Real-life Success Stories of Aml Implementation 🌟

In real-life scenarios, the successful implementation of AML regulations related to Bitcoin in Palestine has showcased the tangible benefits of compliance. These stories not only highlight the effectiveness of AML measures but also demonstrate how businesses and individuals have adapted to regulatory requirements, fostering a more secure environment for digital transactions. By delving into these narratives, we gain valuable insights into the practical application of AML practices and their impact on the Bitcoin landscape.

Challenges and Solutions Faced in Palestine 💡

Palestine’s path in implementing AML regulations for Bitcoin brought both trials and triumphs. Local businesses navigated the complexities of compliance while adapting to evolving regulatory landscapes. Alongside the challenges of interpreting and adhering to stringent regulations, solutions emerged through collaboration and knowledge sharing. The proactive stance of stakeholders fostered a culture of continuous learning, leading to streamlined processes and enhanced security measures. Despite initial hurdles, innovative approaches and dedicated efforts paved the way for sustainable AML practices within the Bitcoin ecosystem. As the industry matures, the experiences from Palestine offer valuable insights for other regions seeking to fortify their regulatory frameworks and promote responsible financial practices.

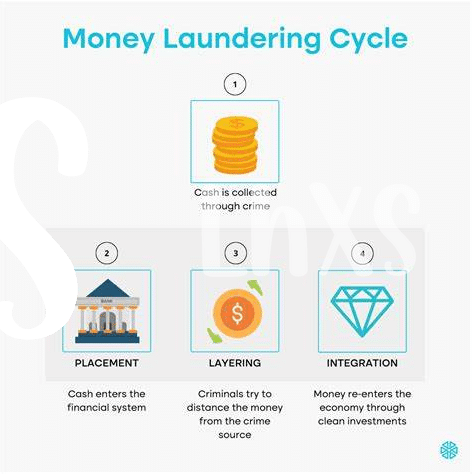

Impact of Aml Regulations on Bitcoin Transactions 💰

Aml regulations in Palestine have significantly impacted Bitcoin transactions, leading to a more secure and transparent environment. Compliance with these regulations has enhanced trust among stakeholders and minimized the risks associated with illicit activities. By incorporating Aml measures, the Bitcoin industry in Palestine has witnessed increased legitimacy and acceptance, attracting more participants and investment. The implementation of Aml regulations has not only safeguarded transactions but also paved the way for sustainable growth and innovation within the sector.

Strategies for Effective Compliance with Regulations 🔒

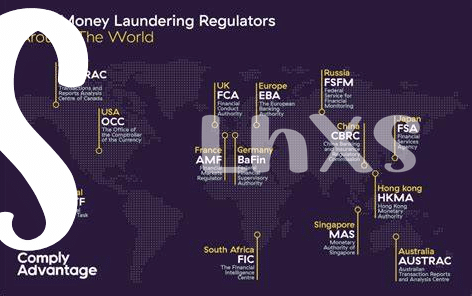

When it comes to maintaining compliance with AML regulations in the Bitcoin industry, businesses and individuals can benefit greatly from adopting proactive strategies. One effective approach is to establish robust internal controls that include regular monitoring, risk assessments, and employee training programs. Additionally, utilizing advanced blockchain analytics tools can help in identifying and addressing potential risks more efficiently. Collaborating with regulatory authorities and industry peers to share best practices and insights can also enhance overall compliance efforts. By implementing these strategies, entities can strengthen their commitment to AML compliance and contribute to a more secure and transparent Bitcoin ecosystem. To learn more about AML regulations in different regions, including Rwanda, check out the detailed guide on bitcoin anti-money laundering (AML) regulations in Rwanda.

Key Takeaways for Businesses and Individuals 🏆

In navigating the realm of AML regulations for Bitcoin in Palestine, businesses and individuals alike can draw essential lessons. Understanding the importance of compliance and the potential ramifications of non-compliance is crucial. Developing robust internal controls, conducting regular risk assessments, and investing in staff training are key pillars for effective AML implementation. Moreover, fostering an open dialogue with regulatory authorities and staying abreast of evolving AML trends can enhance overall compliance efforts. Emphasizing transparency, due diligence, and ongoing monitoring can help mitigate risks and foster trust within the Bitcoin ecosystem. By proactively embracing AML measures, businesses and individuals can not only safeguard their operations but also contribute to the legitimacy and sustainability of the industry.

Future Prospects for Aml in the Bitcoin Industry 🔮

For the future of Anti-Money Laundering (AML) in the Bitcoin industry, advancements in technology and regulatory frameworks are expected to play a significant role. As digital currencies continue to evolve, the implementation of robust AML measures will be crucial to maintaining trust and security within the ecosystem. Enhanced collaboration between governments, financial institutions, and cryptocurrency exchanges will likely shape the landscape of AML practices in the Bitcoin industry. Compliance with established AML regulations will be key to fostering a secure and trusted environment for all participants in the Bitcoin market.

Link to bitcoin anti-money laundering (aml) regulations in Portugal: Bitcoin Anti-Money Laundering (AML) Regulations in Papua New Guinea.