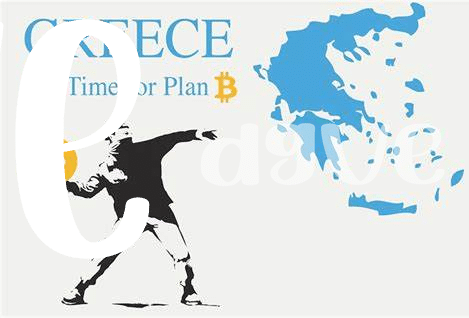

Overview of Greece’s Stance on Bitcoin 🇬🇷

Greece’s stance on Bitcoin has been met with a mix of curiosity and caution. The country has started to outline its regulatory framework regarding the use and trading of cryptocurrencies, signaling a growing interest in this digital asset. With a focus on consumer protection and preventing illicit activities, Greece aims to strike a balance between fostering innovation and ensuring financial stability within its borders. As more clarity emerges on the legal status of Bitcoin in Greece, both users and businesses in the cryptocurrency space are closely monitoring the developments to navigate this evolving landscape responsibly. The government’s approach to regulating Bitcoin reflects a broader trend of countries worldwide adapting to the rise of digital currencies, setting the stage for a potentially transformative impact on the traditional financial sector.

Key Regulations Impacting Bitcoin Users 💼

Bitcoin users in Greece face a landscape shaped by evolving regulatory frameworks. The country’s stance on cryptocurrency has been influenced by global trends and internal policy shifts, impacting how individuals engage with digital assets. Understanding the key regulations is crucial for users navigating this dynamic environment, as compliance is paramount in ensuring a secure and transparent experience. From registration requirements to tax implications, these regulations underscore the need for a well-rounded grasp of the legal framework. Despite challenges, such as potential restrictions or reporting obligations, adapting to these regulations can empower users to participate responsibly in the Bitcoin ecosystem while safeguarding their interests.

For Bitcoin enthusiasts and investors in Greece, staying informed about the evolving regulatory landscape is essential for making informed decisions and seizing opportunities within the cryptocurrency space. By actively engaging with the regulations impacting users, individuals can navigate the complexities of compliance while harnessing the potential benefits of digital assets. As Greece continues to shape its approach to Bitcoin, users can expect further developments that may present both challenges and opportunities in the evolving cryptocurrency ecosystem.

Implications for Cryptocurrency Businesses 🏦

Cryptocurrency businesses in Greece are facing a shifting regulatory landscape that requires adaptability and compliance. The guidelines set forth by the government aim to ensure transparency, security, and accountability within the industry, ultimately fostering trust and legitimacy. For businesses operating in this sector, it is crucial to stay informed about the latest developments and to proactively address any potential challenges that may arise. Despite the regulatory complexities, there are also opportunities for growth and innovation in the cryptocurrency space. By adhering to the regulatory framework and implementing best practices, cryptocurrency businesses can establish themselves as key players in Greece’s evolving financial landscape. As the industry continues to mature, businesses that demonstrate a commitment to compliance and customer protection will be well-positioned to thrive in this dynamic environment.

Potential Opportunities for Bitcoin Investors 💰

Potential Opportunities for Bitcoin Investors 💰: As the regulatory landscape in Greece becomes clearer, there are promising prospects emerging for Bitcoin investors. With more defined guidelines and laws in place, investors can navigate the market with increased confidence. The potential for growth and expansion in the cryptocurrency sector presents opportunities for those looking to diversify their investment portfolios. Additionally, as Greece continues to position itself in the digital asset realm, investors may find new avenues to capitalize on the evolving market dynamics. Keeping a close eye on the upcoming regulatory changes for bitcoin in Georgia will be crucial for investors seeking to stay ahead of the curve and leverage emerging opportunities. By staying informed and adapting to the changing landscape, investors can position themselves strategically to benefit from the potential growth and development in the Bitcoin sector.

Link: upcoming regulatory changes for bitcoin in Georgia

Challenges of Navigating Greece’s Bitcoin Laws ⚖️

Navigating Greece’s Bitcoin laws can be a complex and challenging task for individuals and businesses alike. The evolving regulatory landscape, often influenced by global trends and local economic factors, requires careful consideration and proactive measures. Understanding the legal requirements and compliance obligations can be crucial in mitigating risks and ensuring smooth operations in the cryptocurrency space. Additionally, the varying interpretations and enforcement practices add another layer of complexity, making it essential for stakeholders to stay informed and adapt to changes swiftly. Navigating these challenges efficiently can help stakeholders navigate the legal framework effectively and capitalize on the opportunities emerging in the Greek Bitcoin market.

Future Outlook for Bitcoin in Greece 🌐

Greece’s evolving stance on Bitcoin unveils a promising horizon for the cryptocurrency realm within its borders. The favorable regulatory environment has sparked enthusiasm among investors seeking to participate in this burgeoning market. With clear guidelines in place, Greek citizens, businesses, and investors are poised to navigate the landscape of digital assets with greater confidence, paving the way for a more robust and secure ecosystem.

For a deeper understanding of the regulatory changes impacting Bitcoin worldwide, one must also stay informed about the upcoming regulatory changes for Bitcoin in Germany. These developments not only shape the future of digital currencies but also influence how other countries like Gambia approach their own regulatory frameworks. Stay updated on the latest shifts to make informed decisions in this dynamic space.