What Is Blockchain and Bitcoin? 🌐

Imagine a giant, global ledger that keeps track of all transactions ever made, transparent and accessible by anyone. That’s blockchain for you! It’s like a digital notebook that can’t be erased or altered, ensuring every transaction’s history is permanent and secure. Introduced as the backbone for Bitcoin, this technology revolutionized how we perceive digital assets. Bitcoin, on the other hand, is the first-ever digital currency that operates independently of any central authority. It’s like digital gold, where the value comes from its scarcity and the community’s trust in it.

| Term | Simple Explanation |

|---|---|

| Blockchain | A digital record-keeping system that is secure, transparent, and decentralized. |

| Bitcoin | A type of digital currency that is limited in supply and operates without central control. |

The beauty of Bitcoin sparked a revolution, leading to the creation of numerous other digital currencies and blockchain applications beyond just transactions. Its unique approach to decentralization and security not only changed how we look at money but also opened up a world of possibilities for secure, transparent digital systems.

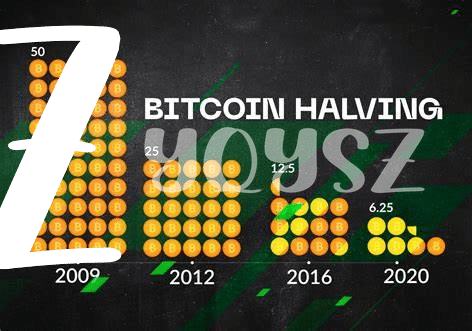

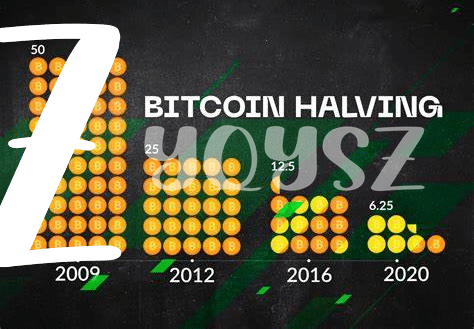

The Big Event: What’s Bitcoin Halving? ⏳

Imagine you have a magic cake that gets cut in half every four years, making each piece more valuable because it’s rarer. This is a bit like what happens with Bitcoin halving. Every four years, the reward for mining Bitcoin is halved, meaning miners receive 50% fewer bitcoins for verifying transactions. This event is a big deal because it affects how many new bitcoins come out into the world. It’s a clever way to make sure Bitcoin doesn’t run out too quickly and keeps its value over time.

This magical event impacts not just miners, but anyone interested in Bitcoin. As the reward decreases, the effort and resources required to mine Bitcoin don’t change, which makes each new bitcoin more costly to produce. Many see this as a trigger for the price of Bitcoin to increase, as fewer new bitcoins are created, and the demand remains strong. However, it’s not just a simple cause and effect; the anticipation and reactions of investors around this event stir the pot even more, making the market swing like a big, exciting rollercoaster. If you’re curious about how other events influence the Blockchain world, take a look at https://wikicrypto.news/exploring-bitcoin-philanthropy-a-new-era-of-giving.

Impact on Bitcoin’s Value: a Rollercoaster Ride 🎢

Imagine going to an amusement park. You’re excited but also a bit nervous about the big rollercoaster—this is a lot like how Bitcoin’s value changes, especially after certain events known as “halvings.” Every few years, the reward for mining (the process of making new Bitcoins) is cut in half. This might sound like a small change, but it can cause big waves. Suddenly, making new Bitcoins is harder, which can make them more valuable. People see this and start to think, “Maybe I should get some Bitcoins before they become too expensive!” This rush can drive the price up quickly, like a rollercoaster shooting to the sky. But what goes up must come down. Sometimes, the price falls just as fast, leaving everyone a bit dizzy. Yet, despite these ups and downs, each cycle brings more attention to Bitcoin and blockchain, making them a bit more part of our everyday lives. So, while it’s a wild ride, it’s also exciting to see where it will go. 🎢💸🔄

Mining Landscape: before and after Halving ⛏️

Digging into the world of Bitcoin, it’s like exploring a mine full of gold, where the “gold” is actually new Bitcoins. Before a big event known as “halving,” miners used their computers to solve complex puzzles, earning Bitcoins as a reward. It was like having a wide field to dig up with plenty of treasures for everyone. However, after halving, the reward for mining gets cut in half, making it tougher to find those precious Bitcoins. This shift can lead to big changes. Some miners might find it too hard to keep going, especially if their digging tools (or in this case, computers) aren’t strong enough. Others might see it as a challenge, upgrading their gear to continue the hunt. Meanwhile, everyone watching this digital treasure hunt, from everyday folks to big investors, starts to think differently about Bitcoin’s value. For those curious about how these changes connect to the wider Bitcoin universe, such as bitcoin forks and their impact and the blockchain, it’s a continual journey of discovery and speculation, shaping the future of digital currencies.

Market Sentiments: Fear and Excitement Collide 💥

As Bitcoin halving events roll around every four years, a tumultuous wave of emotions sweeps through the crypto community. Picture a vast ocean where fear and excitement churn the waters. On one side, there’s a gripping fear of the unknown, a concern that the reduced rewards for miners could lead to a drop in Bitcoin’s security and value. This fear is not without merit, as the halving cuts miners’ incentives by half, potentially pushing the less profitable ones out of the market. On the other hand, there’s palpable excitement, a buzzing anticipation of scarcity driving up Bitcoin’s value. Historical patterns show a significant price surge post-halving, bolstering the belief that history might repeat itself. This blend of fear and excitement generates an electrifying atmosphere in the market, influencing trading strategies and investment decisions. Amidst this emotional whirlpool, the crypto community remains glued to the charts, waiting to see which sentiment will tip the scales.

| Emotion | Impact on Market |

|---|---|

| Fear | Potential drop in Bitcoin value and security concerns |

| Excitement | Anticipation of price surge due to scarcity |

Future Predictions: What’s Next for Blockchain? 🔮

Imagine standing at the brink of a digital frontier, one where the trails of blockchain technology stretch far into the horizon. This journey began with curiosity and a simple idea to make transactions safer and more transparent. Now, as we peer into the crystal ball, we see that the path of blockchain is destined for realms beyond just finance. The adventure of discovering new applications for blockchain technology is akin to unearthing hidden treasures. From revolutionizing how we vote, to transforming supply chains, making them as transparent as a clear blue sky, the possibilities are as vast as the ocean. More than ever, people are starting to realize the potential of blockchain in securing digital identities and in empowering artists through digital art platforms.

At the heart of this evolution, Bitcoin remains a pivotal chapter. Its journey is decorated with moments of awe, as each halving event sends ripples through the market, stirring emotions and dreams of what’s to come. Amidst this, an intriguing application has emerged – bitcoin and political donations and the blockchain. This niche yet impactful use case signifies blockchain’s capability to fuel not just economic, but also societal change. As we navigate through the shifting landscapes of technology and society, the intersection of blockchain with various sectors paints a future rich with innovation and inclusivity. The once narrow path is now broadening, promising a future where blockchain’s potential knows no bounds.