Challenges of Traditional Remittance Methods in Yemen 🌍

Traditional remittance methods in Yemen face a multitude of challenges that hinder the efficiency and accessibility of cross-border transactions. High fees imposed by intermediaries often eat into the already limited funds that individuals are trying to send to their families. Lengthy processing times further exacerbate the financial strain on both the sender and the recipient, especially in urgent situations where immediate access to funds is crucial. Limited access to traditional banking services, particularly in rural areas, adds another layer of difficulty for those seeking to send and receive remittances efficiently and securely. Additionally, fluctuating exchange rates can lead to unpredictable outcomes, causing recipients to ultimately receive less money than initially intended.

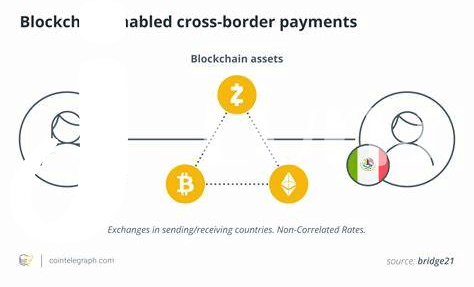

Benefits of Using Bitcoin for Cross-border Transactions 💸

Bitcoin represents a transformative solution for cross-border transactions, offering a range of distinct advantages for users. One key benefit is the efficiency and speed of transactions, enabling individuals to bypass traditional banking systems’ delays and high fees. Additionally, Bitcoin’s decentralized nature provides a level of financial autonomy that can be particularly beneficial in regions like Yemen, where access to traditional banking services may be limited. Furthermore, the transparency inherent in Bitcoin transactions helps to build trust between parties involved in remittances, reducing the potential for fraud or disputes. This newfound level of security can significantly enhance the overall experience for individuals sending and receiving funds across borders. The use of Bitcoin in cross-border transactions not only streamlines the process but also opens up new avenues for financial inclusion and empowerment. As awareness and adoption of Bitcoin grow in Yemen, the potential for socioeconomic development through these innovative remittance channels becomes increasingly promising.

Increased Financial Inclusion through Cryptocurrency 📈

Cryptocurrency offers a pathway to financial inclusion for the unbanked population in Yemen. By utilizing digital currencies like Bitcoin, individuals who lack access to traditional banking systems can now participate in the global economy. This opens up opportunities for them to send and receive money securely and efficiently, bypassing the barriers imposed by traditional financial institutions. The decentralized nature of cryptocurrencies eliminates the need for intermediaries, reducing transaction costs and increasing the speed of cross-border remittances. As more people in Yemen embrace cryptocurrency, the financial landscape becomes more inclusive, empowering individuals to take control of their economic futures and participate in global financial markets.

Security and Transparency Advantages of Bitcoin Transactions 🔒

Bitcoin transactions offer a safeguarded approach to financial exchanges due to their cryptographic nature, ensuring enhanced security and confidentiality for participants. This blockchain-based system provides transparency through its decentralized ledger, allowing for traceability and verification of transactions without the need for intermediaries. Moreover, the use of public and private keys in Bitcoin transactions adds an extra layer of protection, minimizing the risk of fraud or unauthorized access. As a result, individuals engaging in cross-border remittances in Yemen can benefit from the security and transparency inherent in utilizing Bitcoin for their financial transactions.

For more information on legal aspects related to using Bitcoin for overseas transfers, especially in the context of Yemen, you can refer to this insightful article on bitcoin cross-border money transfer laws in Vietnam.

Impact of Bitcoin on Socio-economic Development in Yemen 🌱

Bitcoin has the potential to revolutionize the socio-economic landscape in Yemen by providing a decentralized and secure platform for cross-border transactions. By utilizing Bitcoin for remittances, individuals in Yemen can bypass traditional banking systems, which are often slow and costly. This not only facilitates faster and more cost-effective money transfers but also empowers individuals by giving them greater control over their finances. Additionally, the transparency inherent in Bitcoin transactions can help combat corruption and ensure that funds reach their intended recipients, further contributing to the socio-economic development of Yemen. The adoption of Bitcoin in remittance transactions has the potential to create a more inclusive financial system in Yemen, where individuals who were previously underserved by traditional banking structures can now participate in the global economy and access financial services.

Future Potential and Growth of Bitcoin Remittances in Yemen 🚀

The future potential and growth of Bitcoin remittances in Yemen are poised for significant expansion in the coming years. As cryptocurrency adoption continues to gain momentum globally, more individuals in Yemen are likely to turn to Bitcoin for cross-border transactions due to its speed, cost-effectiveness, and accessibility. This shift towards utilizing Bitcoin for remittances can lead to a more efficient and secure way of transferring funds across borders, ultimately benefiting both senders and recipients in Yemen. Additionally, as awareness and understanding of Bitcoin increases, there is potential for a growing network of users who can further drive the usage and acceptance of cryptocurrency in the country, fostering a more inclusive and resilient financial ecosystem.

Insert link: Bitcoin cross-border money transfer laws in Venezuela