Understanding Bitcoin: More Than Digital Gold 💰

Many people think of Bitcoin as electronic money, but it’s way more interesting than that. Imagine finding a kind of money that isn’t controlled by any government or bank, but by everyone who uses it. That’s Bitcoin for you. It’s like having a treasure chest in your pocket, except this treasure can be sent across the world in minutes without needing to ask permission from anyone. This special money works because of a technology called blockchain, which makes sure everything is fair and secure without needing a middleman.

Now, you might hear folks calling Bitcoin ‘digital gold,’ and there’s a good reason for that. Just like gold, there’s only so much Bitcoin to go around. This scarcity is part of what makes it valuable. But unlike gold, which you can physically hold, Bitcoin lives on the internet. This makes it super handy for buying things online or sending money to someone far away. To sum it up, Bitcoin isn’t just digital money; it’s a new way of thinking about what money can be in our connected world.

| Feature | Bitcoin | Gold | Traditional Money |

|---|---|---|---|

| Scarcity | Yes, only 21 million will ever exist. | Yes, limited by nature. | No, can be printed endlessly. |

| Decentralization | Yes, controlled by a network. | No, mining locations are controlled. | No, controlled by governments/banks. |

| Portability | High, can be sent globally. | Low, physical movement needed. | Medium, digital but needs institutions. |

| Divisibility | High, can be divided into tiny parts. | Low, hard to divide and use. | Medium, divisible but with limitations. |

Why Bitcoin Is Called Deflationary 📉

Bitcoin, often compared to digital gold, has a unique attribute that sets it apart from traditional money – it’s designed to be finite. Just like how gold is rare, Bitcoin’s software caps its quantity at 21 million coins. This built-in scarcity is what gives Bitcoin its deflationary character. In simple terms, deflationary means its value could increase over time, as opposed to regular money that loses buying power because more and more can be printed.

This aspect of Bitcoin sparks a lot of chatter and curiosity. By not allowing an endless supply, Bitcoin behaves differently than the money we use daily, which tends to lose value year after year due to inflation. Imagine if the money in your pocket could buy more, not less, as time goes by. That’s the kind of change Bitcoin introduces, shaking up how we traditionally understand and use money. To further explore how Bitcoin and other digital currencies are reshaping our financial landscape, check out https://wikicrypto.news/exploring-the-impact-of-bitcoin-on-defi-market-expansion for in-depth insights.

The Impact of Limited Bitcoin Supply 🚫

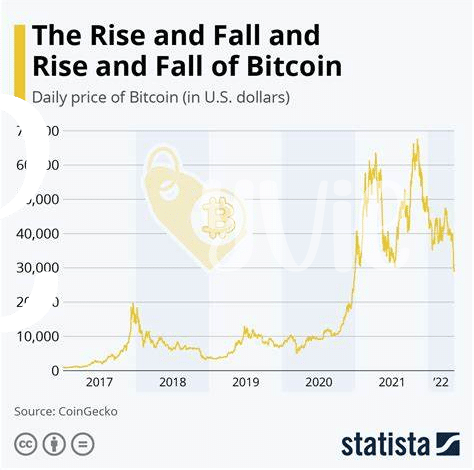

Imagine a world where there’s a finite amount of gold. That’s what happens with Bitcoin. It’s like digital gold, but with a cap on how much can ever be mined – 21 million, to be precise. This rarity is what makes it so special. Just as gold’s limited supply can lead to a rise in its value when more people want it, the same is true for Bitcoin. As fewer bitcoins become available over time (since the rate at which they are produced decreases by half every four years – a process called “halving”), those who hold onto their bitcoins might see their value increase simply because demand is outpacing supply. This creates a unique scenario in our digital age, sparking debates and excitement about how this limited supply could affect everything from personal investment strategies to the broader economic landscape, encouraging a shift in how we view and use money in our increasingly digital world.

Comparing Bitcoin with Traditional Inflationary Currencies 💵

Let’s dive into a friendly chat about money, but not just any kind; we’re focusing on the cool, digital kind known as Bitcoin and how it’s quite different from the money we use daily, like dollars or euros. Imagine you have a magic wallet: if you put a dollar in it, over time, that dollar could buy you less and less stuff—this is what happens with our regular money because there are always more dollars being printed, making each one less special. Now, Bitcoin is like a different kind of magic wallet. It’s unique because there’s a limit on how many Bitcoins can ever exist. This limit helps Bitcoin become more valuable over time, the opposite of our regular money, making it a star player in the digital age.

As we explore this fascinating digital money universe, it’s crucial to understand its role on the global stage. For insights into how Bitcoin is shaking things up from one country to another, check out a country-by-country guide to bitcoin legality market trends. This journey reveals how, unlike traditional currencies that seem to reduce in value, Bitcoin could potentially boost your purchasing power over time. It’s an exciting prospect that is capturing the attention of individuals and businesses worldwide, stirring discussions on what the future of currency looks like. International perspectives provide a broader understanding of Bitcoin’s potential to transform financial landscapes across the globe, leading to a more integrated and economically diverse world.

Economic Effects of Bitcoin’s Deflationary Nature 🌍

When we dive into the world of Bitcoin, we find ourselves exploring a currency that behaves quite differently from what we’re used to. Unlike traditional money that can decrease in value over time because more and more of it gets printed (think about how buying a candy bar is more expensive now than it was when our grandparents were kids), Bitcoin shakes things up by having a fixed amount available. This limitation means that, theoretically, Bitcoin’s value could keep going up as it becomes rarer—kind of like vintage wine or classic cars. This has exciting implications for our economies. For one, it nudges people towards saving rather than spending since their bitcoins could be worth more tomorrow. This saving vs. spending dynamic could lead to lower consumption, potentially slowing economic growth, but it also might foster a more stable economy with less debt. However, it also poses challenges, especially for governments used to injecting more money into their economies to manage inflation. Without the ability to “print” Bitcoin, traditional economic levers won’t work the same way.

| Feature | Traditional Currency | Bitcoin |

|---|---|---|

| Supply | Unlimited, controlled by central banks | Limited to 21 million coins |

| Value Stability | Can decrease over time due to inflation | Potentially increases due to fixed supply |

| Economic Influence | Central banks can adjust supply to influence economy | Limited supply might encourage saving over spending |

Moreover, in places where the local currency is unstable, Bitcoin offers an enticing alternative. Yet, the flip side is that its value can swing wildly, making day-to-day planning hard for businesses and individuals. So, while Bitcoin promises a fascinating world of possibilities, it also brings with it questions and uncertainties we’re only just beginning to explore.

Real-world Cases: Bitcoin’s Influence on Economies 📚

In the bustling markets of Venezuela and Zimbabwe where traditional currencies have taken a hit, Bitcoin has emerged as an unconventional hero. Residents in these countries turned to Bitcoin as a safer option to protect their savings from hyperinflation, showcasing a unique case of how digital currencies can influence economies on a grassroots level. Despite its volatility, Bitcoin offered a semblance of financial stability in regions where the local currency’s value plummeted drastically, illustrating a digital lifeline in times of economic distress.

Beyond individual adoption, the incorporation of Bitcoin into business operations marks a significant shift towards digital finance. A vivid example is seen in the trend of integrating bitcoin payment gateways into online platforms, which not only simplifies transactions for users around the globe but also opens up new avenues for businesses to thrive amidst economic instability. This synergy between Bitcoin and the decentralized finance (DeFi) ecosystem is forging pathways for innovative financial solutions, proving that Bitcoin’s influence extends far beyond mere investment, shaping the very fabric of global economies.