Legal Status 📜

Djibouti’s stance on Bitcoin remains a topic of interest within the international community. The country has yet to officially declare a legal status for the cryptocurrency, leading to a level of uncertainty regarding its use. While the government has not explicitly banned Bitcoin, there is also a lack of clear regulations outlining its acceptance or legality. This ambiguity poses challenges for individuals and businesses looking to engage in Bitcoin transactions within Djibouti. As the global landscape of digital currencies continues to evolve, the need for clarity on the legal status of Bitcoin in Djibouti becomes increasingly pressing. This lack of a defined framework adds layers of complexity to the use of Bitcoin in the country, highlighting the importance of further exploration and potential regulation.

Regulations on Transactions 💸

When it comes to navigating the regulatory landscape surrounding Bitcoin transactions in Djibouti, it’s essential to understand the established guidelines and rules. These regulations aim to provide a framework that safeguards transactions while ensuring compliance with legal requirements. By following the stipulated regulations, individuals and businesses can engage in Bitcoin transactions confidently, knowing that they are operating within the boundaries set by the authorities. Understanding the nuances of these regulations is crucial for avoiding any potential pitfalls and ensuring smooth and secure transactions in the digital currency space.

In Djibouti, the regulations on Bitcoin transactions serve as a roadmap for individuals and businesses looking to leverage the benefits of cryptocurrencies for seamless financial transactions. By adhering to these regulations, stakeholders can navigate the evolving landscape of digital currencies with confidence and security, fostering a conducive environment for the growth and adoption of cryptocurrencies in the country.

Tax Implications 💰

Tax Implications: When it comes to utilizing Bitcoin for international payments in Djibouti, understanding the tax implications is crucial. Businesses and individuals engaging in Bitcoin transactions need to consider how these transactions are taxed according to local laws. This includes determining if gains from Bitcoin transactions are subject to capital gains tax, income tax, or any other applicable taxes. Ensuring compliance with tax regulations is essential to avoid any legal issues and financial penalties. Seeking guidance from tax professionals or consultants familiar with cryptocurrency tax laws can help in navigating the complexities of tax implications related to Bitcoin transactions in Djibouti. Understanding and adhering to these tax regulations will contribute to a smooth and legally compliant use of Bitcoin for international payments.

Security Measures 🔒

When it comes to utilizing Bitcoin for international transactions in Djibouti, ensuring robust security measures is paramount to safeguarding assets and personal information. Implementing strong encryption protocols, multi-factor authentication, cold storage techniques, and regular security audits can help mitigate risks associated with cyber threats and hacks. The use of reputable digital wallets and reputable cryptocurrency exchanges can also enhance security for users engaging in Bitcoin transactions. Moreover, staying informed about the latest security trends and technologies in the cryptocurrency space is crucial to adapt to evolving threats. By prioritizing security measures, individuals and businesses in Djibouti can leverage the benefits of Bitcoin for international payments with confidence and peace of mind. To further delve into the complexities of cross-border Bitcoin transfer laws and their implications globally, including insights on managing transactions effectively, refer to the comprehensive guide on bitcoin cross-border money transfer laws in dominica.

Impact on Businesses 🏢

– Impact on Businesses 🏢

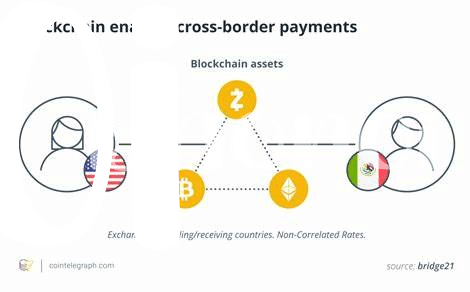

As businesses in Djibouti navigate the realm of Bitcoin for international payments, there are evident shifts in operations. The acceptance and utilization of Bitcoin have enabled smoother cross-border transactions, reducing the reliance on traditional banking systems. This streamlined process has opened doors for businesses to explore new markets and establish connections beyond geographical boundaries. With the potential for faster transactions and lower fees, businesses can enhance their competitiveness and attract international clients more effectively, fostering growth and sustainability in a globalized economy. Additionally, the transparency and security features of Bitcoin transactions provide a level of trust and efficiency that can benefit businesses in various sectors, laying a foundation for innovation and adaptability in the evolving financial landscape.

International Implications 🌍

The impact of Djibouti’s laws on Bitcoin for international payments reaches far beyond its borders, creating ripple effects in the global financial landscape. Businesses seeking to engage in cross-border transactions face a myriad of challenges and opportunities as they navigate through varying regulatory frameworks and cultural practices. Understanding the implications of utilizing Bitcoin in international commerce is crucial for both local enterprises and foreign entities looking to establish a presence in Djibouti. As the digital currency revolution continues to gain momentum worldwide, policymakers and businesses alike must adapt to this new paradigm to harness its full potential for facilitating seamless and secure cross-border transactions. For further insights on the legal aspects of cross-border money transfers involving Bitcoin, explore the regulations in the Dominican Republic and Denmark.