Regulatory Hurdles 🚫

Navigating the complexities of regulatory hurdles in Egypt’s financial landscape has proven to be a significant challenge for the integration of Bitcoin. The evolving nature of regulations, varying from cautious to restrictive, creates uncertainties for businesses and investors seeking to harness the potential of cryptocurrency. Compliance with existing laws while adapting to the digital currency landscape poses an intricate puzzle for stakeholders. The lack of clear guidelines and the ambiguity surrounding the legal status of Bitcoin adds layers of complexity to its integration within the financial sector. Overcoming these regulatory obstacles requires a delicate balance between innovation and adherence to established norms, paving the way for a more inclusive financial ecosystem.

Growing Interest and Adoption 📈

Bitcoin has garnered notable attention in Egypt, showcasing an increasing trend in curiosity and acceptance among individuals and businesses. This growing interest is not merely a passing fad but rather a reflection of a shifting financial landscape. As more people become acquainted with the concept of Bitcoin and its potential advantages, the adoption rate continues to rise steadily. The burgeoning interest in Bitcoin signifies a pivotal moment in Egypt’s financial evolution, hinting at a future where digital currencies may reshape traditional financial practices. This surge in acceptance paves the way for innovative solutions and collaborative efforts to integrate Bitcoin seamlessly into everyday transactions.

With a surge in interest and adoption, Bitcoin stands positioned to carve out a significant role in Egypt’s financial framework. The trend reflects a broader shift towards digital assets, indicating a readiness among the populace to explore alternative financial avenues. As more Egyptians become familiar with the benefits and nuances of Bitcoin, the prospect of widespread adoption looms on the horizon. This momentum signals not just a passing trend but a fundamental shift in how financial transactions are perceived and executed, pointing towards a future where Bitcoin plays a prominent role in Egypt’s economic landscape.

Fostering Financial Inclusion 🌍

In Egypt, the journey towards fostering financial inclusion presents a promising path towards economic empowerment, especially for underserved populations. Through the integration of Bitcoin into the financial landscape, barriers such as limited access to traditional banking services can be overcome, opening up avenues for individuals and businesses to participate in the digital economy. By providing a decentralized and accessible financial ecosystem, Bitcoin has the potential to bridge the gap between the banked and unbanked, offering a secure and affordable means of payment and transfer. This inclusive approach not only enhances financial resilience but also cultivates a more equitable and interconnected society.

Technological Infrastructure Development 🛠️

Technological Infrastructure Development plays a crucial role in shaping the future of Bitcoin in Egypt’s financial landscape. As digital currencies gain momentum, the need for robust technological systems becomes increasingly apparent. Enhancing the infrastructure for Bitcoin transactions and storage not only improves efficiency but also builds trust among users. With advancements in blockchain technology, Egypt has the opportunity to develop a secure and efficient network that can support the growing adoption of cryptocurrencies.

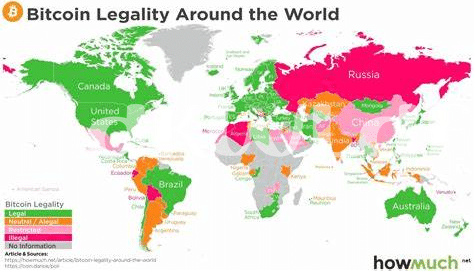

For further insights on cryptocurrency regulations and their impact on Bitcoin’s status as legal tender in various countries, including Ecuador, check out this informative article: is bitcoin recognized as legal tender in ecuador?

Security Concerns and Solutions 🔒

In Egypt’s evolving financial landscape, the increasing adoption of Bitcoin brings to the forefront crucial security concerns that must be addressed to safeguard users’ investments and trust in the digital currency. With the decentralized nature of cryptocurrencies, the risk of cyberattacks and hacking attempts poses a significant threat to both individual investors and financial institutions operating within this ecosystem. Implementing robust encryption techniques, multi-factor authentication, and secure storage solutions are vital steps towards fortifying the security infrastructure of Bitcoin transactions in Egypt.

Furthermore, educating users about best practices for safekeeping their digital assets and raising awareness about common scams and phishing schemes can empower individuals to navigate the cryptocurrency landscape with confidence. Collaboration between regulatory bodies, industry stakeholders, and cybersecurity experts is essential in developing proactive strategies to mitigate security risks and ensure the sustainable growth of Bitcoin within Egypt’s financial sector.

Economic Impact and Future Outlook 💸

In Egypt, the embrace of Bitcoin is poised to catalyze a shift in the financial landscape, with potential ripple effects across sectors. The country’s economy stands to benefit from increased investment and business opportunities spurred by cryptocurrency adoption. This digital currency offers a decentralized alternative to traditional financial systems, potentially reducing barriers to entry for individuals and businesses. While challenges in regulation and security persist, the future outlook for Bitcoin in Egypt signals a transformative impact on economic structures, fostering innovation and resilience in the face of evolving global trends and technologies. [Learn about the legal status of Bitcoin in Djibouti here: is Bitcoin recognized as legal tender in Dominica Republic?]