Regulatory Hurdles 🚫

Navigating the financial landscape in Malawi poses a challenge for Bitcoin banks due to regulatory hurdles. Understanding and adhering to the evolving regulations will be crucial for their operations. This presents an opportunity for collaboration between industry players and regulators to create a conducive environment for innovation and growth within the sector. Embracing transparency and compliance will not only build trust with customers but also pave the way for a sustainable future in the digital banking realm.

Customer Trust and Education 🤝

When it comes to customer trust and education in the realm of Bitcoin banking, the landscape is both challenging and promising. Building trust among customers, especially those new to cryptocurrency, is essential for the adoption and success of Bitcoin banks. Educating customers about the benefits and risks of using Bitcoin as a form of banking can help bridge the knowledge gap, enabling them to make informed decisions. By establishing transparent communication channels and providing educational resources, Bitcoin banks can cultivate a sense of confidence and understanding among their clientele.

Technology Integration 🖥️

In the digital landscape of financial institutions, seamless technology integration stands at the core of the Bitcoin banking sector in Malawi. A dynamic user interface coupled with robust backend systems is imperative to ensure smooth transactions and customer satisfaction. By harnessing cutting-edge technology, Bitcoin banks can offer a convenient and reliable platform for users to manage their digital assets efficiently. Embracing emerging trends in fintech innovation will not only enhance the operational efficiency of these banks but also elevate the overall user experience, setting them apart in a competitive market.

In the realm of technology integration, the key lies in fostering collaborations with tech experts and investing in scalable solutions that cater to the evolving needs of the market. Leveraging advanced analytics and artificial intelligence can further streamline processes and personalize services, propelling Bitcoin banks towards greater success and sustainability in the ever-evolving financial landscape.

Security Risks and Safeguards 🔒

As Bitcoin banks in Malawi navigate the landscape, ensuring robust security measures is paramount. Safeguards against cyber threats and unauthorized access must be diligently implemented to protect users’ funds. Education on safe practices, such as using secure wallets and recognizing phishing attempts, can further enhance the overall security posture.

Embedding encryption technologies and multi-factor authentication processes can fortify defenses against potential breaches. By proactively addressing security risks and instating effective safeguards, Bitcoin banks in Malawi can cultivate trust among users and bolster the resilience of their digital banking ecosystem. For more insights on regulatory frameworks in the realm of Bitcoin banking services, explore the article on bitcoin banking services regulations in Malta.

Competition with Traditional Banks 💼

Bitcoin banks in Malawi face tough competition with traditional banks as they strive to establish themselves in the financial sector. The challenge lies in proving their worth and reliability to customers accustomed to the conventional banking system. Adapting to the existing market dynamics and offering innovative solutions will be essential in gaining a competitive edge over traditional banks in the long run.

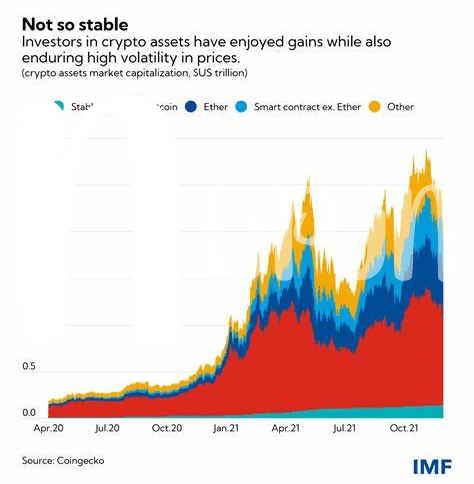

Future Growth and Scalability 📈

For Bitcoin banks in Malawi, future growth and scalability are key factors for long-term success. As the digital currency landscape evolves, these institutions must adapt to meet the increasing demands of their customers. By embracing innovation and expanding their services, Bitcoin banks can position themselves for sustainable growth in the competitive financial market. With a focus on scalability, these banks can ensure they are equipped to handle the growing number of users and transactions in the digital economy. To learn more about the regulations governing Bitcoin banking services in Malawi, please refer to the bitcoin banking services regulations in luxembourg.