Bitcoin’s Potential as a Disruptive Digital Currency 💰

Bitcoin’s potential as a disruptive digital currency lies in its ability to revolutionize traditional financial systems. With its decentralized nature and blockchain technology, Bitcoin offers a secure and transparent way to conduct transactions globally. As more businesses and individuals embrace this digital currency, the traditional banking landscape could undergo significant changes. The potential for Bitcoin to streamline payments, reduce fees, and enable financial inclusion for those without access to traditional banking services is truly transformative. Its borderless nature opens up new possibilities for cross-border transactions and may challenge the status quo of the financial world as we know it.

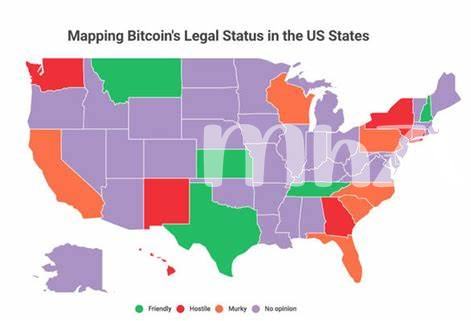

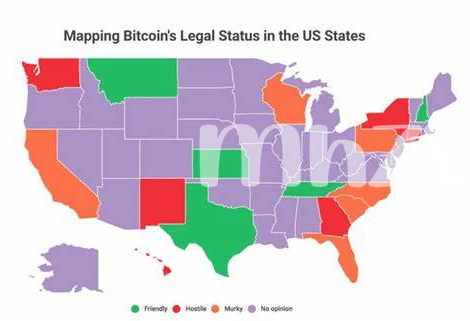

Regulatory Challenges Facing Bitcoin Adoption 🚫

Bitcoin faces various regulatory challenges that hinder its widespread adoption. The lack of clear guidelines and oversight from governing bodies creates uncertainty for users and businesses alike. This ambiguity surrounding legal frameworks and compliance measures adds complexity to the integration of Bitcoin into traditional financial systems. Addressing these regulatory hurdles is crucial in order to build trust and confidence in the use of cryptocurrency, allowing for a more seamless transition to a digital economy.

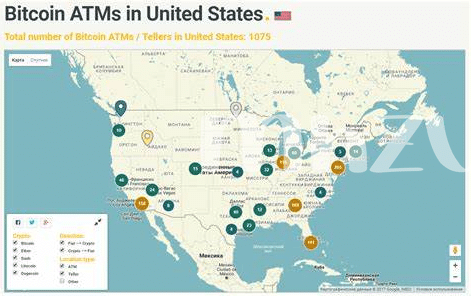

Opportunities for Increased Financial Inclusion 🌍

Bitcoin presents an avenue for previously underserved populations to access financial services, potentially bridging the gap for those without traditional bank accounts. Through its decentralized nature and accessibility, Bitcoin offers opportunities for increased financial inclusion by allowing individuals to participate in the global economy without the need for intermediaries. This can empower marginalized communities and foster economic growth in regions where traditional banking services are limited. The potential for financial inclusion through Bitcoin showcases a promising path towards a more equitable and interconnected financial landscape.

Risks and Volatility Associated with Bitcoin Investments ⚠️

When it comes to investing in Bitcoin, it’s essential to be aware of the inherent risks and volatility involved. The value of Bitcoin can fluctuate significantly within a short period, making it a high-risk asset. This volatility can lead to both substantial gains and losses for investors, emphasizing the importance of thorough research and risk management strategies. Additionally, the lack of regulation in the cryptocurrency space can contribute to increased risks, as scams and market manipulation are prevalent.

For a deeper dive into the regulatory landscape of Bitcoin in various countries, including Uruguay, check out an informative article on is bitcoin legal in Uruguay?.

Impact of Government Policies on Bitcoin’s Future 🏛️

Government policies play a pivotal role in shaping the trajectory of Bitcoin’s future. As authorities grapple with how to regulate and integrate this digital currency into existing financial frameworks, their decisions can significantly impact market dynamics and investor confidence. Clarity and consistency in regulatory approaches are essential to fostering a stable environment for Bitcoin innovation and adoption. By striking a balance between oversight and fostering innovation, governments can help unleash the full potential of Bitcoin as a transformative force in the financial landscape, ensuring its long-term viability and relevance in a rapidly evolving digital economy.

Innovations Driving the Evolution of Bitcoin Technology 🚀

In recent years, advancements in blockchain technology have paved the way for significant innovations in the realm of Bitcoin. From the implementation of the Lightning Network to the development of more efficient mining algorithms, these innovations are driving the evolution of Bitcoin technology at a rapid pace. These advancements not only aim to improve scalability and transaction speeds but also enhance the overall security and decentralization of the Bitcoin network, making it more robust and user-friendly for its growing number of users.

is bitcoin legal in palestine?