Current Landscape: 🌍

In Burundi, the realm of Bitcoin banking services is witnessing an intriguing evolution. The local financial landscape is gradually embracing the concept of digital currency, opening doors to a new era of financial transactions. As more individuals and businesses explore the possibilities of Bitcoin, the current landscape in Burundi is undergoing a noticeable shift, reflecting the global trend towards digital currencies. Exciting opportunities and challenges lie ahead as the country navigates this transformative phase, shaping the future of financial services in a digital world.

Regulatory Challenges: ⚖️

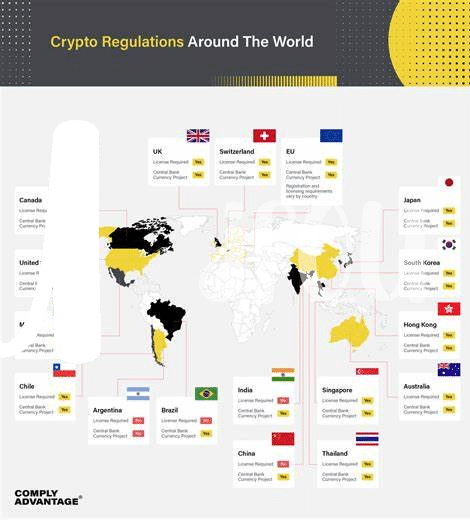

The regulatory landscape surrounding Bitcoin banking services in Burundi presents a complex web of challenges that require careful navigation. Government policies may impact the adoption and expansion of these services, creating uncertainty for businesses and consumers alike. Understanding and adhering to the evolving regulatory framework is crucial to ensure compliance and mitigate potential risks within the burgeoning cryptocurrency sector.

Financial Inclusion Opportunities: 💰

In fostering financial inclusion, Bitcoin banking services in Burundi hold the promise of reaching unbanked populations, providing them with access to essential financial tools and services. By leveraging digital currencies and blockchain technology, these services have the potential to bridge the gap between traditional banking systems and the underserved communities in the country. The convenience, lower costs, and ease of transactions offered by Bitcoin banking can empower individuals and businesses to participate more actively in the formal economy, ultimately contributing to overall economic growth and development in Burundi.

Security Concerns: 🔒

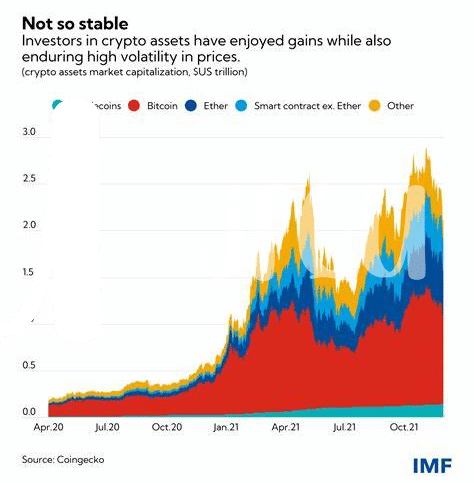

When it comes to utilizing Bitcoin for banking services in Burundi, security concerns are at the forefront. The volatile nature of cryptocurrencies, susceptibility to hacking, and lack of regulatory oversight pose significant risks for users. It’s crucial for individuals and institutions to implement robust security measures, such as cold storage and two-factor authentication, to safeguard their assets. Understanding these risks and taking proactive steps to mitigate them will be essential for the long-term success and adoption of Bitcoin banking services in Burundi.

Remember to check out more insights on **bitcoin banking services regulations in central African Republic** at [this link](https://wikicrypto.news/exploring-the-legal-landscape-bitcoin-banking-in-bosnia).

Technology Adaptation: 📲

As digital currencies like Bitcoin gain traction in Burundi, the country faces the challenge of adapting to new technologies in the financial sector. Embracing mobile banking and secure online transactions is crucial for a seamless integration of Bitcoin into everyday financial activities. This shift towards technology adaptation not only enhances the convenience of banking services but also signifies a progressive step towards a more inclusive financial system. Striking a balance between traditional banking practices and innovative technological solutions is key to unlocking the full potential of Bitcoin banking services in Burundi.

Potential Impact on Economy: 💼

The integration of Bitcoin banking services in Burundi could potentially revolutionize the economy by offering faster, cheaper, and more secure transactions. Economic growth may be stimulated through increased financial inclusion, as individuals without traditional banking access can now participate in the financial system. This influx of new participants could lead to a boost in investment, entrepreneurship, and overall economic activity. Additionally, the adoption of this innovative technology may streamline processes, reduce transaction costs, and enhance transparency, ultimately contributing to a more efficient and vibrant economy.

For more information on Bitcoin banking services regulations in Cabo Verde, please refer to the Bitcoin banking services regulations in Bosnia and Herzegovina.