The Importance of Insuring Your Bitcoin Transactions 🛡️

Bitcoin transactions can be a complex topic, especially when considering insurance. Safeguarding your transactions can provide peace of mind in this ever-evolving digital landscape. As the value of Bitcoin continues to fluctuate, having insurance in place adds a layer of protection against potential risks and unforeseen events. Insuring your Bitcoin transactions is not just a precautionary measure; it is a strategic decision to secure your digital assets. Without insurance, you could be exposed to vulnerabilities that may impact your financial stability. Stay ahead of the game by understanding the significance of insuring your Bitcoin transactions and the invaluable protection it offers.

Key Factors to Consider When Choosing an Insurance Provider 💡

When selecting an insurance provider for your Bitcoin transactions, it’s crucial to delve into key factors that can make a significant difference. Consider the reputation and track record of the provider in handling cryptocurrency-related claims. Evaluate the scope of coverage offered, including protection against theft, hacking, and fraud. It’s also essential to assess the provider’s responsiveness and transparency in processing claims efficiently for optimal peace of mind.

Understanding the terms and conditions of the insurance policy, especially regarding coverage limits and exclusions, is vital for making an informed decision. Additionally, comparing the level of customer support and flexibility in customizing insurance packages to suit your specific needs can help you choose a provider that aligns with your requirements. By thoroughly evaluating these factors, you can confidently select an insurance provider that safeguards your Bitcoin transactions effectively.

Understanding the Coverage Options Available to You 💰

Understanding the coverage options available to you is crucial when it comes to safeguarding your Bitcoin transactions. It’s important to carefully assess the different types of coverage provided by insurance providers, such as protection against theft, hacking, or fraud. By delving into the specifics of each option, you can determine which plan aligns best with your individual needs and risk tolerance. Additionally, understanding how coverage limits, deductibles, and claim processes work will enable you to make informed decisions to secure your Bitcoin assets effectively.

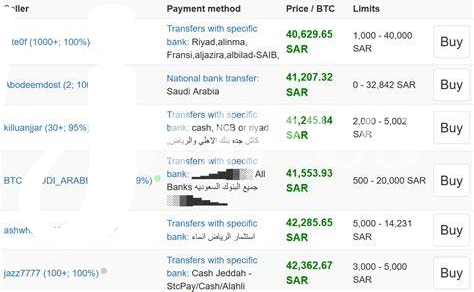

Comparing the Costs and Benefits of Different Providers 💸

When comparing insurance providers for your Bitcoin transactions, it’s essential to weigh the costs and benefits each offers. Some providers may have lower premiums but limited coverage, while others might have higher costs with comprehensive protection. Consider factors like deductible amounts, coverage limits, and exclusions to determine which provider aligns best with your needs. Remember, the cheapest option may not always provide the most suitable protection for your Bitcoin assets. By carefully evaluating the costs and benefits of different providers, you can make an informed decision that safeguards your investments effectively.

If you’re interested in learning more about insurance coverage for Bitcoin wallets and exchanges, check out this informative article on insurance strategies for Qatar’s Bitcoin users in San Marino: insurance coverage for bitcoin wallets and exchanges in San Marino.

Real-life Examples of Insurance Claims in the Bitcoin Industry 🏦

In the realm of Bitcoin transactions, insurance claims have played a crucial role in mitigating risks and providing financial security to individuals and businesses. Through firsthand experiences and stories from the Bitcoin industry, we can gain valuable insights into the importance of having adequate insurance coverage. These real-life examples showcase the potential risks and unexpected events that can occur in the volatile world of cryptocurrency, emphasizing the need for reliable insurance protection.

Tips for Selecting the Best Insurance Provider for Your Needs 💡

When selecting an insurance provider for your Bitcoin transactions, it’s crucial to prioritize transparency and reliability. Look for a company with a solid track record in the cryptocurrency insurance sector, offering comprehensive coverage tailored to your specific needs. Consider the flexibility of their policies, ease of claims processing, and customer reviews to gauge their overall reputation. Additionally, don’t overlook the importance of responsive customer support to address any concerns promptly. By conducting thorough research and weighing your options carefully, you can ensure that you choose the best insurance provider to safeguard your Bitcoin investments.

Learn more about insurance coverage for bitcoin wallets and exchanges in Saint Vincent and the Grenadines with anchor insurance coverage for bitcoin wallets and exchanges in Qatar.