Bitcoin Adoption in Yemen 🌍

Bitcoin adoption in Yemen has been gaining traction in recent years, offering a glimpse into the potential for digital currencies in a region traditionally reliant on cash transactions. Despite facing logistical and regulatory challenges, Yemenis are increasingly turning to Bitcoin as a means of financial inclusion and investment opportunities. This growing adoption reflects a shift towards embracing new technologies in a country where traditional banking services are limited, showcasing the resilience and adaptability of the Yemeni people in a changing financial landscape.

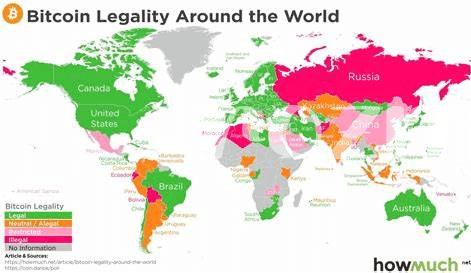

Legal Status and Challenges 💼

Bitcoin faces unique challenges in Yemen due to the lack of legal recognition and regulatory framework. The absence of clear guidelines raises concerns about security, fraud, and consumer protection, hindering widespread adoption. Additionally, the volatile nature of cryptocurrencies adds a layer of complexity, exacerbating skepticism among traditional financial institutions and authorities. Without legal status, Bitcoin transactions operate in a gray area, leaving users vulnerable to potential risks without legal recourse. Overcoming these challenges will require proactive legislative efforts to establish a clear legal framework that addresses the unique considerations of digital currencies in Yemen’s economic landscape.

Impact on Traditional Economy 📉

The introduction of Bitcoin into Yemen’s traditional economy has sparked both excitement and apprehension among its populace. As this digital currency operates independently of traditional banking systems, it presents a novel challenge to the established financial landscape in the country. The fluctuating value of Bitcoin poses a risk to those unfamiliar with its volatility, potentially impacting the stability of Yemen’s traditional economic structures. Furthermore, the decentralized nature of Bitcoin may disrupt the conventional methods of financial transactions, raising concerns about regulatory oversight and consumer protection. Amidst these uncertainties, there exists an opportunity for innovative solutions to emerge, bridging the gap between traditional economic practices and the evolving digital landscape.

Potential Benefits for Yemenis 💰

Bitcoin has the potential to bring significant advantages to the people of Yemen. In a country where access to traditional banking services is limited, the decentralized nature of Bitcoin offers an alternative means of conducting financial transactions. This can empower individuals to participate more actively in the global economy, send and receive funds across borders more easily, and potentially reduce overall transaction costs. Additionally, for Yemenis living abroad, Bitcoin could provide a more efficient way to send remittances back home, bypassing traditional intermediaries and their associated fees. Overall, the potential benefits of Bitcoin for Yemenis extend beyond just financial inclusion, opening up new opportunities for economic empowerment and growth.

Insert link: is bitcoin recognized as legal tender in vanuatu?

Global Perspectives and Implications 🌐

Bitcoin’s global reach has sparked various perspectives and implications. International regulators are closely monitoring its impact on economies worldwide and considering regulatory frameworks. The decentralized nature of Bitcoin raises questions about its potential to disrupt traditional financial systems. However, some view it as a digital asset that could enhance financial inclusion for underserved populations. The adoption of Bitcoin in countries like Yemen could pave the way for a more inclusive and resilient global financial ecosystem. As the debate on Bitcoin’s role in the global economy continues, stakeholders must collaborate to address regulatory challenges and harness its potential benefits for financial innovation.

Future Outlook and Recommendations 🔮

For the future of Bitcoin in Yemen, it is crucial to focus on education and awareness initiatives to ensure that Yemenis understand the risks and benefits associated with cryptocurrency. Providing accessible resources and support for individuals looking to enter the digital asset space can help foster a more inclusive economy. Additionally, collaboration with regulatory bodies and policymakers will be essential to establish a clear framework for the use of Bitcoin within Yemen. Embracing innovation while safeguarding against potential risks will be key in navigating the evolving landscape of digital currencies. is bitcoin recognized as legal tender in venezuela?