment funds regulation in Brunei. Training and educating staff members will not only enhance the fund’s overall compliance posture but also instill a culture of responsibility and professionalism within the organization.