🚀 Start with Understanding What Bitcoin Is

Imagine stumbling upon a treasure chest, but instead of gold, it’s filled with digital coins. That’s a bit like discovering Bitcoin. Created over a decade ago, Bitcoin is like digital money you can send to anyone, anywhere, without needing a bank in the middle. It’s based on a special kind of technology called blockchain, which keeps it safe and allows everyone to agree on who owns what.

| Year | Event |

|---|---|

| 2009 | Birth of Bitcoin |

| 2010 | First purchase with Bitcoin (hint: it was pizza!) |

| Today | A growing community and increasing acceptance |

The beauty of Bitcoin lies in its scarcity (only 21 million will ever exist) and its open nature – anyone with an internet connection can be a part of it. No wonder it’s caught the eye of those looking for a modern way to save and grow their funds. So, diving into the Bitcoin world is like embarking on an adventure, where understanding its roots and how it works is the first step towards unlocking its potential for your financial future.

🐷 Setting up Your Bitcoin Savings Plan

Entering the world of Bitcoin can be likened to setting sail in vast, uncharted financial waters. It’s thrilling yet requires careful navigation. To begin, consider Bitcoin not just as a digital currency but as a potential cornerstone in your long-term wealth preservation strategy. Imagine setting aside a small portion of your monthly income – this could be as modest as the cost of a couple of fancy coffees – and converting it into Bitcoin. The key here is consistency, much like regularly contributing to a traditional savings account. This approach not only eases you into the cryptocurrency markets but also leverages the power of dollar-cost averaging, where, over time, the impact of market volatility is reduced.

Beyond the basics, solidifying your Bitcoin savings plan involves understanding and incorporating it within a broader investment portfolio. This is where diversification acts as your financial safeguard. Think of it as not putting all your eggs in one basket. There are numerous assets out there, be it stocks, bonds, or real estate, each carrying its own set of risks and rewards. Incorporating Bitcoin can not only potentially enhance your portfolio’s growth but also serve as a hedge against inflation. For those curious about how Bitcoin compares to traditional inflation hedges like gold, a deeper dive into the topic can be found here. Remember, the goal is to build a resilient portfolio that can withstand the test of time, ensuring your financial security in the years to come.

🛡️ Diversifying Your Investment Portfolio

Putting all your eggs in one basket might seem adventurous, but when it comes to your hard-earned money, a safer bet is to spread those eggs across different baskets. Think of it this way: if one basket falls, you still have other eggs safe and sound. This is what the smart cookies do with their investments, and it’s especially clever when diving into the digital world of Bitcoin. Including different types of investments like stocks, bonds, or even other cryptocurrencies alongside Bitcoin can help smooth out the bumps on the financial road ahead. It’s a bit like a financial safety net; if Bitcoin faces a storm, your other investments can keep you afloat.

Now, you might wonder, “How do I start?” 🤔 The key is to start small and learn as you grow. Perhaps allocate a portion of your investment to Bitcoin and the rest to other areas you feel confident about. Keep an open mind and be ready to adjust your strategy as you learn more about the market’s ins and outs. 📈🚀 Remember, investing is a marathon, not a sprint. By diversifying, you’re not just protecting your investments; you’re also giving yourself the opportunity to explore and benefit from various sectors of the financial world. Embrace the journey with curiosity and caution, your future self will thank you.

