Bitcoin as a Global Payment Solution 💸

Bitcoin has rapidly emerged as a transformative force in the realm of global payments, offering a decentralized and efficient alternative to traditional financial systems. Its borderless nature enables individuals to seamlessly send and receive funds across international boundaries, bypassing the often cumbersome and costly processes associated with traditional remittance methods. With growing acceptance and adoption, Bitcoin is revolutionizing the way money is transferred worldwide, providing greater accessibility, speed, and lower fees compared to conventional banking channels. Its underlying blockchain technology ensures secure and transparent transactions, offering a level of financial freedom previously unattainable. As Bitcoin continues to gain traction as a global payment solution, it is reshaping the landscape of cross-border remittances and paving the way for a more inclusive and efficient financial ecosystem.

Regulations Governing Bitcoin Remittances 📜

Bitcoin remittances face a complex landscape of regulations that vary from country to country. These regulations define how Bitcoin can be used for cross-border transactions, outlining requirements for compliance, reporting, and security measures. Understanding and adhering to these rules is crucial for ensuring the legality and legitimacy of Bitcoin remittances. Regulatory bodies monitor and enforce these guidelines to prevent illicit activities like money laundering and terrorist financing while promoting transparency and accountability in the financial system. By navigating and complying with these regulations, stakeholders in the Bitcoin remittance industry can help build trust and credibility in this innovative form of transferring money across borders. The evolving regulatory environment presents both challenges and opportunities for the adoption and growth of Bitcoin remittances as a legal and viable payment solution with the potential to reshape the landscape of cross-border transactions.

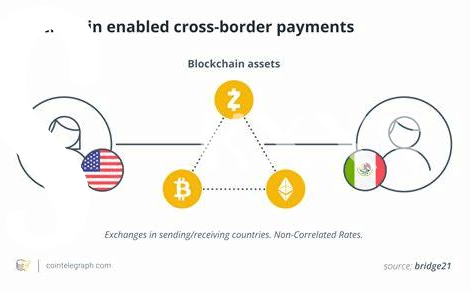

Impact of Bitcoin on Cross-border Transactions 💳

The increasing use of Bitcoin for cross-border transactions is reshaping the global financial landscape. Its decentralized nature and fast transaction speeds have significantly reduced the time and cost associated with traditional remittance methods. By bypassing intermediaries and operating on a peer-to-peer network, Bitcoin enables individuals to send and receive funds across borders in a more efficient and secure manner. This direct and borderless transfer system has particularly benefited underserved populations who rely on remittances for their livelihood. Additionally, the transparency of Bitcoin transactions has instilled a greater level of trust among users, further enhancing the efficiency and reliability of cross-border payments.

Challenges Faced by Bitcoin Remittances 🤔

Bitcoin remittances face several challenges in today’s global financial landscape. One major hurdle is the lack of consistent regulatory frameworks across different countries, creating uncertainty for both senders and receivers. Another issue is the volatility of Bitcoin prices, which can affect the value of remittances sent and received. Additionally, the technical complexity of using Bitcoin for remittances can be a barrier for those unfamiliar with cryptocurrency technology. These challenges highlight the need for clearer regulations and improved user interfaces to make Bitcoin remittances more accessible and user-friendly. For more insights on navigating the legal aspects of cross-border Bitcoin transfers, check out the compliance guidelines for bitcoin cross-border money transfer laws in Uzbekistan.

Potential Benefits of Using Bitcoin for Remittances 💡

Bitcoin offers several advantages as a method for cross-border remittances. One significant benefit is the speed of transactions, with Bitcoin transfers being processed faster compared to traditional banking systems. Additionally, the decentralized nature of Bitcoin means that transactions can be conducted at any time, without being restricted by banking hours or holidays. Another advantage is the potential for lower transaction fees, as Bitcoin transactions may incur lower costs compared to traditional remittance services. Furthermore, the transparency and security features inherent in Bitcoin transactions provide senders and recipients with greater peace of mind regarding the safety of their funds. Overall, using Bitcoin for remittances can offer a convenient, cost-effective, and secure way to transfer money across borders.

Future Trends in Bitcoin Remittances 🚀

In the ever-evolving landscape of cross-border transactions, the future trends in Bitcoin remittances are poised to revolutionize the way we transfer money globally. With the increasing adoption of digital currencies, including Bitcoin, we can expect to see a surge in innovative solutions designed to streamline and enhance the remittance process for individuals across borders. These advancements may include improved regulatory frameworks, technological developments for faster and more secure transactions, as well as greater integration of Bitcoin into existing financial systems.

As we look ahead, the potential for Bitcoin remittances to transform traditional cross-border transfers is significant. By leveraging the decentralized nature of blockchain technology, we anticipate a shift towards more efficient and cost-effective remittance options that prioritize transparency and accessibility. The future trends in Bitcoin remittances hold the promise of empowering individuals worldwide to send and receive money seamlessly, with reduced fees and processing times, ultimately reshaping the global remittance industry.

For more information on Bitcoin cross-border money transfer laws in Venezuela, please refer to the regulations outlined in the bitcoin cross-border money transfer laws in United Kingdom.