Introduction to Bitcoin Regulations Worldwide 🌍

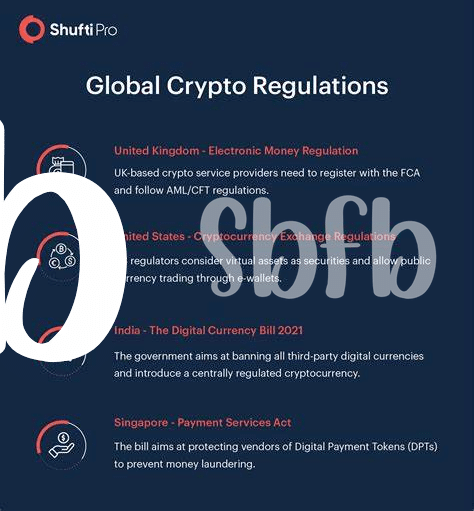

Bitcoin regulations across the globe vary significantly, with some countries embracing the digital currency, while others remain cautious. The decentralized nature of Bitcoin poses a unique challenge to traditional regulatory frameworks. Governments worldwide are grappling with how to categorize and regulate Bitcoin – whether as a currency, commodity, or security. The evolving landscape of Bitcoin regulations reflects a broader shift towards recognizing and incorporating digital assets into the existing financial infrastructure. As the global economy becomes increasingly digitized, the need for standardized and coherent regulatory approaches becomes more critical.

Comparison of Bitcoin Regulations in Uae 🇦🇪

When it comes to Bitcoin regulations in the UAE, the framework in place sets a unique precedent globally. By delving into the specifics of these regulations, we can uncover how the UAE is paving its path in the cryptocurrency landscape. Understanding the nuances and contrasts with regulations in other countries sheds light on the evolving nature of digital currency governance.

Impact of Regulations on Bitcoin Adoption 🔍

Bitcoin regulations have a significant impact on its adoption globally and in the UAE. These regulations play a vital role in shaping how individuals and businesses perceive and interact with Bitcoin as a digital asset. In the UAE, where regulations are relatively progressive, they have helped create a conducive environment for Bitcoin adoption, encouraging innovation and investment in the space. Similarly, on a global scale, clear regulations can promote trust and legitimacy, driving more widespread acceptance and use of Bitcoin among the general population. This positive regulatory environment can lead to increased participation in the Bitcoin ecosystem, fostering growth and development in the industry.

Challenges Faced by Regulators in the Industry ⚠️

Regulators in the cryptocurrency industry encounter numerous challenges on a daily basis. From navigating the complexities of evolving technologies to staying ahead of innovative financial crimes, their task is intricate and demanding. Ensuring compliance without stifling innovation poses a delicate balance, especially in a global landscape where regulations vary significantly. These challenges highlight the need for regulators to continuously adapt and collaborate with industry stakeholders to foster a transparent and secure environment for all participants. To delve deeper into the impact of regulations on Bitcoin banking services, particularly in Ukraine, check out this insightful article from WikiCrypto News: bitcoin banking services regulations in Ukraine.

Future Outlook for Bitcoin Regulations 🚀

Exciting developments lie ahead in the world of Bitcoin regulations. The landscape is evolving rapidly, with countries adapting their approaches to accommodate digital currencies like never before. As we look towards the future, it’s clear that innovation and collaboration will be key drivers in shaping the regulatory frameworks for Bitcoin. With a dynamic interplay of technology, economics, and policy, we can expect a fascinating journey ahead as Bitcoin regulations continue to evolve globally.

Recommendations for Global Regulatory Frameworks 🌐

In light of the increasing global adoption of Bitcoin, it is crucial for regulatory bodies to collaborate and establish a unified framework that ensures the security and stability of the cryptocurrency market. Promoting transparency, investor protection, and innovation should be at the core of these recommendations. Furthermore, a balanced approach that fosters growth while mitigating risks associated with digital currencies is essential for a sustainable regulatory environment. By working together and sharing best practices, policymakers can create a cohesive global regulatory framework that supports the long-term development of the Bitcoin ecosystem.

Bitcoin banking services regulations in Turkey are evolving rapidly to keep pace with the dynamic nature of cryptocurrencies.