Importance of Bitcoin for Cross-border Transactions in Zimbabwe ✨

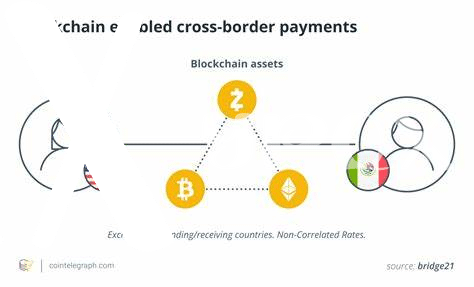

Bitcoin has significantly transformed cross-border transactions in Zimbabwe, offering a reliable and efficient alternative to traditional banking systems. By leveraging the decentralized nature of cryptocurrencies, individuals and businesses can now swiftly and securely transfer funds across borders, circumventing the challenges associated with traditional methods. This shift towards utilizing Bitcoin for cross-border transactions in Zimbabwe has not only streamlined the process but has also contributed to financial inclusion by providing access to global markets for individuals who were previously underserved by traditional banking infrastructures.

Legal Framework for Bitcoin Usage in Zimbabwe 📜

Bitcoin has been embraced in Zimbabwe as a means of facilitating cross-border transactions due to its efficiency and lower costs compared to traditional methods. The legal framework surrounding the usage of Bitcoin in the country is a key aspect that shapes its adoption and regulation. Understanding the legal guidelines and policies governing Bitcoin transactions in Zimbabwe is essential for both users and regulators to ensure compliance and security. By examining the legal framework, individuals and businesses can navigate the landscape of Bitcoin usage with transparency and adherence to regulations. This framework not only sets the boundaries for usage but also provides a foundation for the integration of Bitcoin into the broader financial ecosystem of Zimbabwe. As the regulatory framework continues to evolve, stakeholders must stay informed and engaged to promote a sustainable and secure environment for Bitcoin transactions within the country’s borders.

Challenges Faced in Bitcoin Money Transfers 🤔

Challenges can arise in Bitcoin money transfers, particularly related to regulatory uncertainties and fluctuating exchange rates. The lack of widespread adoption and infrastructure in Zimbabwe may also pose obstacles in the smooth facilitation of cross-border transactions using Bitcoin. Additionally, concerns about security and the potential for fraudulent activities in the digital currency space can deter users from fully embracing Bitcoin for their money transfer needs. Overcoming these challenges requires a collaborative effort between regulators, financial institutions, and technology providers to address issues related to transparency, compliance, and consumer protection. Despite these hurdles, the potential benefits of using Bitcoin for cross-border transfers, such as lower fees and faster transaction speeds, highlight the importance of finding solutions to navigate and mitigate these challenges effectively.

Impact of Bitcoin on Zimbabwe’s Economy 💸

Bitcoin’s impact on Zimbabwe’s economy has been profound, offering a glimmer of hope amidst economic uncertainties. The decentralized nature of Bitcoin has provided Zimbabweans with an alternative means of conducting cross-border transactions, bypassing traditional banking systems plagued by limitations and inefficiencies. The adoption of Bitcoin has created opportunities for individuals and businesses to engage in transactions with greater speed and reduced costs, thus fostering economic growth and financial inclusion.

For more insights on the upcoming regulatory changes for Bitcoin in Afghanistan, visit upcoming regulatory changes for Bitcoin in Afghanistan to stay informed about the evolving landscape of digital currency usage in different regions.

Future Prospects and Opportunities for Bitcoin in Zimbabwe 🚀

Bitcoin adoption in Zimbabwe presents promising future prospects and opportunities as the country grapples with economic challenges. With the potential to facilitate faster and more cost-effective cross-border transactions, Bitcoin offers a new avenue for financial inclusion and growth in a region where traditional banking services are limited. The decentralized nature of cryptocurrencies like Bitcoin could empower individuals and businesses to engage in global trade and access international markets with reduced barriers. Moreover, embracing digital currencies may encourage innovation in financial services and drive economic development in Zimbabwe. As regulatory frameworks evolve and awareness of Bitcoin increases, the technology has the potential to revolutionize the financial landscape in Zimbabwe, offering a glimpse into a more connected and prosperous future.

Conclusion: Advantages of Using Bitcoin for Transfers 💡

Bitcoin offers numerous advantages for cross-border money transfers in Zimbabwe. Its decentralized nature means transactions can be completed faster and at lower costs compared to traditional banking methods. Additionally, the transparency and security features of blockchain technology provide a level of trust and accountability that is beneficial for both senders and recipients.

Furthermore, the ability to send funds across borders without the need for intermediaries or lengthy processing times streamlines the transfer process, making it more efficient and convenient. As Zimbabwe explores the potential of Bitcoin for financial transactions, there is a growing recognition of the benefits it can bring to the economy and individuals alike. With the legal framework slowly evolving to accommodate the use of cryptocurrencies, there is an optimistic outlook for the future of Bitcoin in Zimbabwe.

For more information on the legal framework surrounding Bitcoin cross-border money transfers in Zambia, you can refer to the bitcoin cross-border money transfer laws in Vanuatu.