Understanding Aml Regulations in Albania 🇦🇱

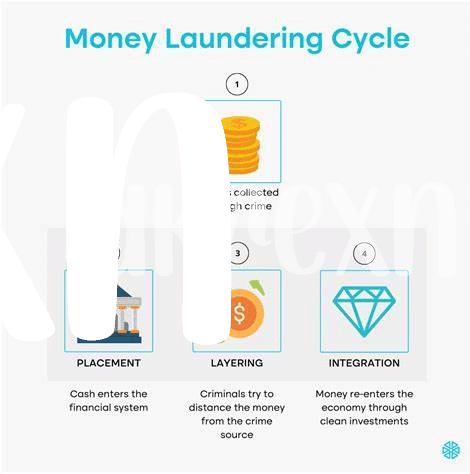

In Albania, Anti-Money Laundering (AML) regulations play a crucial role in ensuring the integrity of financial transactions. These regulations are designed to prevent illicit activities, such as money laundering and terrorist financing, by establishing stringent compliance measures that financial institutions and other entities must adhere to. Understanding the specifics of AML regulations in Albania is essential for companies operating in the cryptocurrency space to avoid regulatory pitfalls and maintain trust with authorities.

Albania’s AML regulations encompass a range of requirements, including customer due diligence, reporting of suspicious activities, and record-keeping obligations. By familiarizing themselves with these rules, businesses can proactively implement robust compliance programs that protect against financial crimes. Stay tuned to delve deeper into the nuanced landscape of AML regulations in Albania.

Impact of Bitcoin on Compliance Measures 💼

Bitcoin’s rise has transformed compliance measures, requiring a closer look at how traditional AML regulations align with this innovative digital currency. As Bitcoin continues to gain traction, regulators are grappling with the complexities of ensuring compliance within this decentralized system. The inherent privacy and pseudonymity of Bitcoin transactions pose unique challenges for AML efforts, prompting a reevaluation of existing frameworks. Addressing these challenges is crucial to fostering trust in the cryptocurrency space and safeguarding against illicit activities. Embracing innovative solutions will be key to enhancing compliance measures in this ever-evolving landscape.

Challenges of Implementing Aml Rules 🛑

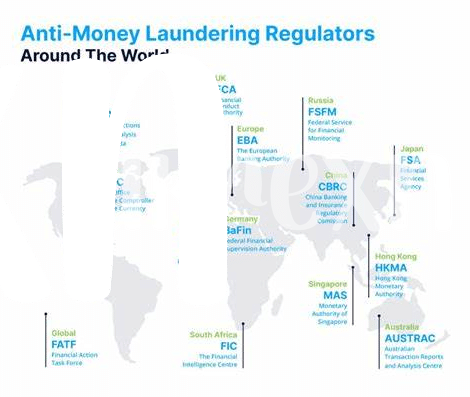

Navigating the landscape of AML regulations can be a daunting task, especially when it comes to implementation. From understanding the intricacies of compliance requirements to ensuring proper training for staff, there are numerous challenges that companies face in adhering to AML rules. One significant hurdle is the evolving nature of money laundering techniques, which requires constant vigilance and adaptability from organizations. Additionally, the lack of standardized global regulations poses a challenge, as companies operating in multiple jurisdictions must navigate varying requirements and expectations seamlessly. Despite the challenges, organizations must prioritize compliance to mitigate risks and maintain trust within the financial ecosystem.

As technology advances and cryptocurrencies become more prevalent, the complexities of implementing AML rules increase further. The decentralized and pseudonymous nature of many cryptocurrencies makes tracking transactions and identifying illicit activities a challenging endeavor. Moreover, the rapid pace of innovation in the crypto space means that regulatory frameworks must continuously evolve to keep pace with new developments. To address these challenges effectively, companies need to invest in robust compliance programs, leverage technological solutions for monitoring and reporting, and collaborate with regulators and other stakeholders to stay ahead of potential threats. By taking a proactive and holistic approach to AML implementation, businesses can navigate the challenges effectively and contribute to a more secure financial environment.

Strategies for Ensuring Regulatory Compliance ✅

Strategies for ensuring regulatory compliance in Albania can be a multifaceted approach that requires a deep understanding of the local AML regulations. Implementing robust KYC procedures, conducting thorough transaction monitoring, and ensuring proper record-keeping are essential steps for staying compliant. Moreover, establishing a culture of compliance within the organization, coupled with regular training sessions for employees, can significantly enhance the overall compliance framework. Adapting to the evolving regulatory landscape and staying abreast of any updates or changes in the AML laws is crucial to ensure continuous compliance in the dynamic cryptocurrency space.

To delve further into effective compliance strategies, read more about bitcoin anti-money laundering (aml) regulations in Austria on wikicrypto.news. Understanding the specific requirements and best practices under the Austrian AML laws can provide valuable insights for executing compliance measures in Albania. By leveraging knowledge and insights from diverse regulatory environments, businesses can enhance their compliance strategies and navigate the intricate landscape of AML regulations successfully.

Importance of Transparency in Cryptocurrency Transactions 🔍

Transparency plays a vital role in cryptocurrency transactions as it helps build trust among users and regulatory authorities. By providing clear visibility into the flow of funds, blockchain technology enables parties to verify the legitimacy of transactions and identify any suspicious activities. This transparency not only enhances security but also facilitates compliance with anti-money laundering regulations, fostering a more robust and accountable cryptocurrency ecosystem.

Moreover, promoting transparency in cryptocurrency transactions can also attract mainstream adoption by reassuring traditional financial institutions and governments about the legitimacy of digital asset transactions. As the industry continues to evolve, maintaining a high level of transparency will be crucial in enhancing the credibility and sustainability of cryptocurrencies as a viable financial medium.

Future Trends in Aml Regulations for Bitcoin 💡

In the rapidly evolving landscape of AML regulations for Bitcoin, future trends point towards enhanced regulatory scrutiny and technological solutions to combat illicit activities. Authorities are exploring innovative approaches to monitor and regulate cryptocurrency transactions, emphasizing the importance of robust compliance measures. As the digital asset space continues to expand, regulators are expected to introduce more stringent AML requirements to ensure the integrity of the financial system.

To dive deeper into the realm of Bitcoin AML regulations, it is crucial to understand the distinctive approaches adopted by different countries. Explore the detailed Bitcoin anti-money laundering (AML) regulations in Australia and the evolving landscape in Armenia to grasp the diverse strategies employed globally in combating financial crimes associated with digital currencies.