Regulatory 🔒 Landscape in Sri Lanka

In the dynamic landscape of financial regulations in Sri Lanka, stakeholders in the Bitcoin industry navigate a complex terrain. The regulatory framework, characterized by its evolving nature, poses challenges as well as opportunities for AML compliance. Understanding and adhering to these regulations is essential for fostering trust and legitimacy within the Bitcoin ecosystem. As the regulatory environment continues to develop, stakeholders must stay informed and adaptable to ensure sustainable operations.

Impact 💥 of Aml on Bitcoin Transactions

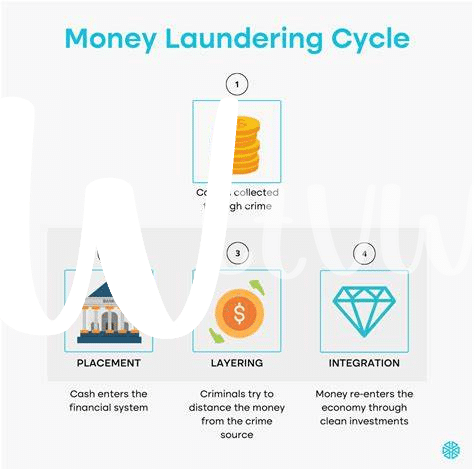

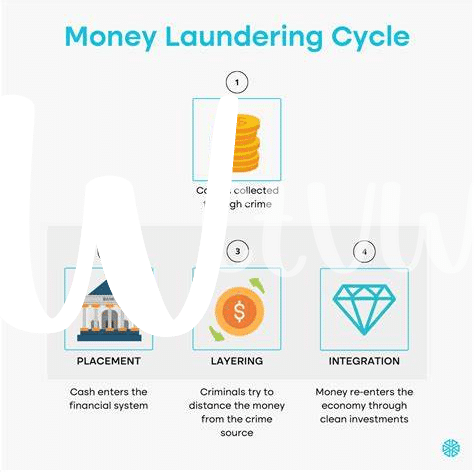

In the realm of Bitcoin transactions, the landscape is shifting with the implementation of Anti-Money Laundering (AML) regulations. These guidelines, aimed at combating illicit activities, are reshaping how individuals interact with digital currencies. AML requirements introduce new layers of transparency and accountability, impacting the way transactions are initiated, conducted, and monitored in the Bitcoin ecosystem. As stakeholders navigate these regulatory waters, they must adapt to the evolving compliance landscape to ensure the continued legitimacy and viability of Bitcoin transactions.

As AML frameworks become more stringent, the intersection of AML and Bitcoin transactions presents both challenges and opportunities for stakeholders. Compliance efforts demand enhanced due diligence and monitoring, raising operational costs and complexities. Yet, these challenges also pave the way for innovations in AML technology tailored for Bitcoin, offering solutions to streamline compliance processes and enhance security measures. Amidst these challenges, opportunities emerge for growth and development, as stakeholders embrace technological advancements and strategic approaches to navigate the evolving AML landscape for Bitcoin transactions.

Compliance 📝 Challenges Faced by Stakeholders

Navigating the regulatory waters in Sri Lanka has posed significant challenges for stakeholders involved in Bitcoin transactions. From ambiguous guidelines to evolving laws, compliance hurdles constantly test the resilience of those in the cryptocurrency space. Ensuring adherence to anti-money laundering (AML) regulations requires a delicate balance of innovation and vigilance. Stakeholders must stay abreast of the dynamic regulatory landscape while implementing robust compliance frameworks to combat financial crimes effectively. The complex nature of AML compliance demands a proactive approach from all parties involved, emphasizing the need for continuous education and adaptation in the face of regulatory uncertainties.

Innovations 💡 in Aml Technology for Bitcoin

Innovations in AML technology are transforming the landscape of Bitcoin transactions, offering enhanced security and transparency. These advancements include sophisticated algorithms that analyze transaction patterns, identify suspicious activity, and enhance detection capabilities. Integrating blockchain technology with AML solutions provides a robust framework for monitoring and regulatory compliance. Moreover, the development of machine learning algorithms enables real-time monitoring and continuous improvement in identifying potential risks in Bitcoin transactions. Stakeholders can leverage these innovative AML technologies to mitigate risks, ensure compliance with regulatory requirements, and enhance the overall integrity of the Bitcoin ecosystem. The collaboration between technology developers and regulatory authorities is essential to address emerging challenges and foster a secure environment for Bitcoin transactions.

Insert link into the sentence: “These advancements include sophisticated algorithms that analyze transaction patterns, identify suspicious activity, and enhance detection capabilities. Integrating blockchain technology with AML solutions provides a robust framework for monitoring and regulatory compliance. For more insights on bitcoin anti-money laundering (aml) regulations in South Sudan, check out this article.”

Opportunities 🌟 for Growth and Development

1) The evolving landscape of AML regulations in Sri Lanka presents new avenues for growth and development within the realm of Bitcoin transactions. As stakeholders navigate compliance challenges, opportunities emerge for the integration of innovative AML technologies into the Bitcoin ecosystem. These advancements not only enhance security and transparency but also pave the way for sustainable growth and increased adoption of cryptocurrencies in Sri Lanka’s financial landscape.

Future 🚀 Outlook and Potential Advancements

Looking to the future, the realm of Bitcoin and AML in Sri Lanka holds promising potential for advancements in technology and regulatory frameworks. As the digital landscape continues to evolve, stakeholders have the opportunity to leverage innovative solutions that enhance AML practices, ensuring the security and integrity of Bitcoin transactions. Collaboration between industry players and policymakers will be key in driving these advancements, paving the way for a more robust and efficient AML ecosystem. By embracing these opportunities and staying ahead of emerging trends, the future outlook for Bitcoin AML in Sri Lanka appears bright and full of potential advancements.

Bitcoin Anti-Money Laundering (AML) Regulations in Spain