Bitcoin’s Birth and Early Days 🌱

Once upon a time, in the vast world of the internet, a special kind of money was born, quite different from the coins and bills we use every day. This new money, called Bitcoin, popped up in 2009, created by a mysterious person or group of people under the name Satoshi Nakamoto. It was a unique idea: money that could be sent directly from one person to another, anywhere in the world, without needing a bank or government to oversee it. In its early days, Bitcoin was like a secret treasure known mostly to computer geeks and digital adventurers. Many people got excited about it because it gave them a new way to think about and use money, free from traditional boundaries.

| Year | Significant Event |

|---|---|

| 2009 | Bitcoin’s Creation |

| 2010 | First Real-world Transaction |

At first, you could get tons of Bitcoins for just a few dollars, or even for free if you were willing to let your computer solve complex puzzles. But back then, hardly anyone could have imagined how this digital money could one day shake the world’s financial systems. It was a time of experimentation and excitement, full of possibilities and dreams about what Bitcoin could become.

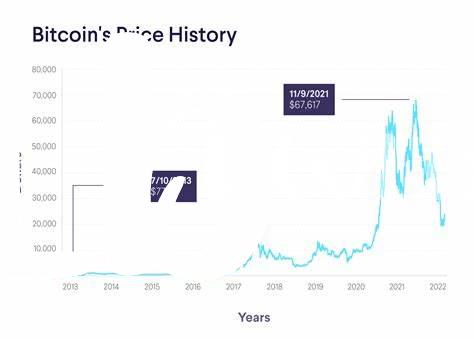

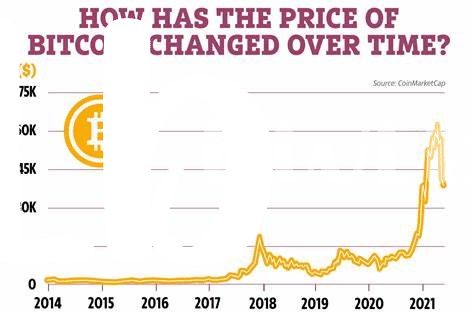

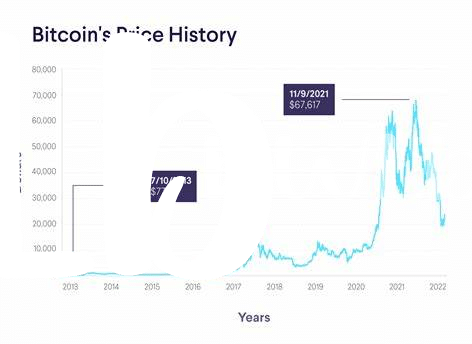

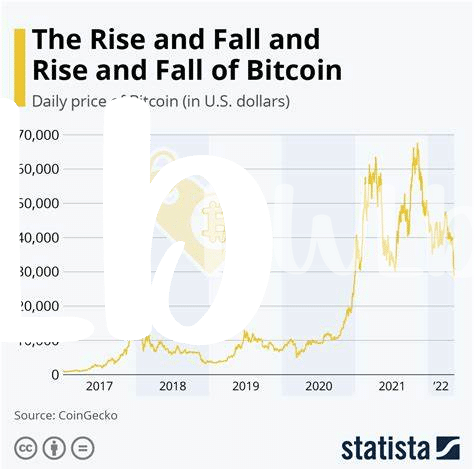

The 2017 Surge and Sudden Dip 🚀

2017 was a whirlwind year for Bitcoin, with its value climbing up like a rocket, leaving many people both amazed and a bit puzzled. Imagine you put a toy rocket under a Christmas tree, and by Christmas morning, it’s somehow flown to the top of the tallest building you can see. That’s kind of what happened. Early in the year, Bitcoin was like any other toy under the tree, valued at less than $1,000. But then, as the months went by, more and more people started talking about it, wanting it, and the price started to soar, reaching an all-time high of nearly $20,000 by December. It felt like everyone was getting into the Bitcoin party. But then, just as quickly as it rose, the value dipped, leaving some folks who bought at the peak feeling a bit like they missed the last seat on the merry-go-round. During these dizzying times, it was essential to have a guide through the world of Bitcoin. For newcomers looking to navigate these exciting yet choppy waters, a visit to https://wikicrypto.news/navigating-bitcoin-tips-for-first-time-users can provide valuable insights and tips for managing their digital treasure.

