Bitcoin’s Impact on Economy 🌐

Bitcoin’s impact on the economy is transforming financial landscapes worldwide. As a decentralized digital currency, Bitcoin offers a new way of conducting transactions that bypass traditional banking systems. Its global reach has the potential to streamline cross-border payments, fostering international trade and economic growth. The transparency and security provided by blockchain technology underpinning Bitcoin transactions have the capacity to enhance financial inclusion, especially in regions where access to traditional banking services is limited. This shift towards digital currency has implications for monetary policy, tax collection, and overall economic stability, prompting governments and financial institutions to reassess their regulatory frameworks.

The rising popularity of Bitcoin has sparked debates among economists and policymakers about its long-term effects on traditional financial systems. Some view it as a disruptive force that could challenge the dominance of fiat currencies and centralized banking institutions. While others see it as a catalyst for financial innovation and a potential tool for promoting greater financial inclusion and economic empowerment. As the adoption of Bitcoin continues to grow globally, its impact on the economy will likely become more pronounced, reshaping the way we think about money and the future of financial transactions.

Regulations Shaping Financial Landscape 🏛️

Bitcoin transactions have significantly impacted the global economy, providing a decentralized alternative to traditional financial systems. In the Solomon Islands, regulations play a crucial role in shaping the financial landscape and determining the framework within which Bitcoin transactions can operate. These regulations aim to balance innovation and security, protecting consumers while fostering growth in the digital currency sector. By navigating and adapting to these regulatory frameworks, the Solomon Islands can harness the advantages of decentralized transactions while mitigating risks and ensuring compliance with international standards. Despite challenges in implementing Bitcoin guidelines, such as regulatory clarity and enforcement mechanisms, the potential for growth in cryptocurrency adoption remains promising. As the Solomon Islands continues to explore the opportunities presented by digital currencies, the future outlook indicates a shifting financial landscape with increased integration of innovative blockchain technologies.

Advantages of Decentralized Transactions 💸

Decentralized transactions offer a level of independence and autonomy that traditional financial systems often lack. By removing the need for intermediaries like banks or payment processors, individuals can engage in direct peer-to-peer transactions, reducing transaction costs and time delays. This peer-to-peer network is built on a blockchain technology that ensures transparency and immutability, meaning that transactions are secure and cannot be altered once recorded. Additionally, decentralized transactions provide a degree of privacy and anonymity, safeguarding personal information from potential breaches or unauthorized access. Overall, the decentralized nature of transactions empowers individuals to have greater control over their finances and facilitates global and inclusive participation in the digital economy.

Challenges in Implementing Bitcoin Guidelines 🔒

Bitcoin guidelines pose unique challenges in their implementation, particularly in the context of varying regulatory frameworks worldwide. These hurdles often stem from the decentralized nature of cryptocurrencies, which can clash with traditional financial regulations intended for centralized systems. As governments grapple with establishing clear guidelines for Bitcoin transactions, issues arise surrounding security, taxation, and enforcement mechanisms. For instance, in countries like Slovenia, foreign exchange controls affecting Bitcoin require careful navigation to ensure compliance without stifling innovation. Overcoming these obstacles necessitates a delicate balance between fostering innovation in digital currency and upholding regulatory standards to protect consumers and maintain financial stability. This complex landscape underscores the importance of proactive collaboration between industry stakeholders and policymakers to establish a coherent framework for the future of Bitcoin transactions.

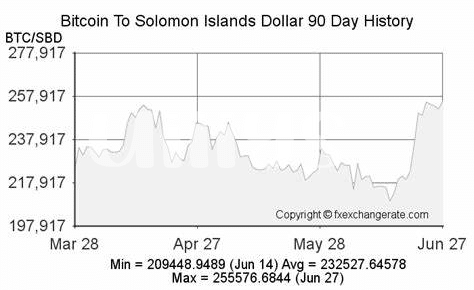

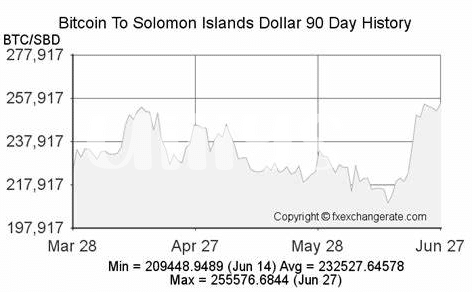

Potential Growth in Cryptocurrency Adoption 📈

Cryptocurrency adoption in the Solomon Islands holds immense potential for reshaping the financial landscape. As more individuals and businesses explore the benefits of digital currencies, there is a growing interest in incorporating cryptocurrencies like Bitcoin into everyday transactions. This shift towards embracing decentralized forms of payment not only offers greater financial inclusivity but also opens up new avenues for economic growth and innovation in the region. With the increasing accessibility and ease of conducting digital transactions, the Solomon Islands are poised to see a surge in cryptocurrency adoption in the coming years.

The evolving regulatory environment, coupled with the rising awareness of the advantages of decentralized finance, is paving the way for a broader acceptance of cryptocurrencies among the local population. As more merchants start accepting digital currencies, the potential for mainstream adoption continues to expand, creating a more diverse and dynamic financial ecosystem in the Solomon Islands. This shift towards embracing cryptocurrencies not only reflects a global trend but also underscores a growing acceptance of alternative forms of payment that offer greater efficiency, security, and financial autonomy to individuals and businesses alike.

Future Outlook for Digital Currency in Solomon Islands 🌺

The Solomon Islands are poised for a digital currency revolution, with the potential for Bitcoin and other cryptocurrencies to reshape the financial landscape. As global trends continue to embrace decentralized transactions, the nation stands at a crucial juncture in determining its future outlook on digital currency adoption. This shift presents both opportunities and challenges, requiring a delicate balance between innovation and regulation. The growing interest in digital currencies highlights the need for clear guidelines and frameworks to support their integration into the economy. By leveraging these advancements in technology, the Solomon Islands can position itself as a leader in embracing the future of finance.

foreign exchange controls affecting bitcoin in slovakia