Bitcoin’s Impact on Traditional Money Transfer 💰

Bitcoin has revolutionized the landscape of traditional money transfers, offering a decentralized and efficient method that transcends borders. This innovative digital currency, often referred to as the future of money, has significantly impacted how funds are transferred internationally. By eliminating the need for intermediaries, Bitcoin streamlines the process, reducing both costs and transaction times. This disruption to the traditional money transfer system is particularly notable in regions like Afghanistan, where conventional banking infrastructure may be limited. With Bitcoin, individuals can securely send and receive funds without being tied to traditional financial institutions. This shift towards digital currencies not only enhances the speed and affordability of money transfers but also promotes financial inclusivity by providing access to those who were previously underserved. The versatility and accessibility of Bitcoin are reshaping the way people think about sending money across borders, marking a significant step towards a more interconnected global economy.

Challenges and Opportunities for Afghanistan 💡

Bitcoin’s rise as a digital currency presents both challenges and opportunities for Afghanistan. The country, faced with a volatile economy and limited access to traditional banking services, sees potential in embracing cryptocurrencies for financial transactions. However, this shift also brings its own set of hurdles, including regulatory uncertainties and technological infrastructure gaps. While the adoption of Bitcoin could streamline cross-border payments and boost financial inclusion for Afghan citizens, there is a pressing need for comprehensive strategies to navigate the risks and maximize the benefits in this evolving landscape.

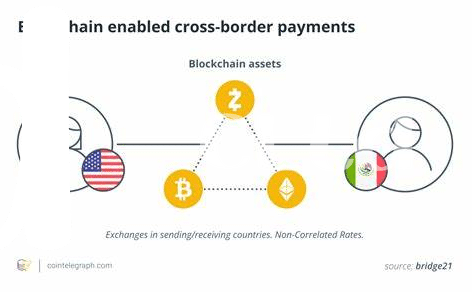

Furthermore, the emergence of blockchain technology offers a promising avenue for transforming financial systems in Afghanistan. By leveraging secure and transparent ledger systems, the country can improve transaction efficiency and enhance trust in financial operations. As Afghanistan explores the potential of Bitcoin and blockchain, there is a unique opportunity to reshape its money transfer laws and drive sustainable economic growth through innovation and regulatory alignment.

The Role of Blockchain Technology 🌐

Blockchain technology has revolutionized the way transactions are conducted, offering secure, transparent, and decentralized systems. Its decentralized nature means that no single entity controls the network, ensuring trust and eliminating the need for intermediaries. This technology’s immutability and transparency provide a secure and efficient platform for financial transactions, making it an ideal solution for countries like Afghanistan seeking to enhance their financial infrastructure. Additionally, blockchain technology allows for greater financial inclusion by providing access to financial services for those who are underserved or excluded from traditional banking systems. By leveraging blockchain technology, Afghanistan can streamline money transfer processes, reduce costs, and increase the efficiency and security of cross-border transactions. This innovation has the potential to significantly impact the financial landscape of Afghanistan, empowering its citizens by providing access to a more inclusive and transparent financial system.

Regulations and Legal Considerations 📜

Bitcoin’s increasing prominence raises pertinent questions about regulatory frameworks and legal implications, particularly in Afghanistan. As governments grapple with the evolving landscape of digital currencies, there is a pressing need for clear guidelines to govern the use of cryptocurrencies such as Bitcoin within existing financial systems. The intersection of innovative technology and traditional finance necessitates a delicate balance to ensure consumer protection, prevent illicit activities, and foster financial stability. Countries like Algeria are already exploring ways to adapt regulations to accommodate the rise of cryptocurrencies and enhance cross-border money transfers. To delve deeper into these dynamics, exploring how Bitcoin is reshaping financial laws globally sheds light on the intricate interplay between emerging technologies and regulatory environments. Notably, initiatives such as the one detailed in the article on innovations in Bitcoin to overcome Zimbabwe’s currency controls underscore the transformative potential of cryptocurrencies in navigating regulatory challenges and fostering economic empowerment.

Empowering Afghan Citizens through Financial Inclusion 🌍

Bitcoin has opened up new avenues for financial inclusion in Afghanistan, offering a lifeline to many citizens who were previously excluded from traditional banking systems. By embracing this digital currency, Afghan individuals and businesses can now access financial services with greater ease, crossing barriers that were once insurmountable. This empowerment through financial inclusion is not just about money; it’s about fostering a sense of belonging and participation in the global economy. As more Afghans become part of this digital financial ecosystem, the potential for economic growth and prosperity within the country rises, creating a more connected and resilient society. The promise of financial inclusion through Bitcoin is not just a concept but a tangible reality that is transforming lives and opening doors to a brighter future for the people of Afghanistan.

Future Prospects and Global Integration 🚀

The integration of Bitcoin into Afghanistan’s financial landscape holds immense potential for advancing global financial systems and fostering economic connectivity. As the world increasingly embraces digital currencies, Afghanistan stands on the brink of a transformative era in financial inclusion and cross-border transactions. This shift towards a more decentralized and borderless financial ecosystem not only amplifies the prospects for economic growth within the country but also opens doors for enhanced global integration. With blockchain technology at its core, Bitcoin offers a decentralized and secure platform for financial transactions, transcending geographical boundaries and traditional banking limitations. The future outlook for Bitcoin in Afghanistan points towards a more interconnected global economy, where individuals and businesses can seamlessly transact across borders, spur innovation, and drive sustainable development. Embracing this digital revolution could pave the way for enhanced trade relationships and financial empowerment, propelling Afghanistan into a new era of financial prosperity and global influence.

Link to foreign exchange controls affecting Bitcoin in Zambia with anchor “foreign exchange controls affecting Bitcoin in Zimbabwe”: foreign exchange controls affecting Bitcoin in Zimbabwe