Legal Status 📜

**Legal Status:**

In Liberia, the legal status of Bitcoin investments remains a topic of discussion among regulators and investors alike. The government has not yet issued specific laws or regulations relating to the use and investment in cryptocurrencies like Bitcoin. This lack of legal clarity poses challenges for individuals and businesses looking to engage in Bitcoin transactions in a regulated manner. As a result, investors need to proceed with caution and seek legal advice to understand the potential risks and implications of investing in Bitcoin within the current regulatory framework. Despite the absence of clear directives, the growing interest in cryptocurrencies globally may spur Liberia to develop comprehensive guidelines to address the legal status of Bitcoin investments in the future.

| Lorem Ipsum | Lorem Ipsum |

|————-|————-|

| Lorem Ipsum | Lorem Ipsum |

Licensing Requirements 📋

In order to engage actively in Bitcoin investments in Liberia, potential investors need to comply with specified licensing requirements. These regulations are essential to ensure a secure and transparent environment for financial transactions involving cryptocurrency. Understanding and adhering to the licensing prerequisites can help investors navigate the legal framework and operate within the boundaries set by the authorities. By obtaining the necessary licenses, investors demonstrate their commitment to ethical practices and regulatory compliance in the cryptocurrency market. Compliance with licensing requirements not only fosters trust among stakeholders but also contributes to a sustainable and accountable investment ecosystem. As Liberia continues to develop its regulatory framework for Bitcoin investments, meeting licensing demands remains a fundamental aspect of participating in the growing digital asset industry in the country.

Tax Implications 💰

Navigating the tax landscape when it comes to Bitcoin investments in Liberia can be a complex journey. Understanding the tax implications is crucial to managing your investments effectively. Investors need to be aware of how profits from Bitcoin transactions are categorized and taxed under Liberian law. This includes capital gains tax, income tax, and any potential exemptions or deductions that may apply. Staying informed about the tax regulations surrounding Bitcoin investments will help investors make well-informed decisions and ensure compliance with the law. By being proactive in understanding the tax implications, investors can mitigate risks and maximize returns in this evolving financial landscape.

Investment Opportunities 💡

When exploring opportunities in the realm of Bitcoin investment in Liberia, investors are met with a diverse landscape ripe for exploration. With the potential for growth and innovation, various sectors beckon those looking to diversify their portfolios. From fintech startups leveraging blockchain technology to real estate ventures incorporating cryptocurrency transactions, the possibilities are vast. Additionally, the emergence of digital asset exchanges and crowdfunding platforms presents new avenues for investment. As regulatory frameworks evolve to accommodate this burgeoning market, savvy investors can position themselves strategically to capitalize on these dynamic opportunities.

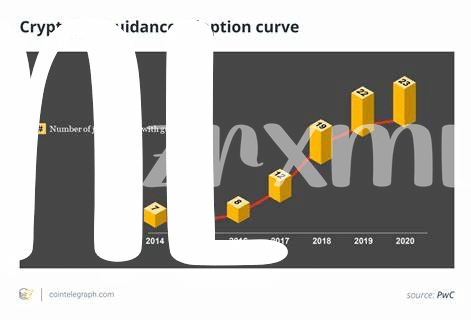

For more in-depth regulatory guidance on Bitcoin investments in Liberia, refer to the regulatory guidance on Bitcoin investments in Laos. Understanding the legal nuances and compliance requirements is essential for making informed investment decisions in this evolving landscape. By staying informed and proactive, investors can navigate challenges and seize the promising investment prospects in Liberia’s burgeoning Bitcoin market.

Regulatory Challenges 🔍

Regulatory challenges in the Bitcoin investment landscape of Liberia present a complex web of hurdles for both investors and authorities. Navigating the evolving regulations and compliance frameworks can prove to be a daunting task, with the lack of clear guidelines often leading to uncertainties and ambiguities in the interpretation of existing laws. Furthermore, the dynamic nature of the cryptocurrency market adds an additional layer of complexity, necessitating a proactive approach in addressing regulatory concerns to ensure a stable and secure investment environment.

| Regulatory Challenges |

|---|

| Complex web of hurdles for investors and authorities |

| Lack of clear guidelines leading to uncertainties |

| Need for proactive approach in addressing concerns |

Future Outlook 🔮

In the realm of Bitcoin investment laws in Liberia, the future outlook is filled with anticipation and uncertainty. As the regulatory landscape continues to evolve, investors must stay vigilant and adaptable to navigate potential changes ahead. With technological advancements and shifting global attitudes towards cryptocurrencies, the future of Bitcoin investments in Liberia holds both promise and challenges.

For regulatory guidance on bitcoin investments in Lebanon, investors can refer to the official documentation provided by the relevant authorities. This documentation offers invaluable insights and recommendations for individuals looking to participate in the crypto market in Lebanon. Visit the regulatory guidance on bitcoin investments in Kyrgyzstan for comprehensive details on compliance and best practices.