The Rise of Bitcoin in Bahrain 🚀

The increasing adoption of digital currencies has sparked a noticeable trend within Bahrain, with Bitcoin emerging as a popular choice among both individuals and businesses. As more people become aware of the potential benefits and opportunities that Bitcoin offers, its presence within the Bahraini market continues to grow. This rise in Bitcoin usage reflects a shifting attitude towards finance and technology, where individuals are seeking innovative ways to manage and store their assets. With this momentum, Bitcoin is carving a place for itself within Bahrain’s financial landscape, paving the way for further advancements and integrations in the future.

Regulatory Landscape in Bahrain 🏛️

Bahrain’s regulatory landscape reflects a dynamic environment shaped by the rapid growth of Bitcoin within the country. The government has been proactive in setting guidelines to navigate the digital currency space, aiming to foster innovation while ensuring compliance with existing financial regulations. As Bahrain embraces the opportunities presented by Bitcoin, balancing innovation with regulatory oversight remains a critical challenge. The evolving nature of the cryptocurrency market necessitates a flexible approach from regulatory authorities to keep pace with technological advancements and emerging trends. Collaborative efforts between regulators, financial institutions, and industry stakeholders are crucial to strike the right balance between fostering innovation and maintaining the integrity of the financial system.

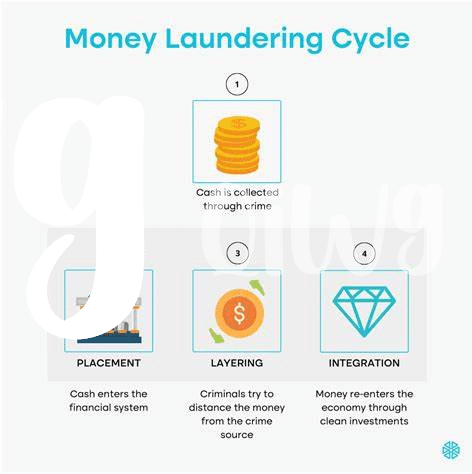

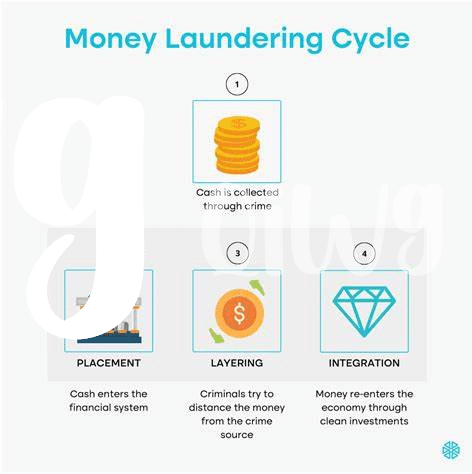

Complexities of Aml Compliance 🤯

A crucial aspect of AML compliance is the intricate web of transaction monitoring and due diligence required to ensure transparency and traceability. Identifying and verifying the parties involved, understanding the source of funds, and adhering to regulatory reporting obligations are just a few of the complexities that organizations face in this realm. The evolving nature of financial crimes and the sophistication of illicit activities further compound the challenges in staying ahead of potential risks. As regulators tighten their grip on digital asset transactions, the need for robust AML frameworks becomes paramount for businesses operating in the cryptocurrency space.

Technology Solutions for Compliance 🌐

The evolution of technology has played a crucial role in enhancing AML compliance efforts for Bitcoin in Bahrain. Utilizing advanced software solutions and blockchain technology, businesses can now streamline their compliance processes, monitor transactions more effectively, and ensure adherence to regulatory requirements. These tech innovations offer a proactive approach to identifying and preventing illicit activities within the cryptocurrency space, strengthening the overall integrity of the financial ecosystem. For more insights on global AML regulations and their impact on the crypto industry, check out the article on bitcoin anti-money laundering (AML) regulations in Angola.

Role of Financial Institutions 💼

Financial institutions play a pivotal role in ensuring compliance with AML regulations in the realm of Bitcoin in Bahrain. As gatekeepers of the financial system, these institutions are on the front lines in detecting and preventing money laundering activities. By implementing robust monitoring mechanisms and conducting thorough due diligence on customers engaging in Bitcoin transactions, they contribute significantly to safeguarding the integrity of the financial system. Additionally, collaboration with regulatory bodies and adopting innovative technologies further enhances their ability to combat illicit financial activities while fostering trust and credibility within the evolving landscape of digital assets.

Future Outlook and Challenges Ahead 🔮

The future of Bitcoin in Bahrain is promising, with increasing adoption and interest from both consumers and businesses. However, as the crypto landscape evolves, so do the regulatory challenges that come with it. Navigating the complex waters of AML compliance in this dynamic environment requires a delicate balance between innovation and regulation. Financial institutions play a crucial role in shaping the future of Bitcoin in Bahrain, acting as gatekeepers and enablers of compliance.

Looking ahead, the challenges of AML compliance will continue to evolve as technology advances and new regulatory frameworks take shape. It is imperative for stakeholders to stay vigilant and proactive in addressing these challenges head-on to ensure the long-term sustainability and legitimacy of Bitcoin in Bahrain. The key lies in fostering constructive dialogue between regulators, businesses, and consumers to strike a balance that promotes innovation while safeguarding against financial crimes. Bitcoin anti-money laundering (AML) regulations in Albania can provide valuable insights into best practices and regulatory approaches, serving as a blueprint for shaping the future of AML compliance in Bahrain.