Benefits of Cameroon’s Digital Currency 💰

Cameroon’s Digital Currency is set to revolutionize the financial landscape by providing faster and more secure transactions for its citizens. With the introduction of this innovative payment method, individuals will have greater access to financial services, empowering them to engage in economic activities more conveniently and efficiently.

Moreover, the adoption of a digital currency in Cameroon will facilitate cross-border transactions, promoting international trade and economic growth. This modern payment system will also enhance financial literacy among the population, fostering a culture of digital financial management and inclusion for all.

Impact on Financial Inclusion 🌍

Cameroon’s digital currency initiative is poised to transform the landscape of financial services, particularly in promoting access to banking and payment services for underserved populations. By leveraging advances in technology, such as blockchain and mobile money platforms, the digital currency plan aims to bridge the gap between traditional banking systems and the unbanked populations in Cameroon. This shift towards digital financial services has the potential to revolutionize the way individuals and businesses transact, ultimately leading to greater financial inclusion nationwide.

As Cameroon embarks on this journey towards a digital economy, the impact on financial inclusion is not just limited to providing access to basic financial services. It also lays the foundation for promoting economic growth, empowering marginalized communities, and fostering innovation in the financial sector. By addressing the barriers that hinder financial inclusion, such as high transaction costs and limited access to banking infrastructure, the digital currency plan sets the stage for a more inclusive and sustainable financial ecosystem in Cameroon.

Technology Driving the Transition 🚀

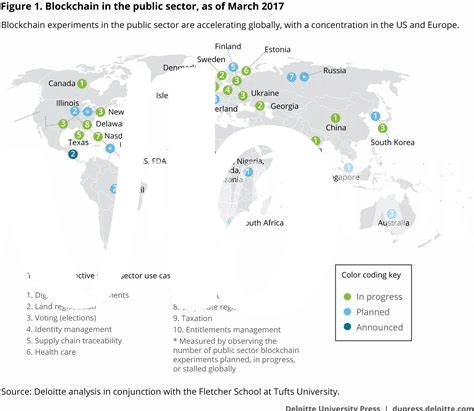

Advancements in digital technologies are at the forefront of Cameroon’s push towards a national digital currency. From blockchain to mobile payments, a myriad of tech-driven solutions are propelling this transition into the digital realm. These innovations not only offer greater accessibility and transparency to financial services but also pave the way for a more inclusive economy. Leveraging the power of these technologies, Cameroon aims to bridge the gap between traditional banking services and unbanked populations, ultimately fostering greater financial inclusion across the nation.

Challenges and Potential Solutions 🤔

Challenges arise when implementing a new digital currency system, such as regulatory hurdles and public acceptance concerns. To address these, education campaigns and partnerships with financial institutions can help overcome resistance. Ensuring cybersecurity measures is crucial to prevent fraud and hacking threats. Additionally, creating user-friendly platforms and robust customer support can enhance user experience and trust in the system. By proactively identifying and resolving these challenges, Cameroon can smoothen the transition towards a successful digital currency ecosystem. Government initiatives on bitcoin and blockchain in Burkina Faso can provide valuable insights and lessons for Cameroon’s own digital currency journey.

Government Support and Partnerships 🤝

The advancement of digital currency adoption in Cameroon is bolstered by key government support and strategic partnerships. This collaboration plays a vital role in laying the groundwork for successful implementation and widespread acceptance. Through joint efforts, regulatory frameworks are being put in place, ensuring a secure and conducive environment for digital currency integration. Additionally, partnerships with industry players and financial institutions further enhance the credibility and usability of the national digital currency. Such synergies not only foster trust among stakeholders but also contribute to the overall success of the initiative.

Future Outlook and Adoption Rate 🔮

The adoption of digital currency in Cameroon holds promising potential for revolutionizing financial inclusion and modernizing economic transactions. The gradual acceptance and integration of this digital financial landscape can pave the way for greater accessibility to financial services, especially for underserved communities. As more individuals and businesses embrace this digital shift, the country may witness a transformation in how financial transactions are conducted, fostering a more inclusive and efficient ecosystem for economic growth and prosperity.

Furthermore, with a forward-looking approach and strategic partnerships, the future outlook for digital currency adoption in Cameroon appears bright. As the government continues to support and collaborate with key stakeholders, the momentum for widespread adoption is likely to increase steadily. The evolving tech-driven landscape, coupled with regulatory frameworks and educational initiatives, is poised to further catalyze the uptake of digital currency, shaping a more seamless and secure financial environment for all. Divine collaboration can promote broader acceptance and understanding, paving the way for a more robust and inclusive financial system.government initiatives on bitcoin and blockchain in cabo verde