Overview of Aml Compliance 🌍

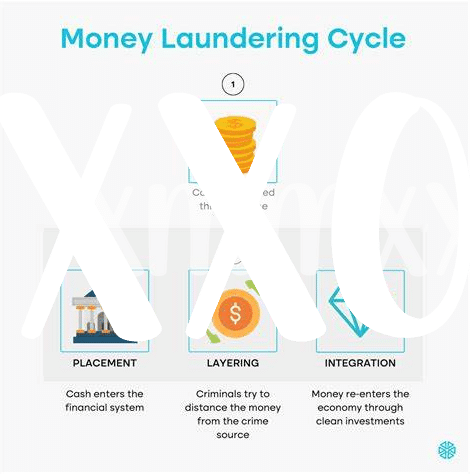

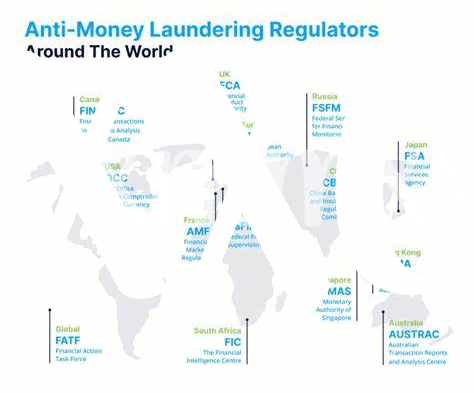

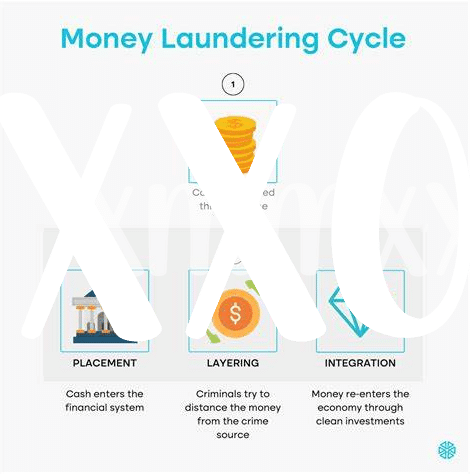

AML compliance is crucial in the global landscape to combat financial crimes that threaten economies and institutions. Implementing effective anti-money laundering measures ensures transparency, credibility, and trust within the financial system, safeguarding against illicit activities and enhancing regulatory oversight. AML regulations provide a framework for entities to monitor, detect, and prevent money laundering and terrorist financing, fostering a culture of compliance and accountability across various industries and jurisdictions.

Ensuring adherence to AML requirements involves robust risk assessments, customer due diligence, transaction monitoring, and reporting suspicious activities. Collaborative efforts between regulatory bodies, financial institutions, and businesses are essential to strengthen AML frameworks and mitigate risks effectively. Embracing technological advancements and data analytics further enhances compliance efforts, enabling organizations to adapt proactively to evolving AML challenges and regulatory expectations.

Impact of Aml Regulations 📉

Amidst the ever-evolving landscape of regulatory compliance, the impact of AML regulations reverberates across industries, shaping governance and financial practices. From stringent customer due diligence to transaction monitoring, AML regulations embed a culture of accountability and transparency within organizations. Inculcating a robust compliance framework not only mitigates financial risks but also safeguards businesses from potential legal repercussions, fostering trust and credibility in the global market. The proactive adoption of AML measures not only safeguards the integrity of financial transactions but also reinforces the ethical foundations of businesses, underscoring the pivotal role of regulatory compliance in sustaining a secure and resilient economic ecosystem.

Case Study 1: Financial Sector 🏦

In the realm of AML compliance within the financial sector, significant progress has been witnessed through a proactive approach to regulation. By implementing robust monitoring systems and conducting thorough customer due diligence, institutions have been able to detect and prevent potential money laundering activities effectively. One notable success story involved the collaboration between regulatory authorities and financial institutions in Seychelles. Through continuous training programs and the utilization of advanced technology, suspicious transactions were flagged and investigated promptly, leading to the identification and mitigation of illicit financial flows.

As a result of these concerted efforts, instances of money laundering within the financial sector decreased significantly, bolstering the integrity of the industry and instilling greater confidence among both domestic and international stakeholders. Such successful outcomes highlight the critical role that effective AML compliance plays in safeguarding the stability and reputation of financial institutions, paving the way for sustained growth and trust in the sector.

Case Study 2: Gaming Industry 🎮

Case Study 2 in the Gaming Industry showcases how implementing robust AML compliance measures led to significant improvements in detecting and preventing illicit activities within the sector. By integrating advanced monitoring technologies and conducting thorough customer due diligence, companies observed a notable decrease in suspicious transactions and enhanced overall transparency. Furthermore, proactive collaboration with regulatory bodies and continuous staff training proved instrumental in cultivating a culture of compliance and accountability. Overall, this case study exemplifies the pivotal role of effective AML strategies in safeguarding the integrity of the gaming industry while fostering trust among stakeholders. For further insights into the challenges surrounding Bitcoin AML regulations, explore the informative article on bitcoin anti-money laundering (AML) regulations in Solomon Islands.

Key Strategies for Aml Success 💡

Key Strategies for AML Success involve a tailored approach that integrates robust technology solutions with comprehensive employee training programs. One key strategy is the implementation of automated monitoring systems that can efficiently flag suspicious transactions in real-time. Additionally, fostering a culture of compliance within the organization through regular training sessions and clear communication channels is crucial for ensuring continued success in AML efforts.

Another effective strategy is the establishment of strong partnerships with regulatory bodies and industry peers to stay updated on the latest compliance requirements and best practices. Proactive risk assessments and continuous evaluation of existing AML processes also play a pivotal role in enhancing the overall effectiveness of compliance programs. By implementing these key strategies, companies can mitigate risks, maintain regulatory compliance, and safeguard their reputation in today’s dynamic regulatory environment.

Future Perspectives and Trends 🔮

In this ever-evolving landscape of AML compliance, future perspectives and trends hold significant importance. As technology continues to advance, incorporating artificial intelligence and machine learning into compliance processes will become more prevalent. Collaboration between nations and regulatory bodies will also be crucial in combating increasingly sophisticated money laundering schemes. Additionally, the focus is shifting towards proactive monitoring and risk assessment rather than reactive measures. Embracing a culture of ongoing training and education for employees will be key in adapting to these changes and ensuring continued AML compliance success. Stay informed and agile in navigating the future landscape of AML regulations.

Bitcoin Anti-Money Laundering (AML) Regulations in Sierra Leone