Introduction to Central Banks and Bitcoin 🌍

Imagine a world where the money in your pocket has a big story behind it, one involving powerful establishments known as central banks. These institutions are like the conductors of an orchestra, making sure the music of the economy plays smoothly. They decide how much money flows through the lands and at what pace, trying to keep things balanced and prevent too much inflation (when prices rise) or deflation (when they fall).

On the other side of the spectrum, we have Bitcoin – a kind of digital treasure that operates without a central leader. Think of it as the new kid on the block, challenging the way traditional money works. Bitcoin’s rise brings a fresh perspective, offering a way to send money across the world quickly and without the need for a middleman, like banks. Here, we dive into what makes these two different and why it matters to us, the people using money every day.

| Feature | Central Banks | Bitcoin |

|---|---|---|

| Leadership | Centralized Authority | Decentralized Network |

| Operation | Regulates Monetary Policy | Purely Digital Currency |

| Influence on Inflation | Actively Manages | Limited Supply Caps Inflation |

| User Base | General Public | Technology Enthusiasts, Investors |

How Central Banks Influence Our Money 💵

Think of central banks like the big bosses of the money world. They have a huge role in deciding how much money is floating around in the economy. To do this, they tweak interest rates, which is a bit like adjusting the volume on your music player. If they turn it up (raise interest rates), people are less likely to borrow money because it becomes more expensive to do so. On the flip side, if they turn it down (lower interest rates), borrowing money becomes cheaper, encouraging people and businesses to spend more. It’s their way of trying to keep the economy just right – not too hot, not too cold.

These central banks also have a say in how much your money is worth compared to money from other countries. This can make a big difference when you’re buying things from abroad or traveling. Plus, they’re like the guardians of the currency, stepping in to avoid any big problems that could make the money in our pockets worth a lot less overnight. In essence, they hold the steering wheel of the financial system, making sure everything runs smoothly while we go about our daily lives.

Bitcoin: the Digital Challenger to Traditional Money 💻

Imagine a world where you don’t have to rely on big banks to keep your money safe or to send it to a friend halfway across the globe. That’s the vision Bitcoin brings to the table 🌐. Created by a person (or group of people) under the pseudonym Satoshi Nakamoto in 2009, this digital currency offers a fresh, decentralized alternative to traditional, central bank-controlled currencies. Simply put, it allows you to be your own bank. Unlike the dollars or euros, which are managed by central banks, Bitcoin operates on a technology called blockchain. Think of it as a digital ledger that records every transaction in a secure and transparent way, without the need for a middle man 🛡️. This means lower fees, faster transactions, and a level of privacy traditional banks can’t match. As more people and businesses start to embrace this groundbreaking technology, it’s poised to give the old way of handling money a run for its money 💨. Without a doubt, the rise of Bitcoin signals a significant shift in how we think about and use money in our digital age.

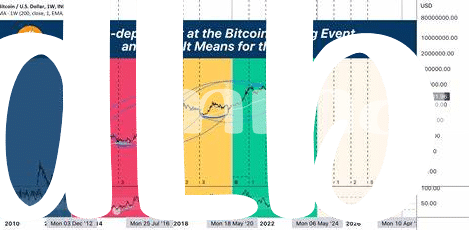

Adoption Trends: Central Banks Vs. Bitcoin in 2024 📊

As we step into the year 2024, the tug-of-war between traditional central banks and the rising star, Bitcoin, paints a fascinating picture. On one side, we find central banks, the giants that have long governed our financial systems, tweaking policies and launching digital currencies to stay relevant. On the other, Bitcoin, with its decentralized charm, is rapidly gaining ground, thanks in part to its scarcity and independence from government control. This fascinating dynamic is not just confined to the tech world or finance enthusiasts. Its ripples are felt far and wide, influencing how everyday folks think about and use money. Whether it’s paying for a cup of coffee or transferring money overseas, the choice between digital currencies and traditional banknotes is becoming real for many.

Understanding these shifts is crucial, and for those looking to dive deeper, a comprehensive guide on the matter can be found what you need to know about bitcoin halving events in 2024. This event is a significant milestone in the Bitcoin ecosystem, directly influencing its adoption and how it stands up against central banks. As the landscape of money continues to evolve, keeping an eye on these developments can help us navigate the future more wisely. Whether it’s choosing where to invest or understanding the money in our wallets, knowing the interplay between these two financial titans will be key.

The Impact on Everyday People Like You and Me 👫

When you and I go about our daily lives, buying groceries or saving for a rainy day, we might not think much about how the big battle between central banks and Bitcoin affects us. But, let’s dive a little deeper 🕵️♂️. Imagine this: You wake up one day to find that your savings in the bank now have different purchasing power because the central bank decided to print more money. Sounds frustrating, right? Now, enter Bitcoin 🚀. This digital currency offers a kind of safety net – its value isn’t decided by any one person’s decisions or policies. If more folks start using Bitcoin, it could mean a lot for our wallets. For one, sending money to a friend abroad would be cheaper and faster because it cuts out the middleman (like banks). And for those without access to traditional banking, Bitcoin could be a real game-changer. But it’s not all sunshine; the value of Bitcoin can go up and down very quickly, which can be a bit nerve-wracking. So, as we march into 2024, the choice between sticking with traditional money managed by central banks or going the Bitcoin route could really shake up how we all save, spend, and think about money.

| Aspect | Central Banks’ Money | Bitcoin |

|---|---|---|

| Control | Managed by policies & government decisions | Decentralized, not controlled by any single entity |

| Accessibility | Requires access to banking services | Available to anyone with internet access |

| Transaction Speed & Cost | Can be slow and costly for international transfers | Generally faster and cheaper, especially internationally |

| Value Stability | Generally stable, but can be influenced by inflation | Can be volatile with rapid increases or decreases in value |

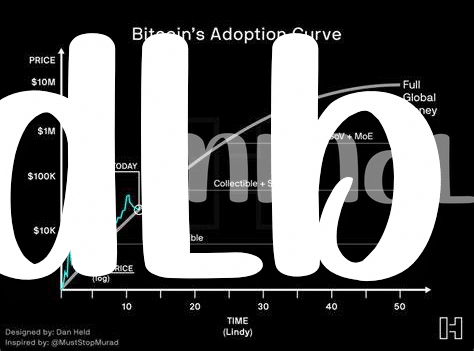

Predictions: the Future Landscape of Money 🚀

As we look towards the future, the landscape of money is gearing up for an exciting transformation, driven by innovation and the growing acceptance of digital currencies. Imagine a world where paying for your morning coffee doesn’t require physical cash or a card, but just a quick scan of a Bitcoin app on your phone. This isn’t just a dream; it’s becoming more of a reality every day. Central banks around the globe are exploring digital currencies, aiming to make transactions faster, cheaper, and more accessible. On the other side, Bitcoin continues to break barriers, offering a decentralized alternative that empowers individuals to be their own bank. The tug-of-war for adoption has led to an increase in countries recognizing the potential of Bitcoin, not just as an investment but as a step towards financial inclusion. For a glimpse into how Bitcoin is making a difference, check out bitcoin’s contribution to financial inclusion worldwide in 2024, showcasing the countries where it has been embraced as legal tender. As these trends evolve, we’re not just witnessing a shift in how we think about money but a redefinition of financial freedom, where the power is increasingly in the hands of the people. The future of money promises more inclusivity, security, and flexibility, shaping a world where financial systems embody the needs and values of their users.