Current Acceptance and Awareness of Bitcoin in Gambia 🌍

In Gambia, the landscape for Bitcoin is gradually evolving, with a growing interest and curiosity among individuals. Increased accessibility to information and educational resources has spurred a modest level of awareness about the potential of this digital currency. While still in its early stages, the concept of using Bitcoin for transactions is gaining traction within certain tech-savvy communities. The current acceptance of Bitcoin in Gambia is more prevalent in urban areas where digital literacy is relatively higher, indicating a shift towards a more technologically-inclined financial ecosystem.

As this awareness continues to spread, it presents an exciting opportunity for further exploration and integration of Bitcoin into the Gambian economy. With a foundation of curiosity and emerging acceptance, there is potential for the adoption of Bitcoin to grow beyond its current status, contributing to a more inclusive and diversified financial landscape in the country.

Regulatory Challenges and Legal Framework 📜

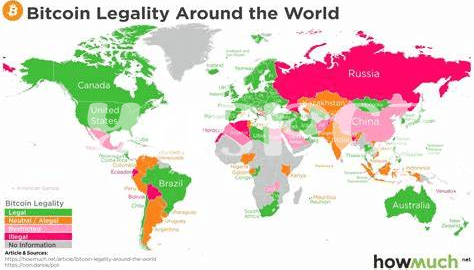

The regulatory landscape surrounding Bitcoin integration in Gambia presents a complex tapestry of challenges and opportunities for stakeholders. As the global interest in cryptocurrency continues to grow, policymakers in Gambia face the pressing need to establish a clear legal framework that balances innovation with consumer protection. Regulatory challenges in this context encompass issues related to taxation, money laundering, and investor safeguarding. Developing a robust legal framework will be crucial to fostering trust and confidence in the use of Bitcoin within the Gambian economy. By addressing these regulatory hurdles proactively, Gambia can position itself as a progressive hub for digital currency adoption in the region.

Accessibility and Infrastructure Limitations 🛠️

In Gambia, the adoption of Bitcoin faces notable challenges related to accessibility and infrastructure limitations. The lack of widespread internet connectivity and technological resources hinders the smooth integration of Bitcoin into daily transactions. Without robust digital infrastructure in place, the potential benefits of digital currencies remain out of reach for many individuals and businesses in the region. To overcome these obstacles, there is a crucial need for investments in improving connectivity, expanding access to technology, and enhancing the overall infrastructure to support the seamless use of Bitcoin in Gambia.

By addressing these accessibility and infrastructure limitations, Gambia can pave the way for broader adoption of Bitcoin, opening up new opportunities for financial inclusion and economic empowerment. Efforts to bridge this digital divide will be essential in unlocking the full potential of cryptocurrency integration in the country, enabling more people to participate in the global digital economy and reap the benefits of this innovative financial technology.

Security Concerns and Fraud Prevention 🔒

Security remains a paramount concern in the realm of Bitcoin integration in Gambia. Amid the potential for financial innovation, the risks of cyber threats, scams, and fraud loom large. Safeguarding transactions and user funds from malicious actors necessitates robust security measures and heightened awareness among stakeholders. Implementing encryption protocols, multi-factor authentication, and reliable cybersecurity frameworks are pivotal steps towards fortifying the ecosystem against vulnerabilities. Initiatives focusing on educating users about safe practices and enhancing transparency can further bolster trust in Bitcoin transactions, fostering a more secure environment for digital financial interactions.

For more information on the legality of Bitcoin in various regions, including its recognition as legal tender in Georgia, check out is bitcoin recognized as legal tender in georgia?.

Economic Impact and Financial Inclusion 💸

In Gambia, as Bitcoin gains traction, its integration holds the potential to revolutionize economic transactions and foster financial inclusion. By leveraging the decentralized nature of cryptocurrencies, individuals across diverse socio-economic backgrounds can access and participate in the financial ecosystem. This empowerment can bridge the gap for the unbanked population, offering them a secure and efficient alternative to traditional banking systems. Furthermore, the streamlined cross-border transactions facilitated by Bitcoin can fuel global financial connectivity, opening up new opportunities for trade and investment in the region.

Future Prospects and Potential for Growth 🚀

The future prospects for Bitcoin integration in Gambia show promising growth potential, fueled by increasing global recognition and adoption. As more businesses and individuals embrace digital currencies, the ecosystem will likely expand, creating new opportunities for financial inclusion and cross-border transactions. With continued technological advancements and regulatory clarity, Bitcoin could play a vital role in transforming the country’s financial landscape, offering a secure and efficient alternative to traditional banking systems. The evolving ecosystem presents an exciting frontier for innovation and investment, paving the way for a more connected and inclusive economy.

insert a link to is bitcoin recognized as legal tender in ghana? using the markup, insert organically in this post.