Overview 🌍

Cryptocurrency, a digital form of currency, has been gaining increasing popularity globally. It has the potential to revolutionize the way transactions are conducted, offering benefits such as increased security, reduced processing times, and lower transaction fees. Governments around the world are beginning to explore the possibility of accepting cryptocurrency payments for services, marking a shift towards embracing this modern financial technology. This move not only reflects a willingness to adapt to the changing digital landscape but also signals a recognition of the efficiency and convenience that cryptocurrencies offer. By understanding the implications and challenges associated with this form of payment, governments can pave the way for a more secure and streamlined payment ecosystem.

Benefits of Cryptocurrency Payments 💰

Implementing cryptocurrency payments for government services opens up a world of possibilities for both the administration and the citizens. The transparency and security provided by cryptocurrencies streamline transactions, reducing operational costs and minimizing the risk of fraud. With faster processing times and lower fees compared to traditional payment methods, cryptocurrencies offer a more efficient and cost-effective solution for conducting transactions securely. Additionally, embracing cryptocurrency payments can enhance financial inclusion, especially for individuals without access to traditional banking services.

Challenges and Solutions 🔒

Encountering obstacles when implementing cryptocurrency payments for government services is inevitable. One major challenge is the volatility of cryptocurrencies, making it difficult to predict their value accurately. This can result in uncertainty for both the government and citizens involved in transactions. Additionally, security concerns pose a significant threat, as the risk of cyberattacks and fraud is heightened in the digital payment landscape. To address these challenges, implementing robust risk management strategies and encryption methods is crucial to safeguard transactions and ensure data protection for all parties involved.

Moreover, regulatory compliance remains a key issue, as navigating the complex legal frameworks surrounding cryptocurrency can be a daunting task for governments. Collaborating with regulatory bodies and adopting transparent policies is essential to foster trust and regulatory compliance in cryptocurrency transactions. By proactively addressing these challenges with innovative solutions, governments can effectively integrate cryptocurrency payments into their services and pave the way for a more secure and efficient payment ecosystem.

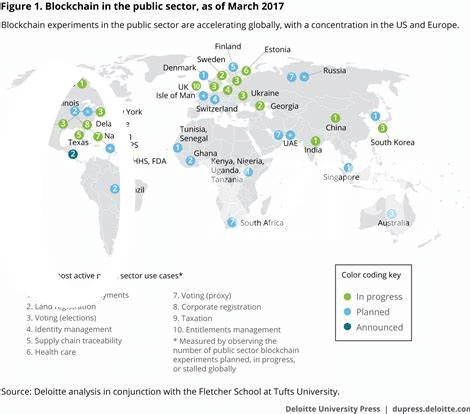

Case Study Analysis 📊

In a detailed analysis of the case study, it becomes evident that the integration of cryptocurrency payments into government services has yielded promising results. The data reveals a significant increase in transaction speed and cost-efficiency, leading to improved service delivery for citizens. Additionally, the transparency and security provided by blockchain technology have enhanced trust in the government’s financial processes.

Through a comprehensive examination of the case study, it is clear that the successful implementation of cryptocurrency payments has paved the way for innovative solutions in governmental transactions. This shift towards digital payment methods has not only modernized the service delivery system but also set a precedent for other countries to explore similar initiatives. The results signify a paradigm shift in the way governments can leverage blockchain technology to improve efficiency and accountability in public services. For more insights on government initiatives on bitcoin and blockchain in South Africa, refer to government initiatives on bitcoin and blockchain in South Africa.

Implementation Process 🚀

1) For the successful implementation of cryptocurrency payments for government services, a systematic approach is crucial. It begins with thorough research and analysis to understand the potential impact on existing systems. The next step involves establishing secure and user-friendly platforms for both citizens and government agencies to facilitate seamless transactions. Additionally, clear communication and guidance are essential to educate stakeholders on the process and benefits of incorporating cryptocurrency payments.

2) Real-world testing and feedback play a pivotal role in refining the implementation process. By conducting pilot programs with selected government services, any issues can be identified and addressed promptly. Continuous monitoring and evaluation are necessary to ensure compliance with regulations and security standards. Collaborating with industry experts and incorporating best practices will further enhance the efficiency and reliability of cryptocurrency payments for government services.

Future Implications and Recommendations 🔮

As the landscape of government services evolves with technological advancements, embracing cryptocurrency payments opens up a realm of future implications. By adopting blockchain technology and digital currencies, governments can increase transparency, efficiency, and accessibility for citizens. This shift towards decentralized payment systems not only streamlines processes but also reduces costs associated with traditional financial transactions. To fully leverage the benefits, it is crucial for governments to invest in educating both officials and the public on the intricacies of cryptocurrencies.

In light of these considerations, recommendations for successful implementation include collaboration with fintech experts, continuous monitoring of regulatory frameworks, and regular updates to security protocols. This proactive approach ensures that government initiatives on bitcoin and blockchain in Seychelles continue to align with global best practices, similar to the pioneering efforts seen in Slovakia. Through strategic planning and adaptation, governments can pave the way for a more inclusive and technologically robust future in public service delivery.