🌍 the Dawn of Digital Currency in Central Banks

Imagine a world where you could pay for everything, from your morning coffee to your car, without using cash or cards, but with digital money provided by the bank that usually keeps your money safe. That’s not a scene from a sci-fi movie anymore. Central banks around the world are exploring the creation of their own digital currencies. Yes, just like the dollars or euros in your wallet, but in a form that lives entirely online. This move could change how we think about money forever.

Central banks are diving into the future head-first, experimenting with technology that could make transactions faster, cheaper, and more secure than ever before. They’re testing waters with what’s called “central bank digital currencies” or CBDCs for short. Imagine transferring money as easily as sending a text message, without waiting days for it to clear. These trials aim to figure out the best way to turn this idea into reality, marking the beginning of a new era in banking where digital is king.

| Central Bank Activity | Focus Area |

|---|---|

| CBDC experiments | Digital currency implementation and security |

| Technology trials | Efficiency and speed of transactions |

🔍 Understanding Blockchain: Simple Yet Revolutionary

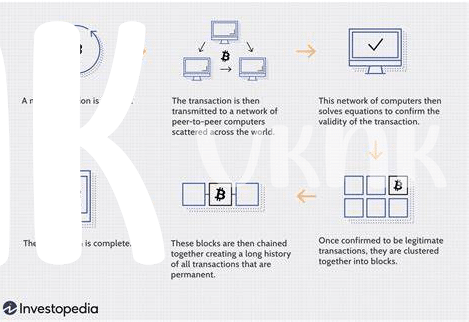

Imagine a world where every transaction you make, from buying your morning coffee to trading stocks, is recorded in a digital ledger, transparent yet securely encrypted. This is the promise of blockchain technology. At its heart, blockchain is a way to store information in a way that’s difficult to hack or cheat. Think of it as a digital chain of blocks. Each block contains a bunch of transactions that anyone can view, but only those with the right encryption keys can add new blocks. This simple concept has the potential to revolutionize not just our banking systems but how we trust and verify any kind of information. Interestingly, blockchain isn’t just for the tech-savvy or finance professionals. Its implications stretch far and wide, impacting industries in ways we’re just starting to explore. For a deeper dive into how blockchain is fueling innovation beyond its roots in cryptocurrency, this https://wikicrypto.news/blockchain-innovations-transforming-industries-beyond-cryptocurrency is a must-read.

💡 Central Banks’ Pilot Programs: Trials and Errors

Imagine central banks as big, traditional banks that have decided to try out new tech tools, just like someone learning to use a smartphone for the first time. They started experimenting with this thing called blockchain, a digital ledger where transactions are recorded. It’s like a high-tech journal that’s very hard to mess up or cheat on. These trials, or “pilot programs”, were a mix of homework sessions and science lab experiments. Not all of them went smoothly—some were like getting a flat tire on the first ride of a brand-new bike. But that’s the beauty of it. Each stumble and reroute provided valuable lessons. They explored how to make sending money faster, safer, and cheaper. Like kids in a candy store, they learned which flavors—or in this case, technologies—worked best. Through these trials, they’re paving the way to a future where digital money could become as common as texting.

🚀 Blockchain’s Impact on Financial Stability and Security

Imagine a world where every time you make a transaction, it’s not just fast and secure, but also transparent for every party involved. This isn’t a distant dream but a reality being shaped through the introduction of blockchain technology in the realm of central banking. This revolutionary approach not only promises to enhance the financial stability of banks but also significantly increases the security measures in place. By creating a system where transactions are recorded on a ledger that’s both tamper-proof and accessible, blockchain is transforming the way we think about financial security and stability. It’s like building an unbreakable vault that everyone can see but no one can touch without leaving a trace. Moreover, for those keen on staying updated with bitcoin regulation updates and the blockchain, it’s clear that this technology is paving the way for a safer, more transparent banking ecosystem, making it easier for both banks and customers to navigate the financial seas with confidence. Through trials and learning, our banking systems are not only becoming more robust but also more inclusive, marking a significant leap forward in how we manage, distribute, and secure our money in this digital age.

🤝 Enhancing Transparency and Trust in Banking

When we think about our money in the bank, we want to feel sure it’s safe and that we can see where it is and where it’s going, right? Imagine a world where every transaction is open for you to see, like checking the journey of a package you ordered online. This is not a far-off dream, but a reality that’s being shaped with the help of a special technology called blockchain. By recording every transaction in a secure and unchangeable way, banks are beginning to show us a future where we can trust them more. No more hidden fees or mysterious charges, as everything is out in the open.

| Feature | Description |

|---|---|

| 🔒 Security | Blockchain creates a secure and unalterable record of transactions, greatly reducing the risk of fraud. |

| 🔎 Transparency | Every transaction is recorded and can be seen by anyone, helping to build trust between banks and their customers. |

| 🔄 Efficiency | Transactions are processed more quickly and smoothly, making banking more efficient for everyone. |

This sea change is leading us towards a banking environment where trust is not just a word, but a built-in feature. The more we know about where our money travels, the more confident we feel. Through trials, adjustments, and learning, banks are paving the way for a future where financial transparency isn’t just an option; it’s the norm.

💳 the Future of Money: Beyond Paper and Coins

Imagine walking into a store and paying for a coffee with just a smile or a quick tap of your phone, no physical money changing hands. This isn’t a scene from a sci-fi movie; it’s fast becoming our reality. With the evolution of digital currencies, our wallets are getting lighter, as coins and paper bills are steadily replaced by smartphones and smartwatches. Every transaction we make is becoming a part of a giant digital ledger, thanks to a technology called blockchain. It’s making our money smarter, faster, and a lot more secure. Now, we’re not just moving towards a future where cash is obsolete, but one where even our concept of what money is and how it works is transformed.

To get a deeper dive into how this groundbreaking tech works and the exciting possibilities it opens up, take a look at bitcoin educational resources and the blockchain. From transforming the way central banks operate to introducing new forms of digital currency, blockchain is at the heart of these changes. It’s not just about creating money that’s digital; it’s about making financial systems more inclusive, efficient, and transparent. As we pilot new programs and embrace these technologies, we’re not just witnessing the evolution of money; we’re taking part in a financial revolution.