Understanding Legal Implications 📜

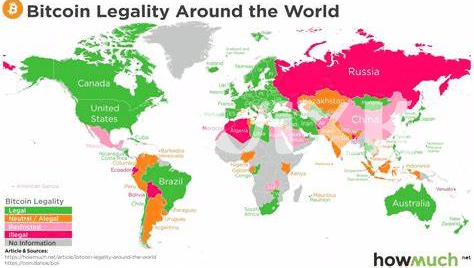

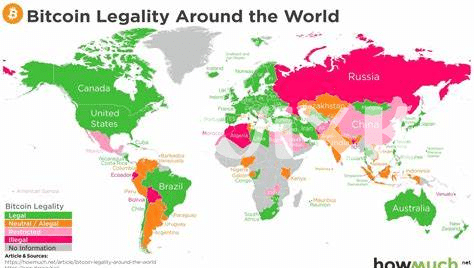

Understanding the legal implications surrounding Bitcoin in Kuwait is crucial for users to navigate this evolving landscape. With the rapid growth of digital currencies, it is essential to grasp the legal framework to ensure compliance and risk mitigation. This includes understanding how laws and regulations apply to Bitcoin transactions, ownership, and use within the Kuwaiti jurisdiction. By delving into the legal implications, users can make informed decisions and protect themselves from potential legal pitfalls.

Regulatory Framework in Kuwait 🇰🇼

Kuwait’s regulatory landscape in the realm of Bitcoin is shaped by a unique set of considerations. Understanding the legal framework is crucial for users navigating the digital currency space within the country. Knowledge of the regulatory guidelines provides insights into compliance measures necessary for engaging with Bitcoin in Kuwait. As the cryptocurrency ecosystem evolves, staying abreast of regulatory developments is essential for ensuring a seamless and compliant experience for users in the region. Compliance with existing regulations not only safeguards users but also contributes to the legitimacy and sustainability of Bitcoin adoption in Kuwait.

Embracing the regulatory framework in Kuwait empowers users to navigate the legal terrain confidently. As regulations adapt to accommodate digital currencies like Bitcoin, awareness of the evolving landscape equips users to make informed decisions. By aligning with compliance requirements, users can engage with Bitcoin in Kuwait securely and responsibly. Building a comprehensive understanding of the regulatory framework lays a foundation for compliant Bitcoin usage, fostering a transparent and trustworthy environment for digital transactions within the country.

Compliance Challenges for Bitcoin Users 💼

Bitcoin users in Kuwait face a myriad of challenges when it comes to compliance. Navigating the complex regulatory landscape, ensuring adherence to anti-money laundering laws, and staying abreast of evolving tax requirements can be daunting tasks. With the decentralized nature of cryptocurrency, ensuring compliance with traditional financial regulations poses additional hurdles for users. Moreover, the lack of clear guidance and consistent enforcement in this emerging field creates uncertainties that users must navigate carefully. Balancing innovation with regulatory compliance remains a key challenge for Bitcoin users in Kuwait.

A Look at Money Laundering Risks 💸

Money laundering risks associated with Bitcoin transactions are a growing concern in Kuwait’s financial landscape. As digital currencies offer a degree of anonymity, illicit actors may exploit this feature to conceal the origins of their funds. This presents a challenge for authorities in detecting and preventing potential money laundering activities. Understanding the methods and incentives behind such practices is crucial for Bitcoin users to navigate these risks effectively. By staying informed and implementing robust compliance measures, individuals can contribute to a safer and more transparent digital financial ecosystem.

To delve deeper into the legal implications of Bitcoin in different regions, such as Israel, you can explore the article on navigating the legal landscape of Bitcoin in Israel at is bitcoin legal in Israel?.

Tax Considerations in the Digital Realm 💰

Navigating the tax landscape in the digital realm can be complex for Bitcoin users in Kuwait. As virtual currencies continue to gain traction, authorities are grappling with how to apply traditional tax laws to this new form of wealth. Understanding how to report Bitcoin transactions and the potential tax implications is crucial for individuals looking to stay compliant with Kuwaiti regulations. Additionally, the evolving nature of digital currencies poses challenges for tax authorities in monitoring and enforcing tax laws in this rapidly changing space. Stay informed and proactive to ensure compliance with tax regulations in the digital age.

Future Trends and Emerging Issues 🔮

Regarding future trends and emerging issues in the realm of Bitcoin compliance, the landscape is constantly evolving in response to regulatory changes and technological advancements. As digital currencies continue to gain mainstream acceptance, there is a growing focus on enhancing transparency and security within the ecosystem. Additionally, the rising popularity of decentralized finance (DeFi) platforms poses new challenges for regulatory bodies in monitoring financial transactions. Moreover, the integration of blockchain technology beyond cryptocurrencies, such as in supply chain management and voting systems, opens up possibilities for novel compliance frameworks and potential regulatory dilemmas.

To delve deeper into the legal aspects of Bitcoin in different jurisdictions, you can check the statuses of “is bitcoin legal in Japan?” and “is bitcoin legal in Iran?” respectively.