Central Banks: Guardians of Money Stability 🏦

Imagine a world where all your money is kept safe, where its value doesn’t change wildly from day to day. That’s the world central banks try to create. These big players in the world of money work hard to make sure prices don’t jump too high or drop too low. They’re like referees in a game, making sure everything runs smoothly. Central banks have a few tricks up their sleeves, like tweaking interest rates or buying and selling stuff to influence how much money is floating around. Their goal? Keeping the value of money stable so that you can plan your shopping or savings without worrying about sudden changes.

| Tool | Description | Goal |

|---|---|---|

| Interest Rates | Adjusting how much it costs to borrow money | Control inflation and keep the economy steady |

| Buying/Selling Assets | Buying or selling things to influence how much money is in the system | Ensure there’s not too much or too little money in circulation |

These methods help central banks act as guardians of money stability. They aim to make sure that when you wake up tomorrow, your money will hold its value, allowing you to make plans with certainty. This effort brings a sense of calm and predictability to economies around the world, making these institutions crucial players in the global financial ecosystem.

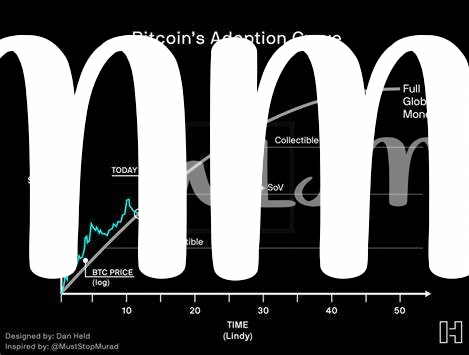

Bitcoin: the Digital Rebel Rises 📈

Imagine a world where you can secure your savings, make purchases, and even earn a little extra without ever stepping into a bank. This isn’t a far-off dream but the reality offered by Bitcoin, a digital currency that operates independently of traditional banking systems. Born from the financial tumult of 2008, Bitcoin emerged as a beacon of hope for those seeking an alternative to the often rigid and exclusive financial institutions. It’s money, but not as we’ve known it. Instead of being controlled by a central authority, Bitcoin runs on a network of computers worldwide, making it not just global but incredibly inclusive.

As Bitcoin’s popularity and value shot up, it caught the world’s attention, challenging the status quo and sparking debates on financial freedom and control. It represents not just a technological innovation but a shift in how we perceive and utilize money. For a deep dive into how various countries are navigating Bitcoin’s rise and integrating it into their financial regulations, one can explore an insightful analysis here. Through its decentralized nature, Bitcoin extends an invitation to anyone, anywhere, to partake in the financial system, promising a level of autonomy and opportunity that was once hard to imagine.

The Power Struggle: Control Vs. Freedom 🤼

Picture this: on one side, we have the traditional giants who’ve been around for ages, looking after the money in our pockets and the stability of economies. They like rules and order. On the other side, we’ve got this digital newcomer, moving fast and playing by a new set of rules, all about making financial dealings quick, borderless, and less dependent on those traditional giants. This clash could be straight out of an epic tale, only it’s happening in the real financial world.

This struggle isn’t just about who holds the reins but also about how we, the regular folks, prefer to manage and spend our money. 🌐🤝 Imagine a world where you could send money across the globe as easily as sending a text message, without waiting days or paying hefty fees. But, at the same time, the folks who’ve been keeping our money safe for so long argue that without oversight, things could get pretty chaotic. 💸🔍 They believe in protecting us from financial storms and keeping everything nice and orderly. It’s a classic case of freedom meets control, where finding a middle path could shape the future of money.

Global Perspectives: Different Approaches Around the World 🌍

Around our big, wide world, countries are taking a closer look at Bitcoin and its friends, the cryptocurrencies, deciding how they fit into their financial playgrounds. Some places, like a cautious parent, decide to keep a tight grip on these digital newcomers, worried they might upset the balance of their money’s health. They introduce rules to make sure everything stays safe and sound. Others see Bitcoin as the cool, mysterious visitor that might just change how we think about money, offering it a seat at the table with fewer rules, hoping it’ll spark some positive change. It’s fascinating to see how different corners of the globe are navigating this new terrain, from places rolling out the red carpet and embracing the potential for innovation, to those drawing a line in the sand, firm on maintaining control. For those curious about diving deeper into the world of cryptocurrencies and understanding the intricacies of its ecosystem, specifically on how to engage in bitcoin futures trading regulatory outlook, there’s a wealth of information waiting to be discovered. As we gaze into the crystal ball, trying to foresee how this global patchwork of attitudes and regulations will evolve, it’s clear that finding a balance that respects the freedom digital currencies offer, while ensuring the financial safety of the citizens, remains a significant challenge.

Future Predictions: What Could Happen Next? 🔮

Peeking into the crystal ball, the relationship between central banks and Bitcoin seems primed for an intriguing evolution. Imagine a future where balance is the name of the game. On one side, we have central banks, traditionally seen as the vigilant stewards of our financial systems, who might begin to embrace digital currencies, albeit cautiously. This could mean developing their own digital money to keep up with the times and perhaps, integrating blockchain, the technology behind Bitcoin, to enhance security and efficiency. On the flip side, Bitcoin, the once maverick force challenging the status quo, could find itself moving towards the mainstream, its rough edges smoothed over by regulations making it a more stable, albeit less rebellious player in the game of finance.

However, the path won’t be entirely smooth. Challenges such as ensuring privacy while maintaining transparency, preventing illicit use while encouraging innovation, and balancing control with freedom will be at the heart of this journey. Governments and financial regulators around the world will play a pivotal role, sculpting the landscape through policies that could either stifle growth or foster a new era of financial inclusion and innovation.

What’s certain is change. Whether through fierce competition or cautious collaboration, the coming years will likely see a transformative shift in how we perceive and use money. Here’s a glimpse into what this future might look like:

| Year | Central Banks | Bitcoin | Global Policy |

|---|---|---|---|

| 2025 | Experimentation with digital currencies | Becoming more mainstream | Emerging regulations |

| 2030 | Widespread adoption of digital currencies | Regulated but thriving | Standardized global regulations |

| 2035+ | Blockchain integration in financial systems | Seen as a traditional asset class | Harmonized financial ecosystems |

Amidst this evolving landscape, the quest for a middle ground may lead to an unprecedented era of cooperation that could redefine the global economic order for generations to come.

Finding Common Ground: Is It Possible? 🤝

As the journey between central banks and Bitcoin unfolds, finding a middle ground may seem like walking through a maze with countless turns. Imagine a world where the traditional guards of our money take a step towards understanding the digital rebel, and vice versa. The key might lie in acknowledging the strengths of both worlds. Central banks could explore ways to innovate within their regulatory frameworks, embracing some of the flexibility and efficiency that Bitcoin brings to the table. On the flip side, the Bitcoin community might consider how aspects of regulation can provide users with safety nets and trust in their transactions. Together, they can enhance the financial ecosystem, making it more robust and inclusive.

In this evolving narrative, the discussions around renewable energy solutions for bitcoin mining operations regulatory outlook illuminate how collaboration can pave the way for advancements that align with global sustainability goals. By focusing on shared objectives, such as financial inclusion and environmental sustainability, central banks and Bitcoin advocates can forge a path that leverages the strengths of both sides. This partnership could lead to innovative solutions that not only secure our financial future but also ensure it is built on a foundation of mutual respect and understanding. The ultimate goal? A system that empowers individuals worldwide, making financial services accessible to all 💡🌱🌍.