What Is a Bitcoin Mining Pool? 🔍

Imagine you’re trying to find a needle in a haystack, but instead of doing it alone, you join a group. Everyone searches together, and when someone finds the needle, you all get a piece of the prize. That’s pretty much what a bitcoin mining pool is – a group of people who combine their computer power to solve complex puzzles. By working together, they can find the solutions faster than if they were all trying it alone. Once they solve a puzzle, they all share the rewards, based on how much power each person contributed. It’s like a team sport where everyone has a role, and when the team wins, everyone gets a slice of the victory cake.

| Pros of Joining a Mining Pool | Cons of Joining a Mining Pool |

|---|---|

| Increased chances of earning bitcoins. | Your earnings get split among the pool, often resulting in smaller payouts. |

| Consistent payouts, rather than the “all or nothing” of solo mining. | Dependence on the pool’s rules and fee structures. |

| Reduced technical setup and knowledge required. | Possible centralization of the Bitcoin network, which goes against its decentralized ethos. |

This system not only makes mining more accessible to people all over the world but also strengthens the network by pooling resources. Whether you’re a seasoned pro or just dipping your toes in the cryptocurrency waters, understanding how these mining pools operate is key to navigating the seas of bitcoin mining.

Joining Forces: How Mining Pools Work ⚙️

Imagine a group of gold miners, each with their own tools, working together at a massive mining site to find gold more efficiently. That’s essentially how mining pools operate in the Bitcoin world. Individual miners combine their computing power over a network to tackle Bitcoin transactions together. By joining forces, they increase their chances of successfully adding a block to the blockchain and, in return, earning some Bitcoin as a reward. This teamwork approach makes it more feasible for individuals to earn rewards, as trying to mine Bitcoin solo is akin to finding a needle in a haystack with today’s competition and technical requirements.

Choosing the right mining pool is like finding the right team to play a sport with. You want a group that matches your playing style, shares your goals, and understands your strategy. In the context of Bitcoin mining, this means looking at the pool’s size, fee structure, and how it rewards members. Some pools might offer a larger share of the spoils for those contributing more computing power, while others might split rewards more evenly. Balancing these factors can maximize your earnings. Whether you’re diving deep into the details of mining or exploring broader topics like the future of Bitcoin, understanding the nuances of mining pools is crucial. For more insights into Bitcoin’s journey, consider exploring discussions on layer 2 scaling solutions and Bitcoin’s path to mass adoption.

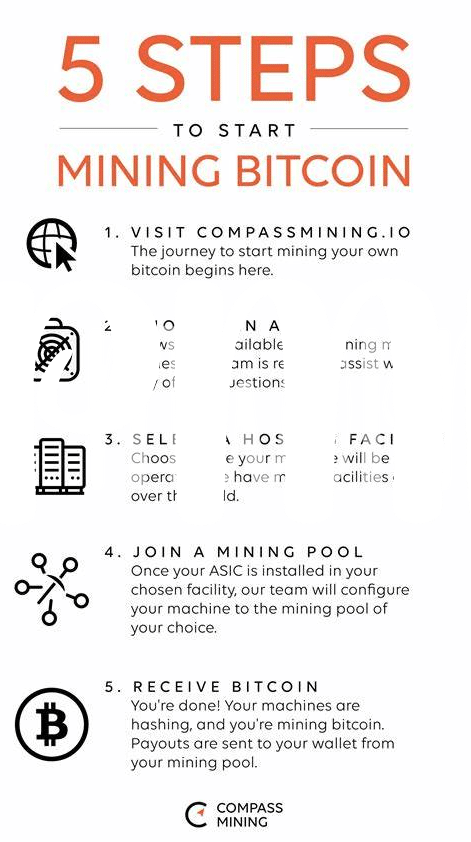

Choosing the Right Pool for Your Needs 🤝

When deciding where to dive into the world of mining together with others, think of it as finding your perfect team. It’s all about matching what you can offer with what you want out of the experience. Some pools might be huge, boasting incredible computing power, which could mean a steady flow of rewards, but remember, you’ll be sharing with a big crowd. Others are smaller, maybe more like a gathering of friends, where rewards might come less often but you get a bigger slice of the pie when they do. ⚙️🤝💸 It’s crucial to consider fees, as they can vary and will affect your take-home pay. Also, think about how tech-savvy you are; some pools are super user-friendly, while others might have you scratching your head. Finally, look at how they share out earnings; it’s not just about how much you earn, but how you earn it that can make all the difference in your mining adventure.

