Current State of Cryptocurrency Regulation in Burkina Faso 🌍

Cryptocurrency regulation in Burkina Faso is at a pivotal juncture, reflecting the global trend towards formalizing oversight in the digital asset space. The government is actively considering frameworks to address the challenges posed by cryptocurrency transactions while balancing innovation and risk mitigation. As Burkina Faso seeks to navigate this evolving landscape, stakeholders are engaging in dialogue to shape policies that promote financial inclusion and safeguard against illicit activities. Furthermore, education initiatives are underway to enhance awareness among the public about the complexities of decentralized finance and the role of regulatory oversight in ensuring a secure ecosystem.

Challenges Faced by Authorities in Regulating Cryptocurrencies 🤔

Authorities in Burkina Faso face various challenges when it comes to regulating cryptocurrencies. The lack of clear guidelines and framework often leads to uncertainty and confusion among stakeholders. Additionally, the fast-paced nature of the cryptocurrency market makes it difficult for authorities to keep up with evolving technologies and trends. Ensuring consumer protection, preventing financial crimes, and addressing potential risks such as money laundering and terrorism financing are key concerns for regulators. Balancing innovation and security remains a delicate task, requiring a nuanced approach to policymaking. Collaborating with industry experts, engaging with international counterparts, and staying abreast of global regulatory developments are essential strategies for tackling these challenges effectively. Ultimately, finding a harmonious balance between fostering innovation and safeguarding the financial system will be crucial for the successful regulation of cryptocurrencies in Burkina Faso.

Impact of Regulatory Clarity on Cryptocurrency Adoption 📈

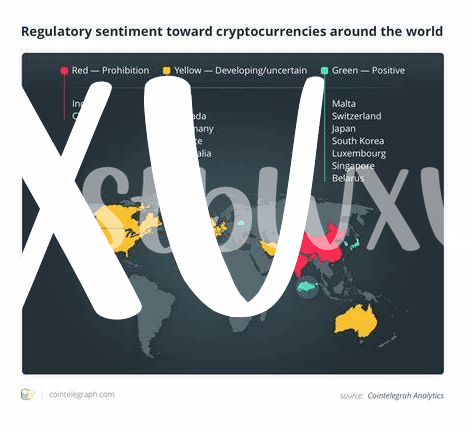

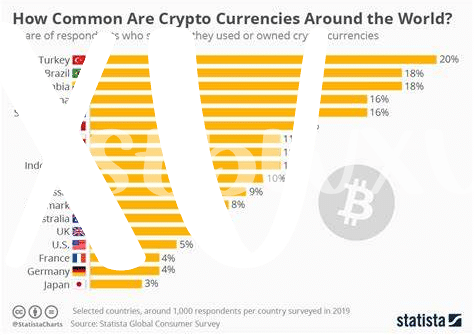

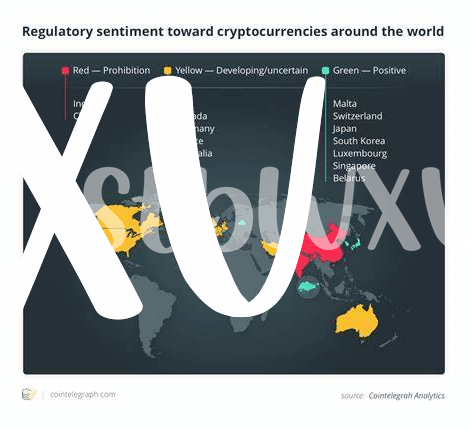

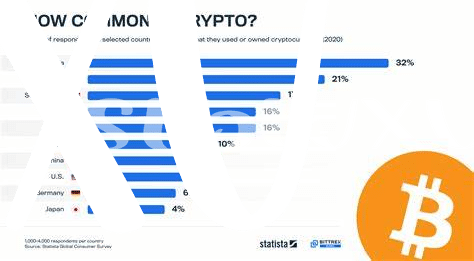

In countries like Burkina Faso, where cryptocurrency regulations might currently be unclear or evolving, the impact of regulatory clarity on cryptocurrency adoption can be monumental. Clear and consistent regulations provide a level of certainty that encourages more individuals and businesses to participate in the cryptocurrency sector. When potential users understand the rules and feel confident in the legal framework surrounding cryptocurrencies, they are more likely to invest, trade, and utilize digital assets. Regulatory clarity also helps to mitigate risks associated with fraud, money laundering, and other illicit activities, fostering a safer environment for cryptocurrency transactions. Ultimately, the establishment of transparent regulations can pave the way for increased adoption and integration of cryptocurrencies into mainstream financial systems, driving growth and innovation in the sector.

Opportunities for Growth in the Cryptocurrency Sector 🚀

Opportunities for Growth in the Cryptocurrency Sector 🚀: As the cryptocurrency sector continues to evolve in Burkina Faso, there are significant opportunities for growth and expansion. With increasing awareness and acceptance of digital currencies, there is a ripe environment for innovation and investment in various cryptocurrency-related projects. The potential for collaboration between government bodies, financial institutions, and tech startups could pave the way for a more robust cryptocurrency ecosystem in the country. By fostering a supportive regulatory environment and encouraging local entrepreneurship, Burkina Faso can position itself as a hub for cryptocurrency innovation in the region. Looking towards success stories in other nations, such as Bhutan’s crypto-friendly initiatives, Burkina Faso has the chance to drive economic development and financial inclusion through strategic adoption of cryptocurrencies. This momentum presents an exciting prospect for the future of the cryptocurrency sector in Burkina Faso.

Insert the link to the article about Bhutan’s potential as a crypto-friendly nation here: government stance on the future of cryptocurrencies in Brazil.

International Cooperation and Best Practices in Regulation 🤝

International cooperation is essential in establishing consistent regulatory frameworks for cryptocurrency across borders. By sharing insights and best practices, countries can work together to address challenges and seize opportunities in this rapidly evolving sector. This collaborative approach not only promotes innovation but also helps in combating illicit activities such as money laundering and terrorism financing. Through enhanced cooperation, regulators can learn from each other’s experiences and adapt regulations to better suit the global nature of cryptocurrencies. Best practices in regulation can be identified and implemented to create a more secure and transparent environment for cryptocurrency users and businesses alike, fostering trust and confidence in this emerging digital economy.

Future Outlook and Potential Developments in Burkina Faso 💡

In considering future outlook and potential developments in Burkina Faso regarding cryptocurrency regulation, it is essential to assess the country’s stance and readiness to adapt to the evolving digital landscape. The government’s approach towards embracing innovative financial technologies will play a pivotal role in shaping the regulatory framework and fostering a conducive environment for cryptocurrency activities. As Burkina Faso navigates the complexities of regulating cryptocurrencies, collaboration with international partners and leveraging best practices can offer valuable insights into effective strategies that align with global standards and promote sustainable growth within the sector.

For further insights into government perspectives on the future of cryptocurrencies, you can explore the official stance of Burkina Faso through the link provided: government stance on the future of cryptocurrencies in bhutan. By staying informed and proactive in addressing challenges while capitalizing on opportunities, Burkina Faso can pave the way for a promising future that embraces the benefits of digital currencies for its economy and society.