Overview of Bitcoin Use in Libya 🌍

In Libya, the adoption of Bitcoin has been steadily increasing, offering an alternative means of financial transactions in a country facing economic challenges. The decentralized nature of Bitcoin appeals to individuals seeking financial independence, especially in regions with limited access to traditional banking services. Despite regulatory uncertainties, the use of Bitcoin in Libya showcases the evolving landscape of digital currencies in the country, presenting both opportunities and challenges for users navigating this new financial paradigm.

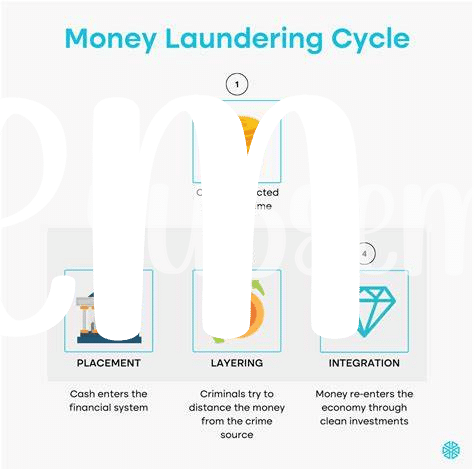

Common Aml Violations in Crypto Transactions 💸

In the world of cryptocurrencies, particularly in the context of Bitcoin transactions, there are several common Anti-Money Laundering (AML) violations that can occur. These violations often involve the illicit transfer of funds or assets through crypto channels, bypassing regulatory checks and balances. One of the most prevalent violations is the use of mixers or tumblers to obfuscate the origin of funds, making it difficult to trace the source of transactions. Another common violation is structuring transactions to avoid reporting requirements, where individuals conduct multiple smaller transactions instead of a single large one to evade detection. Additionally, the use of unregistered or anonymous wallets can also contribute to AML violations by masking the identities of those involved in the transactions.

Impact of Aml Penalties on Bitcoin Users 💥

Bitcoin users in Libya face significant ramifications when AML penalties are imposed, affecting their financial activities and reputations. The stringent enforcement of AML regulations can result in frozen assets, hefty fines, and even legal consequences for individuals utilizing Bitcoin for transactions. Moreover, the threat of penalties serves as a deterrent, influencing users to adhere to compliance measures to avoid the adverse impact on their financial standing and overall transactional freedom. Overall, the imposition of AML penalties on Bitcoin users in Libya underscores the importance of regulatory compliance and the need for robust risk management strategies in the cryptocurrency market.

Case Studies of Aml Breaches in Libyan Bitcoin Market 📉

When exploring the landscape of AML breaches within the Libyan Bitcoin market, compelling case studies emerge, shedding light on the complexities faced by users. These real-world examples serve as cautionary tales, illustrating the repercussions that can follow non-compliance with regulations. From inadvertent violations to deliberate circumventions, each case study unveils a unique facet of the challenges inherent in navigating AML requirements. By delving into these instances, stakeholders gain valuable insights that can inform strategic approaches to fostering a culture of adherence and vigilance in the realm of cryptocurrency transactions.

To further enhance AML compliance practices in Bitcoin operations, it is essential to learn from proven strategies and best practices. One valuable resource for understanding Bitcoin anti-money laundering (AML) regulations in Luxembourg can be found at [this link](https://wikicrypto.news/best-practices-for-aml-compliance-in-lebanese-bitcoin-operations). By incorporating such insights into operational frameworks, stakeholders can fortify their defenses against potential AML breaches and contribute to a safer, more secure ecosystem.

Regulatory Measures to Combat Aml in Libya 🛡️

Within the evolving landscape of cryptocurrency in Libya, regulatory measures are being streamlined to combat Anti-Money Laundering (AML) practices. The government is actively working on implementing stricter guidelines and monitoring systems to curb illicit activities within the Bitcoin market. By enforcing robust AML regulations, authorities aim to create a safer environment for investors and uphold the integrity of financial transactions. These regulatory measures are pivotal in fostering transparency and accountability, thereby enhancing trust in the burgeoning Bitcoin ecosystem in Libya. Through collaboration between regulatory bodies and industry stakeholders, the framework for combating AML violations continues to progress, signaling a proactive approach towards ensuring compliance and safeguarding against financial crimes.

Strategies for Ensuring Aml Compliance in Bitcoin Transactions 🔒

Successfully navigating the complexities of Anti-Money Laundering (AML) compliance in Bitcoin transactions requires a multifaceted approach. One key strategy is to implement robust Know Your Customer (KYC) procedures to verify the identity of individuals engaging in cryptocurrency transactions. Additionally, employing transaction monitoring tools can help detect suspicious activity and ensure compliance with AML regulations. Regular staff training on AML protocols and continuous monitoring of regulatory developments in the cryptocurrency landscape are also essential. Collaborating with regulatory bodies and industry peers can provide valuable insights and guidance on best practices for AML compliance in the Bitcoin sphere. Ensuring transparency and accountability throughout the transaction process is paramount in fostering a secure and compliant environment for all stakeholders involved.