Meet Bitcoin: the Digital Gold 🌐

Imagine if you could take gold, make it digital, and then use it to buy things or save it, just like you do with the money in your bank. That’s kind of what Bitcoin is – a digital version of gold, but cooler. Created back in 2009 by a person (or group of people) we only know by the name Satoshi Nakamoto, Bitcoin brought the world something it had never seen before: a completely digital currency that you could send to anyone, anywhere, without needing a bank in the middle. It was like magic internet money, and it appealed to people who were looking for different ways to handle their financial matters outside the traditional banking system.

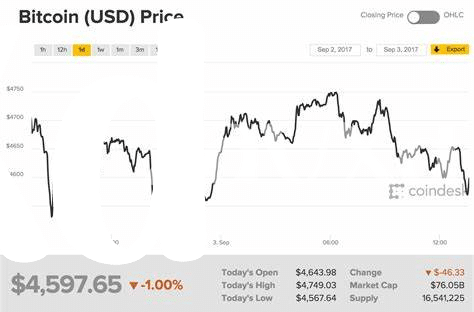

Bitcoin works on a technology named ‘blockchain,’ which is super important because it keeps all transactions safe and sound. Think of it as a giant, secure, digital ledger that everyone can see but no one can mess with. This technology doesn’t just power Bitcoin; it’s got the potential to change how we do a lot of things in the future. And as Bitcoin grows more popular, its value can swing up and down, just like gold. Sometimes it’s up in the sky, and other times it takes a dive. But that’s also what makes it exciting and, for some, a smart addition to their “digital wallet.”

| Date | Important Bitcoin Milestone |

|---|---|

| 2009 | Creation of Bitcoin |

| 2010 | First real-world transaction using Bitcoin |

| 2017 | Bitcoin’s price hits an all-time high |

| 2021 | Bitcoin becomes legal tender in El Salvador |

Why People Love Cash: the Traditional Touch 💵

Cash has this unique charm that digital numbers on a screen can’t match. It’s tangible, real in our hands, telling stories of transactions past and perhaps even carrying a bit of history in its wrinkles and folds. This physicality offers comfort and a sense of real ownership that digital forms of money often struggle to emulate. When people pay with cash, they instantly know the transaction is complete. There’s no need to wait for a notification or check an app. It’s this straightforwardness and immediate finality that gives traditional currency its enduring appeal.

Beyond its tactile satisfaction, cash provides an anonymity that digital transactions can’t. When you hand over a bill, there’s no digital footprint left behind, no trail for someone to track. This privacy is a cherished aspect for many, offering a cloak of invisibility in a world that’s increasingly transparent. For those wary of the digital gaze, cash is a silent protector of identity, keeping purchases discrete and personal finances veiled. This blend of simplicity, immediacy, and privacy cements the traditional touch of cash in our daily lives, making it a beloved choice despite the growing digital tide.

[For more insights on secure cryptocurrency trading, check out https://wikicrypto.news/the-mystery-of-eth-its-usage-and-disappearance.]The Cost of Convenience: Fees and Transferring 💸

When you want to send money the old-school way, it might feel comfy like your favorite pair of shoes, but it can pinch your wallet just like those shoes can pinch your feet after a while. 😅 With things like wire transfers, the fees can add up, especially if you’re sending money overseas. It’s like buying a ticket for your money to travel. And don’t get me started on how long it can take – sometimes your money seems to take the scenic route before it reaches its destination.

On the flip side, digital currencies like Bitcoin have entered the scene, promising to make things quicker and often cheaper. 🚀 It’s like sending an instant message to your friend across the world – swift and straightforward. But, it’s not all sunshine and rainbows. Transferring Bitcoin can also come with its fees, especially during busy times on the digital network. Think of it like rush hour traffic; the more people trying to move, the slower things go unless you’re willing to pay a bit more to get ahead. Both ways have their perks and quirks, it’s just about finding what’s best for your pocket and patience.

Keeping Secrets: How Safe Your Money Is 🔒

When it comes to keeping our money safe, it’s like guarding a treasure chest in the digital world. Imagine your hard-earned cash and savings; you’d want them stored in a vault so secure that only you hold the key. That’s the promise of digital currencies like Bitcoin. Unlike traditional banks where your money is kept under lock and key, Bitcoin operates on a technology called blockchain. This is like a super-secure record book that everyone can see, but no one can tamper with. It’s a bit like writing something in invisible ink that only you can see. The magic of this technology is that it makes your money very safe, guarding it against unwanted snooping or theft.

But just how safe are these digital vaults compared to the storied security of traditional banks? The truth is, while banks have layers of security and insurance, the digital world brings its own armor in the form of cryptography – a way of writing secret codes. These codes are incredibly tough to crack, securing your money online. However, it’s important to remember the phrase, “not your keys, not your coins,” highlighting the responsibility of managing and securing your private keys in the crypto world. For those curious about diving deeper into cryptocurrencies and exploring their potential beyond Bitcoin, the tether price offers a glimpse into the evolving landscape, providing insights and future outlooks. Whether digital or traditional, understanding the mechanisms of keeping your assets safe is key to navigating the future of finance.

The World Is Your Oyster: Global Use 🌍

In a world where moving across borders is as simple as hopping on a flight or opening a map, money should keep up, and that’s where the magic of digital currency shines ✨. Imagine sending money to a friend halfway around the globe in mere minutes without worrying about exchange rates or bank holidays. That’s the beauty of Bitcoin and similar digital currencies. They’re not tied down by geography; whether you’re sipping coffee in Paris or trekking through the Andes, as long as you have an internet connection, your digital wallet goes where you go 🌐. Compare this to traditional currency, which requires banks, ATMs, or carrying physical cash, all of which can be cumbersome and sometimes not even possible if you’re far from home. Plus, with apps and platforms, converting digital currency to local currency is becoming easier, making it a truly global option for adventurers and global citizens alike 🌍. Meanwhile, traditional currencies must navigate a maze of exchange rates, international fees, and delays. The difference is clear: in the digital age, borderless money is not just possible; it’s here.

| Feature | Digital Currency (e.g., Bitcoin) | Traditional Currency |

|---|---|---|

| Geographic Boundaries | None, operates globally | Limited by country-specific regulations and availability |

| Conversion Ease | High (digital platforms) | Variable (depends on local banks and exchange rates) |

| Transfer Speed | Fast (minutes to hours) | Varies (can take days) |

| Access Requirements | Internet connection and a digital wallet | Bank account, physical cash, ATMs |

Time Flies: the Future of Transactions ⏰

Just like flipping pages in a book, the way we trade and deal with money is ever-changing. Not too long ago, the idea of digital currency like Bitcoin seemed like something out of science fiction. Meanwhile, traditional cash has been our companion for centuries, familiar and universally understood. However, as we glance into the future, the scales seem to be tipping. The ease of clicking a button to send money across the globe, without waiting in lines or filling out forms, appeals to our fast-paced lives. Yet, in this rapidly evolving landscape, there’s a blend of nostalgia and innovation. People are getting curious about how digital currency works and its benefits.

Speaking of digital currencies, did you know that there are many types out there, not just Bitcoin? For those looking to dive deeper into this world, understanding the basics like litecoin cryptocurrency is a good starting point. It gives a glimpse into the vast ocean of possibilities that digital currencies offer. As we march forward, virtual wallets could become as commonplace as smartphones. The big question remains: will the ease of digital transactions entice everyone to leave behind the tangibility of cash? As technology advances, it’s clear the horizon of financial transactions will expand, blending the old with the new in ways we can only begin to imagine. 🚀🌐💡