Overview of Crypto Regulations in Italy 🇮🇹

In Italy, the regulatory landscape concerning cryptocurrencies is constantly evolving, reflecting the dynamic nature of the digital asset market. From establishing licensing requirements to outlining reporting obligations, Italian authorities are actively shaping the framework within which crypto exchanges operate. Understanding these regulations is crucial for both existing and aspiring exchanges to ensure compliance and navigate the legal environment effectively. Keeping pace with regulatory updates is paramount to operating sustainably in the Italian crypto market.

Key Legal Requirements for Crypto Exchanges 📝

Cryptocurrency exchanges in Italy are subject to a set of key legal requirements that aim to ensure transparency, security, and consumer protection. These requirements typically include obtaining proper licensing from regulatory authorities, implementing robust anti-money laundering (AML) and know your customer (KYC) procedures, and adhering to data protection regulations. Compliance with these legal obligations is crucial for exchanges to operate lawfully within the Italian market and maintain the trust of users and stakeholders.

Additionally, cryptocurrency exchanges in Italy must also be mindful of tax regulations, reporting obligations, and cybersecurity standards as part of their legal responsibilities. Staying abreast of regulatory developments and adapting operations accordingly is essential for exchanges to navigate the evolving legal landscape effectively. By prioritizing compliance and implementing best practices, crypto exchanges can foster a secure and sustainable operating environment for themselves and their users.

Impact of Recent Regulatory Changes on Exchanges 💼

In the ever-evolving landscape of cryptocurrency regulations in Italy, recent changes have brought about significant impacts on crypto exchanges operating within the country. These regulatory updates have necessitated exchanges to adapt their operations and practices to ensure compliance with the new rules. From licensing requirements to reporting obligations, exchanges are navigating through a shifting regulatory environment that requires them to stay agile and proactive in addressing compliance challenges. As a result, these recent regulatory changes have sparked discussions within the industry on how best to align with the evolving legal framework while continuing to innovate and serve users effectively.

Compliance Challenges Faced by Exchanges 🛡️

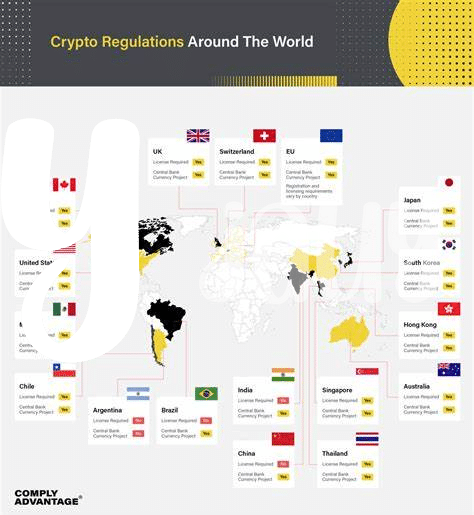

Compliance in the world of crypto exchanges can be a complex and demanding challenge, with regulatory requirements constantly evolving. Ensuring adherence to these regulations while also staying competitive and innovative poses a significant obstacle for exchanges. From AML (Anti-Money Laundering) procedures to data protection measures, the demands can be vast and intricate. Navigating this landscape requires a deep understanding of the legal framework, proactive risk management strategies, and ongoing compliance monitoring. The link provides additional insights into the global landscape of compliance for cryptocurrency exchanges. Cryptocurrency exchange licensing requirements in India.

Strategies for Navigating the Legal Landscape ⛰️

Navigating the legal landscape for crypto exchanges in Italy requires a strategic approach that balances compliance with innovation. It’s vital for exchanges to stay abreast of the evolving regulatory environment while also fostering relationships with key stakeholders. Establishing robust internal protocols and engaging in dialogue with regulatory authorities can help exchanges proactively address legal challenges and ensure long-term sustainability. By prioritizing transparency and cooperation, exchanges can navigate the legal terrain effectively and maintain trust within the industry. Strategically positioning themselves within the legal framework will not only mitigate risks but also pave the way for future growth and expansion.

Future Outlook for Crypto Exchanges in Italy 🔮

Italy’s rapidly evolving regulatory landscape presents both challenges and opportunities for crypto exchanges operating within its borders. As the country continues to refine its stance on virtual currencies and blockchain technology, industry players must stay nimble and proactive in adapting to new legal requirements. The future outlook for crypto exchanges in Italy is a mix of uncertainty and potential growth, with regulations expected to become more stringent while also providing clearer guidelines for compliance. Navigating this dynamic environment will require exchanges to prioritize transparency, security, and innovation to thrive in the Italian market. Adapting to these changes will be crucial for the long-term sustainability and success of crypto exchanges operating in Italy.