Overview of Bitcoin Laws in Haiti 🌍

Haiti, a country known for its vibrant culture and rich history, has recently made significant strides in regulating the use of Bitcoin within its borders. These new laws aim to provide clarity and guidance to individuals and businesses engaging in cryptocurrency transactions. By establishing a framework for the legal use of Bitcoin, Haiti is positioning itself as a forward-thinking nation in the rapidly evolving world of digital currencies. This move has the potential to attract investment and promote financial inclusion among its population.

The implementation of Bitcoin laws in Haiti reflects a growing recognition of the importance of blockchain technology and its role in shaping the future of finance. As the country continues to navigate the complexities of regulating this emerging sector, stakeholders are closely monitoring how these laws will impact the local economy and pave the way for innovative business opportunities. With a solid foundation in place, Haiti is poised to embrace the potential benefits of Bitcoin while addressing any associated risks and challenges.

Impact on Local Economy and Businesses 💼

The integration of Bitcoin into Haiti’s economy has sparked a wave of transformations for local businesses and the broader economic landscape. With its decentralized and borderless nature, Bitcoin is revolutionizing the way transactions are conducted, enabling faster and more cost-effective cross-border payments. This shift has not only streamlined financial operations for businesses but has also opened up new avenues for growth and global market participation. As businesses embrace Bitcoin as a medium of exchange, they are tapping into a wider network of opportunities and customers, transcending geographical barriers. The adoption of Bitcoin in Haiti has the potential to enhance financial inclusion, spur innovation, and drive economic progress by empowering businesses to engage more seamlessly in the global marketplace.

Challenges and Concerns with Current Regulations ⚠️

Navigating the evolving landscape of Bitcoin laws in Haiti presents a range of challenges and concerns that warrant close attention. One primary issue revolves around ensuring regulatory clarity and consistency to provide a stable environment for businesses and investors. Without clear guidelines, there is a risk of ambiguity that could hinder adoption and growth within the cryptocurrency sector. Additionally, addressing concerns related to security and fraud prevention is crucial to mitigate risks associated with digital transactions. Striking a balance between promoting innovation and safeguarding consumer interests remains a key challenge for regulators. Furthermore, the need for effective enforcement mechanisms to combat illicit activities and protect market participants underscores the importance of refining existing regulations. As the regulatory framework continues to evolve, stakeholders must collaborate to address these challenges and uphold the integrity of the cryptocurrency ecosystem in Haiti.

Potential Opportunities for Growth and Innovation 💡

In exploring the landscape of Bitcoin regulations in Haiti, one cannot overlook the potential opportunities for growth and innovation that lie ahead. The evolving regulatory framework presents a platform for new ideas and technologies to flourish within the cryptocurrency space. Entrepreneurs and businesses in Haiti have the chance to pioneer innovative solutions, driving economic development and fostering financial inclusion. By embracing these opportunities, the country can position itself as a hub for blockchain-based projects, attracting investment and talent from both local and international communities. As the sector continues to mature, collaborations and partnerships may pave the way for groundbreaking advancements in financial technology. These opportunities not only signal growth for the industry but also hold the promise of transforming traditional systems, bringing about a more inclusive and efficient financial ecosystem. For further insights on regulatory implications for Bitcoin investors, especially in cross-border money transfer laws, refer to the detailed analysis at bitcoin cross-border money transfer laws in Trinidad and Tobago.

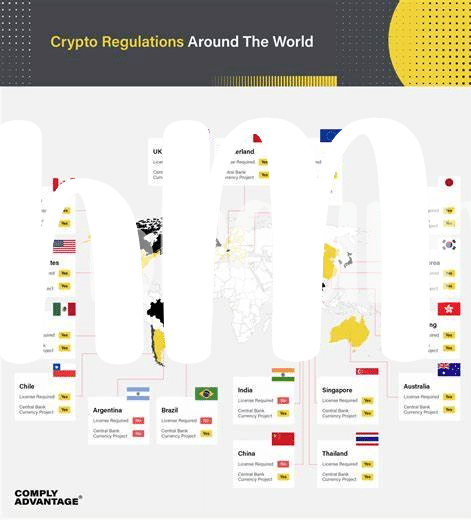

Comparison with Global Cryptocurrency Trends 🌐

Cryptocurrency trends continue to evolve globally, with varying degrees of acceptance and regulation across different countries. In the midst of this dynamic landscape, Haiti’s approach to Bitcoin laws presents an interesting case study. While some nations lean towards embracing the digital currency revolution, others exercise caution or skepticism. By comparing Haiti’s stance with trends in countries like the United States, Japan, or China, we gain valuable insights into the diverse approaches shaping the future of cryptocurrency on a global scale. Understanding these variations can provide a broader context for assessing the implications of regulatory decisions on the cryptocurrency market and its participants.

Future Outlook and Implications for Investors 💰

The evolving regulatory landscape surrounding Bitcoin in Haiti presents both challenges and opportunities for investors. The future outlook for the digital currency in the country hinges on the government’s approach to regulation and adoption. Potential implications for investors include increased transparency and security measures, which could boost investor confidence and attract more capital into the market. As Haiti navigates this new terrain, investors will need to stay informed about the changing regulations and market dynamics to make informed decisions. Keeping an eye on global cryptocurrency trends and initiatives can also provide valuable insights for investors looking to capitalize on emerging opportunities. Furthermore, staying updated on upcoming regulatory changes for Bitcoin in Grenada will offer additional perspectives on how the market is evolving. With careful consideration and a forward-thinking approach, investors can position themselves strategically in the Haitian cryptocurrency market for the long term.