Overview of Micronesia 🌴

Micronesia comprises a cluster of picturesque islands scattered across the vast Pacific Ocean, each offering a unique blend of culture, history, and natural beauty. With a population known for their warm hospitality and rich traditions, Micronesia embodies a harmonious blend of modernity and tradition. The vibrant shades of turquoise waters, lush greenery, and vibrant marine life make this region a paradise for nature enthusiasts and adventure seekers alike. Stepping into Micronesia is like entering a world where time slows down, allowing visitors to immerse themselves in the peaceful serenity of island life. The diverse cultures and customs of the indigenous peoples add layers of depth to the tapestry of Micronesian society, creating a truly enchanting destination for travelers seeking an authentic and enriching experience.

Legal Perspective on Bitcoin 💼

In the realm of digital currencies in Micronesia, a nuanced legal perspective on Bitcoin is vital. As governments globally navigate the terrain of cryptocurrency regulations, Micronesia’s approach to Bitcoin remains a focal point. Understanding the legal framework surrounding Bitcoin usage in Micronesia offers insight into the broader regulatory landscape and sets the stage for discussions on compliance, innovation, and financial inclusion. The interplay between existing financial laws and emerging digital assets shapes the opportunities and challenges faced by individuals and businesses engaging with Bitcoin in Micronesia. Clarity on regulatory requirements and enforcement mechanisms is essential to foster a secure and conducive environment for cryptocurrency adoption and investment in the region. By examining the legal nuances of Bitcoin in Micronesia, stakeholders can better navigate the evolving regulatory terrain and contribute to the ongoing dialogue on financial innovation and digital transformation.

Impact on Local Economy 💰

Micronesia’s embrace of Bitcoin is reshaping the local economy, offering new opportunities for businesses and residents alike. With the digital currency gaining traction, transactions are becoming faster and more secure. This shift towards Bitcoin has the potential to attract investors and boost economic growth in the region. By incorporating cryptocurrency into daily financial practices, Micronesia is adapting to global trends and positioning itself as a forward-thinking economy. The increased use of Bitcoin can also lead to greater financial inclusion, allowing more individuals to participate in the digital economy. Overall, the impact on the local economy is promising, paving the way for a more connected and dynamic financial landscape.

Consumer Protection Measures 🛡️

Micronesia’s latest laws on Bitcoin usage have introduced important consumer protection measures aimed at safeguarding individuals engaging with digital assets. These measures focus on transparency, accountability, and dispute resolution to ensure that consumers are protected from fraud, scams, and other risks associated with cryptocurrency transactions. By implementing regulations that promote fair practices and accountability among Bitcoin service providers, Micronesia aims to create a secure environment for its residents to participate in the digital economy. These consumer protection measures are crucial in building trust and confidence in the growing cryptocurrency market, ultimately benefiting both consumers and the overall economic landscape of Micronesia. For more insights on upcoming regulatory changes for Bitcoin in Monaco, click here: upcoming regulatory changes for bitcoin in monaco.

Challenges and Future Considerations 🔮

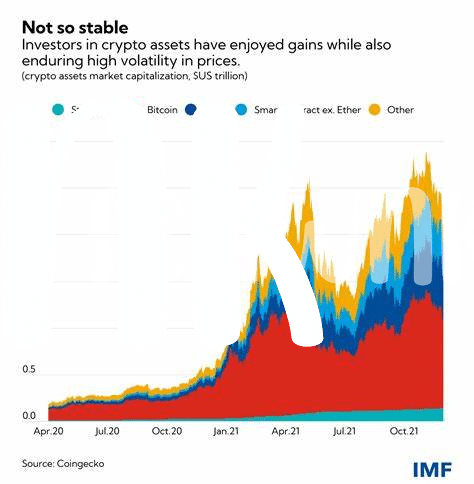

Challenges ahead may revolve around the volatility of Bitcoin’s value, potential regulatory changes, and ensuring secure infrastructure for transactions. Education and awareness campaigns may be necessary to increase understanding and adoption of digital currencies among the population. Furthermore, addressing concerns about security breaches and potential fraud will be vital in building trust among users and safeguarding against financial losses. Looking ahead, policymakers will need to stay abreast of technological advancements and global trends to shape effective strategies for integrating Bitcoin into the local economy.

In considering the future of Bitcoin in Micronesia, fostering partnerships with industry experts and international organizations could provide valuable insights and support in navigating this evolving landscape. Developing a robust framework for monitoring and evaluating the impact of Bitcoin on the economy will be essential for making informed decisions and adjusting policies as needed. Embracing innovation while also prioritizing consumer protection will be key in shaping a sustainable and thriving environment for digital currency usage in Micronesia.

Conclusion and Key Takeaways 🏁

In wrapping up the discussion on Micronesia’s latest laws regarding Bitcoin usage, it is evident that these regulatory changes carry significant implications for both the local economy and consumer protection. The legal framework surrounding Bitcoin in Micronesia not only provides clarity to businesses and individuals but also signals the region’s commitment to embracing digital currencies within a structured framework. These changes underscore the importance of adapting legislation to evolving financial landscapes in the modern world, showcasing Micronesia’s proactive stance towards supporting innovation while ensuring regulatory compliance.

For those keen on staying informed about upcoming regulatory changes for Bitcoin in other regions, it is worth keeping an eye on developments related to upcoming regulatory changes for Bitcoin in Mauritius. These changes can serve as valuable insights into how different countries navigate the integration of digital currencies within their legal and economic systems, offering lessons and perspectives that may also be relevant to upcoming regulatory changes for Bitcoin in Moldova.