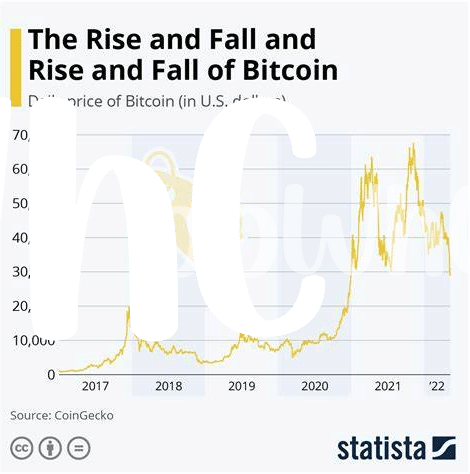

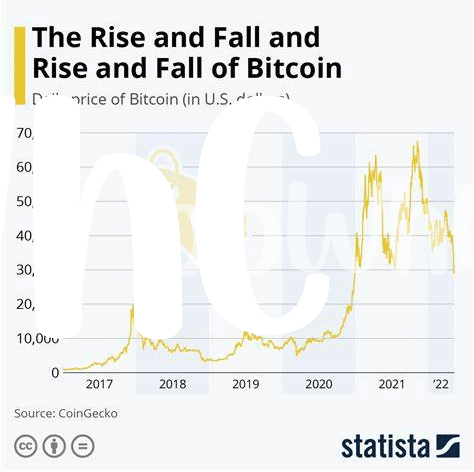

🔍 Keeping an Eye on Market Trends

Just like the weather can change from sunny to stormy, the world of Bitcoin also experiences shifts that can affect your investment. Staying informed about these changes is like having a good weather app for your financial journey. It’s not just about watching the prices go up and down; it’s also understanding why these movements happen. From global economic news to changes in technology, various factors can push the boat of Bitcoin’s value in different directions. It’s crucial to keep an eye on these because what happens around the world can directly influence your digital treasure chest.

For anyone looking to understand more about how bitcoin acts as a hedge against inflation market trends, there’s much to learn. Being part of investment communities online can offer insights and perspectives you might not have considered. Discussions in these groups often cover the latest news and strategies, helping you to make more informed decisions. Remember, the goal isn’t to predict the future perfectly but to be prepared and adaptable. This way, you can better protect your investment and possibly even grow it, regardless of the financial weather ahead.

🤝 Joining Bitcoin Investment Communities

Investing in Bitcoin might seem like navigating a wide, unknown ocean at first. However, think of joining communities focused on Bitcoin investment as assembling your crew and map for this voyage. Picture this: a place where everyone speaks your language, from beginners to seasoned explorers. They share stories of their travels, storms they’ve weathered, and treasures they’ve discovered. In these communities, you’ll find a treasure trove of firsthand experiences, advice, and strategies that can illuminate your path. Whether it’s through online forums, social media groups, or local meetups, the collective wisdom and support you gain can serve as your compass, helping you make more informed decisions and avoid the common pitfalls that snag many solo adventurers.

| Benefits | Examples |

|---|---|

| Real-time advice and support | Online forums, Social media groups |

| Networking opportunities | Local meetups, Conferences |

| Learning from experienced investors | Webinars, Workshop sessions |

Imagine expanding your horizons beyond your individual efforts, by tapping into the collective insights and experiences. The information exchanged in these spaces can be a beacon, guiding you toward making decisions that align with your long-term investment goals. Plus, the connections made can prove invaluable, offering opportunities to collaborate or learn from others who’ve successfully navigated the Bitcoin investment landscape. So, as you chart your course towards long-term wealth preservation with Bitcoin, remember that the journey is both personal and communal, and joining the right community could be the wind in your sails towards success.

💡 Embracing Patience and Long-term Thinking

When it comes to building wealth with Bitcoin, remember it’s more like planting a tree than buying a lottery ticket. You wouldn’t plant a seed and expect a full-grown tree the next day, right? Similarly, smart Bitcoin investments require giving your assets time to grow, unaffected by the daily ups and downs. This journey is not just about watching numbers go up and down; it’s about understanding the value behind what you’re investing in and believing in its potential over the years. It’s easy to get swayed by short-term fluctuations, but true growth comes from standing firm in storms, knowing sunny days are ahead.

Moreover, connecting with like-minded folks can enrich this journey. Consider joining a Bitcoin developer community: how to contribute market trends, where you can exchange ideas, strategies, and experiences. Here, you’ll learn the importance of staying informed and adaptable, ensuring your investment approach evolves with the market. Engaging in such communities encourages a proactive rather than reactive stance on investing, emphasizing the value of foresight and planning. So, take heart, plant your investment seeds wisely, and watch patiently as they grow into a forest of wealth.