Overview of Aml Regulations in Suriname 🌐

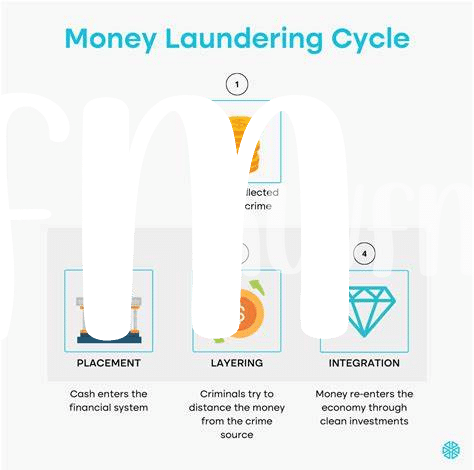

Anti-money laundering (AML) regulations in Suriname serve as a critical framework to combat financial crimes and illicit activities. By establishing guidelines and procedures for financial institutions and individuals, these regulations aim to promote transparency and integrity in the country’s financial sector. In recent years, Suriname has intensified its efforts to enforce AML regulations, highlighting the government’s commitment to safeguarding the integrity of its financial system. As part of a global initiative to combat money laundering and terrorist financing, Suriname’s AML regulations play a crucial role in preserving the country’s economic stability and reputation on the international stage.

Impact on Bitcoin Users in the Region 💰

Bitcoin has been gaining popularity in Suriname, with more users in the region embracing the digital currency for various transactions. However, the implementation of Anti-Money Laundering (AML) regulations has presented challenges for Bitcoin users. These regulations aim to combat illicit activities and ensure financial transparency, impacting how individuals can buy, sell, and use Bitcoin in Suriname. As a result, users are required to adhere to certain compliance measures, which can sometimes be complex and burdensome, affecting the ease and convenience of using Bitcoin in the region. Despite these challenges, there are ways for Bitcoin users to navigate the AML regulations effectively and continue utilizing cryptocurrency for their financial needs. As regulations evolve, the future outlook for Bitcoin users in Suriname remains uncertain, with potential shifts in the regulatory landscape shaping the digital currency environment in the region.

If you have any additional requirements or need further assistance, feel free to let me know.

Requirements and Compliance for Individuals 📝

Individuals in Suriname need to be aware of the specific requirements and regulations when it comes to using Bitcoin within the country. Compliance with Anti-Money Laundering (AML) measures is essential for anyone engaging in cryptocurrency transactions. This includes verification of identity, reporting suspicious activities, and ensuring transactions are legitimate. Being informed about these requirements is crucial to avoid potential legal repercussions and safeguard against illicit activities in the cryptocurrency space.

To comply effectively, individuals must stay updated on any changes to AML regulations, implement proper identity verification processes, and be vigilant in monitoring and reporting any suspicious transactions. By understanding and adhering to these requirements, Bitcoin users in Suriname can navigate the regulatory landscape with confidence and ensure a safer and more secure environment for cryptocurrency transactions.

Challenges Faced by Bitcoin Users in Suriname 🤔

Bitcoin users in Suriname face a variety of challenges when it comes to navigating the Anti-Money Laundering (AML) regulations in place. These challenges can range from issues with verifying identities on platforms to concerns about the privacy of their transactions. Additionally, the fluctuating nature of cryptocurrency values can make it difficult for users to stay compliant with reporting requirements. Finding reputable exchange platforms that adhere to AML regulations while still providing a user-friendly experience can also be a challenge. Despite these obstacles, education and awareness about AML regulations can help users better understand their responsibilities and rights in the cryptocurrency landscape. For more insights into cryptocurrency exchange licensing requirements in different regions, check out this informative article on cryptocurrency exchange licensing requirements in Bangladesh.

How to Navigate Aml Regulations Effectively 🧭

Navigating AML regulations effectively requires a thorough understanding of the compliance requirements and proactive measures to ensure adherence. In this dynamic landscape, staying informed about the latest regulatory updates and engaging with reputable financial institutions or experts can provide valuable insights. Implementing robust KYC (Know Your Customer) procedures, conducting regular audits, and utilizing secure platforms for transactions are essential strategies. Leveraging technological tools and resources can streamline compliance efforts and mitigate potential risks. By adopting a proactive approach and maintaining compliance vigilance, Bitcoin users in Suriname can navigate AML regulations effectively and safeguard their financial activities.

Future Outlook for Bitcoin Users in Suriname 🔮

In the evolving landscape of Suriname’s regulations, the future outlook for Bitcoin users brings a mix of opportunities and challenges. As the regulatory environment continues to mature, users can expect increased scrutiny and compliance requirements. However, this also paves the way for a more secure and stable ecosystem that may attract a broader range of investors and enthusiasts alike. Navigating these changes effectively will be crucial for users to adapt and thrive in the evolving digital economy.

For further insights into cryptocurrency exchange licensing requirements in various regions, including Azerbaijan, check out the detailed guidelines provided for reference: Cryptocurrency Exchange Licensing Requirements in Azerbaijan and Cryptocurrency Exchange Licensing Requirements in Argentina.