Sharing the Spoils: Reward Distribution Methods 💸

When it comes to making money together in the vast digital ocean of Bitcoin mining, understanding how the pie is split is key 🔑. Imagine you’re part of a team working on a big project. Once the job is done, everyone looks forward to their share of the rewards. In mining pools, this is where reward distribution methods come into play. These methods decide how the Bitcoin earned from solving complex puzzles is divided among all the contributors. Some pools split the reward equally based on the amount of work each miner contributes, while others might have a more complex system that rewards not just the work done but also factors like how long you’ve been part of the pool.

To dive deeper into how these digital gold mines operate, it’s important to grasp the basics of the technology fueling the process. A great starting point is this comprehensive guide explaining bitcoin blockchain technology to beginners regulatory outlook. As miners join forces, pooling their computational power, they increase their chances of solving those puzzles and earning Bitcoin. However, choosing the right pool involves understanding the various reward methods involved, from Pay-Per-Share, rewarding miners for each share they contribute, to more unpredictable methods, like PPLNS (Pay Per Last N Shares), which benefits those who contribute more over longer periods. Knowing the ins and outs of these methods can greatly affect your earnings, making it a crucial step for any aspiring miner 🌟.

The Impact of Mining Pools on Bitcoin’s Network 🌐

Imagine a world where many small streams flow together to create a mighty river. That’s quite similar to how mining pools impact the heart and soul of Bitcoin’s network. By combining their computational power, these pools contribute significantly to the blockchain, ensuring transactions are verified and secured more efficiently. This collective effort not only democratizes the mining process, enabling smaller players to participate but also stabilizes and secures the network. However, it’s not all sunshine and rainbows. The rise of these mining pools also brings up concerns about centralization. If a few pools grow too large, they could, in theory, control a substantial portion of the network’s hash rate (which is like having a bigger slice of the pie in terms of mining power), potentially threatening the decentralized nature of Bitcoin. This scenario is akin to a river becoming too powerful and threatening the landscapes around it. Despite these concerns, the benefits seem to outweigh the risks, as the network continues to thrive, thanks to the vigilant community keeping an eye on the balance of power. It’s a delicate dance of give and take, where participants work together for the greater good, ensuring a secure and vibrant ecosystem.

| Impact Area | Description |

|---|---|

| Security & Efficiency | Pooling resources boosts the network’s security and helps in verifying transactions more swiftly. |

| Democratization of Mining | Allows smaller miners to participate and earn rewards, fostering inclusivity. |

| Risks of Centralization | Potential for a few large pools to control significant portions of the network’s power, posing threats to decentralization. |

| Network Stability | The collective effort of mining pools contributes to the overall stability and health of the Bitcoin network. |

Tips for Maximizing Earnings in a Pool 📈

If you’ve decided to join a mining pool to increase your Bitcoin earnings, there are some strategies to ensure you get the most out of your participation. Picture yourself as part of a team where every player’s performance can lead to a bigger win. One critical approach is to regularly assess how well the pool aligns with your mining capabilities and goals. Technology upgrades can shift the landscape quickly, and staying informed can help you switch to a more profitable setup. 📊 Additionally, understanding the pool’s fee structure and how rewards are calculated is crucial. Some pools might offer smaller, more consistent payouts, which could be more beneficial for your situation than larger, less frequent ones. 🧮

Beyond the immediate pool dynamics, it’s wise to keep an eye on the broader Bitcoin landscape. Factors like market price and network difficulty play a significant role in your earnings. Engaging with community resources and utilizing mining profitability calculators can offer valuable insights. 🚀 For those interested in diving deeper into the efficiency and future of digital currency, considering solutions to bitcoin scalability issues and future prospects regulatory outlook could provide a broader understanding of what lies ahead in maximizing your mining endeavors. Balancing these aspects effectively will not only maximize your contributions to the pool but also enhance your individual rewards.