December 2017: a Peak to Remember 📈

In the chilly month of December, right before the year waved goodbye, Bitcoin decided to take everyone on an unforgettable ride. It was as if a rocket had been attached to its back, and up it went, soaring to heights that left everyone gazing up in awe. This wasn’t just any ordinary peak; this was the moment the world truly paid attention to Bitcoin, reaching an all-time high that set the scene for conversations around dinner tables and in boardrooms alike. It wasn’t just the tech enthusiasts and financial wizards watching anymore; the whole world was tuning in.

As quickly as it climbed, the anticipation of where it could go next had everyone on the edge of their seats. The magic of this surge wasn’t just in the numbers, though they were certainly staggering. It laid the groundwork for a broader discussion about the future of money, making December a landmark month that would be etched in the history of digital currencies. The excitement and fervor it sparked wasn’t only about the potential riches; it was the dawn of a new era in financial technology, opening doors to possibilities that were once deemed as mere daydreams.

2018: the Great Bitcoin Crash 📉

After the highs of 2017, the next year brought everyone back to earth with a thud. Imagine riding the highest rollercoaster, only for it to take a sudden dive – that was the story for Bitcoin enthusiasts in 2018. The digital currency, which had soared to nearly $20,000, began to tumble. By the end of the year, it lost about 80% of its value. This period is often referred to as the “crypto winter,” a time when the warmth of quick profits turned into the chill of reality. Many investors found themselves unprepared for this steep decline, highlighting the unpredictable nature of Bitcoin and the need for solid strategies and safety nets in digital currency investment.

Amidst the turmoil, a silver lining appeared in the form of education and tools aimed at protecting investors’ digital assets. One essential resource is bitcoin recovery tools for beginners, offering guidance on how to safeguard investments against unforeseen drops and cybersecurity threats. These tools, coupled with a deeper understanding of market trends, have become invaluable for navigators of the Bitcoin rollercoaster. The crash served as a harsh lesson but also a catalyst for a more mature market, where the excitement of potential gains is balanced with a respect for the risks involved.

2020: Pandemic Panic and Bitcoin’s Boom 💥

In 2020, as the world grappled with the unexpected twists and turns brought about by a global pandemic, the financial markets were thrown into a frenzy. Amidst the chaos, Bitcoin, the pioneering digital currency, took everyone by surprise. The sudden lockdowns and economic uncertainty sparked a renewed interest in cryptocurrencies as a safer replacement for traditional investments. People started looking for alternatives to safeguard their money and there it was, Bitcoin, shining like a beacon of hope for many. Its value began to climb steadily, proving itself to be a resilient asset in times of worldwide turmoil.

The rise was so meteoric that it caught the eyes of both seasoned investors and everyday folks, trying to make sense of the financial shifts happening around them. Strategies to navigate this new wave of investment became a hot topic. Predictions about Bitcoin’s future started flooding in, ranging from wildly optimistic to cautiously skeptical. Despite the varying opinions, one thing was clear: Bitcoin had firmly established itself in the financial landscape of 2020, demonstrating not just its volatility, but also its potential for significant growth in times of economic distress.

| Date | Event | Bitcoin Price Impact |

|---|---|---|

| March 2020 | Global Lockdowns Begin | Price Dip, then Steady Increase |

| Mid-2020 | Increased Investment Interest | Significant Price Rise |

| End of 2020 | Record Highs | Price Peaks |

Navigating the Waves: Strategies and Predictions 🧭

Riding the Bitcoin wave has been like hopping on the world’s most thrilling rollercoaster – exhilarating highs and stomach-churning drops included 🎢. To navigate this unpredictable journey, savvy enthusiasts often resort to a mix of old-school wisdom and cutting-edge strategies. Keeping an eye on market trends, being aware of global economic shifts, and maybe a bit of luck, allow some to ride the waves more smoothly. It’s a bit like weather forecasting in a digital realm, trying to predict the sunshine and storms in Bitcoin’s future.

Predicting which way the wind will blow in the world of Bitcoin isn’t easy, and there’s always a risk involved 🌪️. That’s why understanding the ins and outs is crucial before diving in. For anyone looking to get a solid grip on the basics, especially how Bitcoin intersects with the broader financial system, diving into resources about bitcoin investment risks for beginners can offer some essential insights. Whether you’re a seasoned sailor or new to the game, equipping yourself with knowledge and being prepared for all kinds of weather is your best bet in navigating these waters.