Understanding Bitcoin’s Impact on Guyana 🌍

Bitcoin has been making waves in Guyana, offering a new way for its citizens to engage in global transactions. As traditional banking systems face limitations in cross-border transfers, Bitcoin provides a decentralized alternative that is gaining traction. The impact of Bitcoin in Guyana extends beyond just financial transactions; it represents a shift towards digital innovation and opportunities for individuals to participate in the global economy from the comfort of their homes. With increasing access to mobile devices and the internet, Guyanese citizens are exploring the world of cryptocurrency, opening up avenues for financial inclusion and economic empowerment.

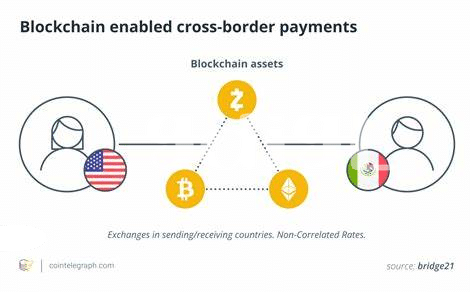

Emerging technologies like blockchain are reshaping how money moves across borders, and Guyana is no exception to this trend. As the country navigates the evolving landscape of financial technology, understanding the implications of Bitcoin on the local economy becomes crucial. While challenges and uncertainties remain, the adoption of digital currencies presents a promising pathway for Guyanese individuals and businesses to connect with international markets and drive financial growth within the region. Amidst regulatory considerations and potential risks, the transformative potential of Bitcoin in Guyana offers a glimpse into a future where traditional barriers to global transactions are reimagined.

Regulatory Challenges Faced in Cross-border Transfers 🚫

Cross-border Bitcoin transfers come with a set of unique regulatory challenges that must be navigated meticulously. From varying legal frameworks to concerns over money laundering and terrorism financing, regulatory clarity remains a constant struggle for individuals and businesses engaging in cross-border transactions. The lack of universal standards and transparency in regulatory requirements adds layers of complexity, hindering the seamless movement of funds across borders. As governments grapple with the evolving landscape of digital currencies, finding a balance between fostering innovation and ensuring compliance poses a significant obstacle in the realm of cross-border Bitcoin transfers.

In light of these challenges, industry stakeholders in Guyana are actively advocating for clearer regulatory guidelines to enhance the security and efficiency of cross-border transactions. Collaborative efforts between policymakers, financial institutions, and technology providers are essential to address the regulatory hurdles and create a conducive environment for cross-border Bitcoin transfers. By fostering dialogue and embracing innovative solutions, Guyana can position itself as a forward-thinking player in the global digital economy, propelling financial inclusion and economic growth for its citizens.

Exploring Financial Opportunities for Guyanese Citizens 💰

In Guyana, the realm of digital finance presents a realm of new possibilities for the local population. With the rise of Bitcoin and other cryptocurrencies, Guyanese citizens now have access to financial opportunities that were previously unavailable to them. By embracing these digital assets, individuals in Guyana can explore avenues for investment, savings, and remittances that were once limited by traditional banking systems. The decentralized nature of cryptocurrencies eliminates many barriers to entry, empowering individuals to take control of their financial futures. As the country navigates the complexities of the global economy, the adoption of digital currencies opens doors to a wider range of economic activities for Guyanese citizens. Embracing this new financial landscape can lead to increased financial inclusion and empowerment for individuals across the nation.

Leveraging Blockchain Technology for Secure Transactions 🔒

Blockchain technology has revolutionized secure transactions by providing a decentralized and transparent system that enhances trust between parties. The immutable nature of blockchain ensures that transactions are recorded securely and cannot be altered, reducing the risks of fraud and tampering. By leveraging blockchain for cross-border transfers, Guyanese citizens can benefit from faster, more cost-effective, and secure transactions. This technology enables real-time tracking of funds, eliminating the need for intermediaries and reducing transaction costs. With its potential to streamline the transfer process and increase financial inclusion, blockchain holds promise for transforming the way cross-border transactions are conducted in Guyana. Embracing blockchain technology can significantly enhance the efficiency and security of cross-border transfers, opening up new opportunities for businesses and individuals in the country.

For more information on how blockchain is impacting cross-border money transfers, you can read further at bitcoin cross-border money transfer laws in Honduras.

Global Comparison of Cross-border Transfer Regulations 🌎

When considering cross-border transfer regulations globally, one observes a diverse landscape where countries have varying approaches to overseeing such financial activities. While some nations have embraced digital currencies like Bitcoin for cross-border transfers, others maintain strict regulations or outright bans. For instance, countries in the European Union have introduced stringent Anti-Money Laundering (AML) directives that impact cross-border cryptocurrency transfers. On the other hand, countries like Japan have established a regulatory framework that recognizes Bitcoin as a legal form of payment, facilitating smoother cross-border transactions for their citizens.

Looking beyond individual countries, international organizations like the Financial Action Task Force (FATF) play a crucial role in setting standards for cross-border financial transfers. Their guidelines influence how nations shape their regulations to combat activities like money laundering and terrorism financing, impacting the cross-border transfer landscape on a global scale. Understanding this broader context is essential for policymakers and businesses seeking to navigate the complex terrain of cross-border transactions in the digital age.

Future Outlook and Potential Developments in Guyana 💡

In Guyana, the future outlook for Bitcoin and potential developments hold promise for shaping the country’s financial landscape. As regulatory frameworks continue to evolve, there is a growing awareness of the benefits that digital currencies can offer in terms of efficiency and cost-effectiveness. With a focus on enhancing cross-border transactions, Guyana is poised to embrace innovative technologies to streamline financial processes and promote economic growth.

For further insights into Bitcoin cross-border money transfer laws in various countries, including Hungary and Haiti, click here to compare the regulatory environments and discover the latest developments in this increasingly significant aspect of global finance.