Overview of Bitcoin Cross-border Transfers 🌍

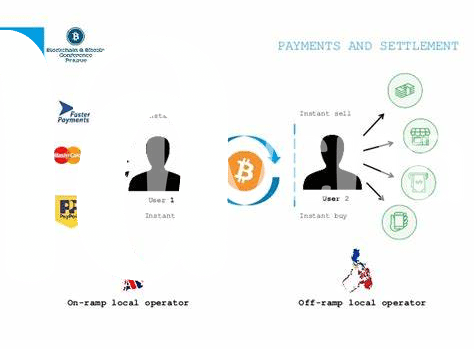

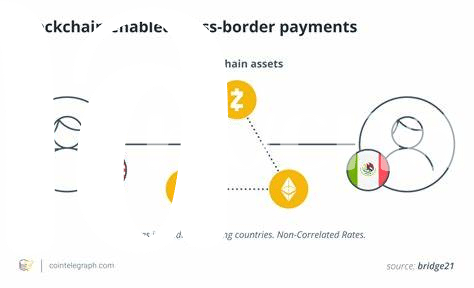

Bitcoin cross-border transfers have gained momentum in reshaping the way money moves across borders, offering a decentralized and efficient alternative to traditional banking systems. As individuals and businesses navigate the complexities of international transactions, the rise of Bitcoin has introduced a new paradigm for cross-border transfers. The borderless nature of cryptocurrency enables seamless peer-to-peer transactions across different countries, transcending geographical boundaries and regulatory frameworks. With its potential to revolutionize cross-border payments, Bitcoin serves as a catalyst for financial inclusion and innovation on a global scale, fostering a borderless economy where traditional barriers are reimagined.

Legal Landscape in Lesotho 📜

Lesotho’s legal framework navigates the evolving landscape of Bitcoin cross-border transfers, shaping the regulatory environment for digital transactions. With a proactive approach, the country establishes guidelines for financial entities to ensure compliance with international standards. This creates a stable foundation for secure and transparent cross-border payments, fostering trust and confidence in the financial ecosystem. The regulatory framework in Lesotho reflects a balance between embracing innovative technologies and mitigating potential risks, showcasing a progressive outlook on digital financial services within the nation. As the global financial landscape continues to shift towards digitalization, Lesotho’s legal landscape plays a crucial role in shaping the future of cross-border transactions and positioning the country as a forward-looking player in the digital economy.

Compliance Framework for Financial Institutions 🏦

In Lesotho, financial institutions play a crucial role in upholding the compliance framework surrounding Bitcoin cross-border transfers. These institutions are required to adhere to strict regulatory guidelines to ensure the legality and security of such transactions. By implementing robust compliance measures, financial institutions not only safeguard the integrity of the transfer process but also contribute to maintaining the overall financial stability within the country.

The compliance framework for financial institutions in Lesotho is designed to promote transparency, accountability, and adherence to anti-money laundering regulations. Through diligent monitoring and reporting practices, these institutions work in conjunction with regulatory bodies to combat illicit activities and mitigate potential risks associated with cross-border Bitcoin transfers. Such proactive efforts not only enhance the credibility of the financial sector but also foster trust among stakeholders, paving the way for a more secure and efficient cross-border payment ecosystem.

Impact on Lesotho’s Economy 💰

The increasing adoption of Bitcoin for cross-border transfers in Lesotho is significantly impacting the country’s economy. As more individuals and businesses utilize Bitcoin for international transactions, traditional banking systems may face challenges in keeping pace with the changing landscape. The streamlined nature of Bitcoin transfers can lead to quicker and more cost-effective cross-border payments, which could potentially boost economic growth and financial inclusion in Lesotho. However, the shift towards digital currencies also presents regulatory challenges for authorities seeking to maintain stability and prevent illicit activities within the financial sector.

For further insights into the regulatory framework surrounding Bitcoin cross-border transfers, you can explore the article on bitcoin cross-border money transfer laws in Libya on WikiCrypto News. This in-depth analysis sheds light on the crucial aspects of Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations in the context of cryptocurrency transactions.

Challenges and Opportunities 💡

Challenges arise in adopting Bitcoin for cross-border transfers in Lesotho, including regulatory concerns and volatility risks. However, amidst these challenges lie significant opportunities. By embracing innovative blockchain solutions, financial institutions have the chance to enhance transparency, efficiency, and financial inclusion. This technology can empower individuals to securely transfer funds across borders at lower costs, especially for the unbanked populations. Moreover, leveraging Bitcoin for cross-border payments could attract foreign investment, stimulate economic growth, and position Lesotho as a progressive player in the global digital economy. Therefore, while navigating these challenges is crucial, the opportunities presented by embracing Bitcoin for cross-border transfers are vast and promising for Lesotho’s financial landscape.

Future Outlook for Cross-border Payments 🚀

The evolution of cross-border payments is set to be transformative, as advancements in technology, regulatory frameworks, and digital currencies continue to reshape the financial landscape. With the rise of Bitcoin as a popular medium for international transfers, the future outlook for cross-border payments is filled with promise and potential. As countries like Lesotho navigate the complexities of enforcing compliance requirements and adapting to digital financial ecosystems, the door opens to new possibilities for seamless and efficient cross-border transactions. This shift towards embracing innovative payment solutions not only streamlines processes for financial institutions but also paves the way for greater financial inclusion and economic growth. Looking ahead, the trajectory of cross-border payments appears to be accelerating towards a borderless, interconnected global financial network where traditional barriers are dismantled, ushering in a new era of financial accessibility and opportunity. For more information on Bitcoin cross-border money transfer laws in Lebanon and Kyrgyzstan, refer to the bitcoin cross-border money transfer laws in lebanon.