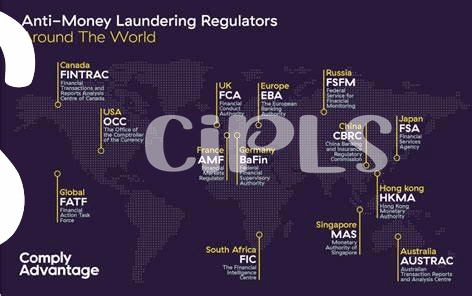

Regulatory Maze 🌐

Navigating the complex seas of regulatory guidelines for Bitcoin in Senegal can feel like a labyrinth of uncertainty. With evolving laws and varied interpretations, businesses must tread cautiously to ensure compliance. The regulatory maze poses challenges in understanding and adhering to the rules while striving for innovation and growth. It requires a delicate balance of legal awareness and strategic foresight to traverse this intricate landscape effectively.

Emerging Adaptation 🚀

The rapid evolution of AML laws for Bitcoin in Senegal has brought about a wave of Emerging Adaptation in the regulatory landscape. As authorities grapple with the complexities of integrating digital currencies into existing frameworks, stakeholders are exploring innovative solutions to ensure compliance while fostering growth. This dynamic environment presents both challenges and opportunities for the cryptocurrency industry, with a focus on staying ahead of the curve in a constantly evolving ecosystem. Amidst these changes, the potential for new avenues of collaboration and development is on the horizon, signaling a promising future for Bitcoin in Senegal.

Financial Inclusion Dilemma 💰

The adoption of Bitcoin in Senegal presents a unique challenge regarding financial inclusion. With traditional banking services often inaccessible to a significant portion of the population, the potential for Bitcoin to provide financial services to the unbanked is promising. However, concerns arise regarding the volatility of cryptocurrency prices and the potential for exploitation of vulnerable individuals. Finding a balance between leveraging the benefits of Bitcoin for financial inclusion while ensuring consumer protection and regulatory compliance is crucial. Collaborative efforts between regulators, financial institutions, and technology innovators are essential to address these challenges and create a more inclusive financial system in Senegal.

Compliance Tech Solutions 🤖

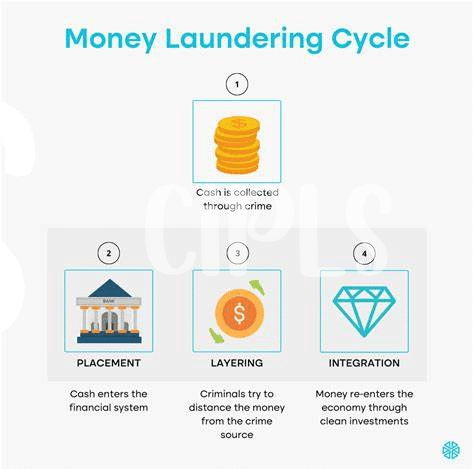

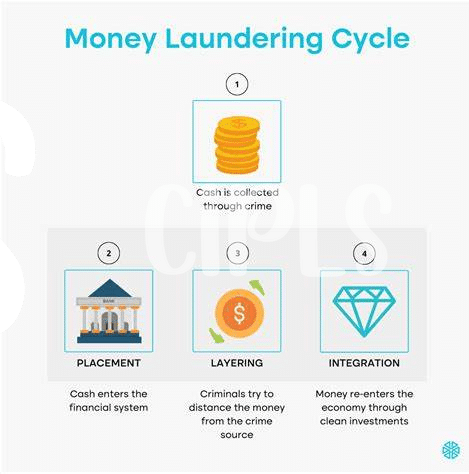

Compliance technology solutions play a crucial role in navigating the intricate landscape of AML laws for Bitcoin in Senegal. These innovative tools are designed to streamline regulatory compliance processes, enhance transparency, and mitigate risks associated with money laundering. By leveraging sophisticated algorithms and automation, businesses can efficiently monitor transactions, assess risks, and ensure adherence to regulatory requirements. Implementing robust compliance tech solutions not only simplifies the complexities of AML laws but also demonstrates a commitment to ethical business practices and regulatory compliance.

For further insights on the intersection of Bitcoin and AML practices, especially in the context of emerging markets, explore the comprehensive analysis on bitcoin anti-money laundering (aml) regulations in Sao Tome and Principe. This informative resource sheds light on the evolving regulatory landscape and the potential implications for the cryptocurrency industry in diverse global jurisdictions, offering valuable perspectives on navigating compliance challenges effectively.

Security Concerns 🔒

Bitcoin’s growth in Senegal poses Security Concerns that must be proactively addressed. With the digital nature of cryptocurrencies, protecting against cyber threats becomes paramount. Instances of hacking, fraud, and theft highlight the vulnerabilities that the Bitcoin ecosystem faces. Implementing robust encryption methods and secure storage practices are crucial in safeguarding assets. Additionally, educating users on best security practices is essential to mitigate risks. Strengthening regulatory frameworks to tackle illicit activities is also key in enhancing security within the Bitcoin landscape. By addressing these concerns head-on, Senegal can bolster trust and confidence in Bitcoin transactions, paving the way for sustainable growth and adoption.

Future Outlook and Potential 🌟

In the digital landscape of Senegal, the future outlook for Bitcoin presents a promising vista of potential growth and innovation. As regulatory frameworks continue to evolve and adapt to the complexities of cryptocurrency, there emerges a realm of opportunity for businesses and individuals alike to explore the benefits of financial inclusion and decentralized transactions. The increasing integration of compliance tech solutions offers a pathway towards enhanced security and transparency, while also addressing the pressing concerns surrounding AML laws. Despite the challenges that come with navigating the regulatory maze, the overall trajectory points towards a dynamic ecosystem where Bitcoin plays a pivotal role in shaping the future of financial systems. This transformation sets the stage for a new era of economic empowerment and technological advancement in Senegal and beyond.

Link: bitcoin anti-money laundering (aml) regulations in saint vincent and the grenadines