Bitcoin 101: the Basics of Digital Gold 🏆

Imagine a world where your money is like a digital treasure, safe and sound, without needing a bank to guard it. That’s what Bitcoin, often called digital gold, offers. It’s like having a vault in your pocket, accessible anywhere you go. Created in 2009, Bitcoin is a pioneer, opening the doors to a place where transactions happen directly between people, skipping the middlemen. It’s all powered by a technology called blockchain, a digital ledger that’s both secure and transparent.

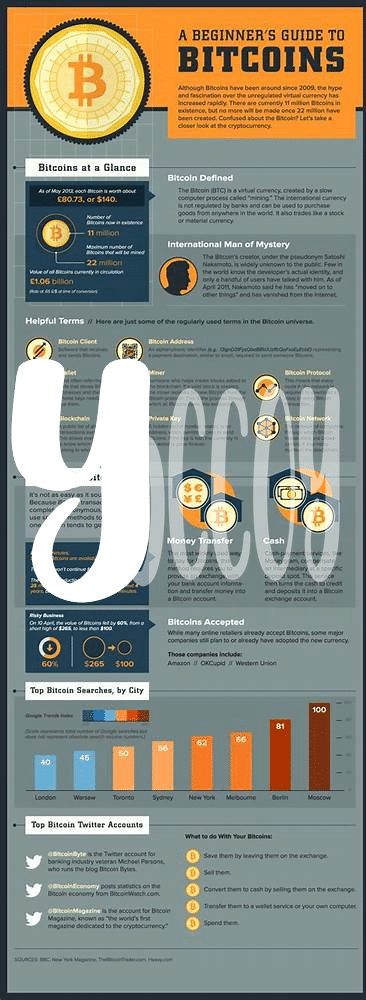

Bitcoin’s value has swung up and down, making headlines, but its real magic lies in its ability to let anyone, anywhere, send and receive money as easily as sending an email. 🌍💫 Below is a quick look at how many bitcoins are out there and how many are yet to be discovered:

| Total Bitcoins to Ever Exist | Bitcoins Already Mined | Bitcoins Left to Mine |

|---|---|---|

| 21 million | Over 19 million | Less than 2 million |

This scarcity is part of what gives Bitcoin its value, drawing comparisons to gold, a precious metal with a limited supply. Yet, unlike gold, you can send Bitcoin across the globe in minutes. It’s no wonder many see it as the future of money. 🚀💰

Unpacking Decentralized Finance: a Beginner’s Guide 🌐

Imagine a world where you don’t need a bank to send money, get a loan, or even save for the future. That’s what decentralized finance, or DeFi for short, is all about. It’s like a big, global financial system that anyone with internet access can join, without needing permission from banks or governments. Instead of having one company or institution in charge, it’s spread out all over the place, like a spider web. This means no single point of failure and, ideally, more security and freedom for its users.

DeFi is built on technology called blockchain, which you might know from Bitcoin, the digital currency that kinda started it all. The cool thing about blockchain is that it keeps a record of all transactions across many computers. This makes it really hard to cheat the system. With DeFi, you can do a lot of the same things you do with traditional banks, but in a way that puts you in control. It’s still early days, but the potential is huge. It could change how we think about money altogether. For a deeper dive into how Bitcoin is paving the way for such innovations, check this out.

How Bitcoin Is Shaping the Future of Money 💰

Imagine a world where you control your money like never before, without needing a bank to guard it. This is what Bitcoin is doing to our concept of money. By operating on a system that is decentralized, meaning it’s spread out across thousands of computers rather than controlled by a single entity, it’s changing the game. No more waiting days for a transaction to clear or facing hefty fees to send money overseas. Bitcoin is making financial transactions faster, cheaper, and accessible to everyone, everywhere. Whether you’re buying a cup of coffee or investing in your future, it empowers you to do so directly and securely. This transformation isn’t just about digitalizing currency; it’s about reimagining the flow of money in a way that serves us all, removing barriers and making financial freedom possible for people around the globe. As more people and businesses embrace Bitcoin, we’re stepping into a new era of finance where control shifts back to the individual, promising a future where money is more democratic and everyone has a fair chance to prosper.

The Pros and Cons of a Decentralized World 🔄

Imagine a world where you’re the boss of your money—no banks, no middlemen, just you and your digital wallet, cruising through the internet bazaar. This dream is becoming a reality, thanks to the magic of decentralized finance. It’s a world where financial empowerment is the name of the game 🎮, and everyone gets a fair shot at the treasure chest. But, like every adventure, there are dragons to slay. On the bright side, this newfound freedom means no more waiting in line at the bank or biting your nails over hidden fees. You’re in control, and that’s a mighty feeling.

However, with great power comes great responsibility. In this open sea of opportunities, it’s easy to get lost or, even worse, fall into a trap. That’s why it’s crucial to arm yourself with knowledge, such as understanding bitcoin payment gateways for beginners. Missteps can lead to your digital treasure vanishing into thin air 💨. Plus, this brave new world is still kind of like the Wild West—exciting, but sometimes lawless. As we navigate this decentralized landscape, weighing the scales of freedom against the risks of the unknown is key. So, let’s embark on this journey together, with eyes wide open to both the treasures and the pitfalls that lie ahead.

Real-world Examples of Bitcoin in Decentralized Finance 🌍

Imagine a world where sending money to your friend in another country is as easy as sending a text message, and buying a coffee doesn’t require a card or cash, but just a tap of your phone. This isn’t a glimpse into a distant, high-tech future; it’s the reality that Bitcoin and decentralized finance (DeFi) are starting to create today 🌍. Picture a small business owner in Africa investing in a project in Europe, or a student in Asia receiving a microloan funded by someone in South America—all without middlemen, hefty fees, or lengthy waiting times. Through Bitcoin, individuals globally are empowered to lend, borrow, and transact directly with one another, using technology to bridge the gap 🌉. DeFi platforms harness the power of Bitcoin to offer services ranging from simple transactions to complex financial products, without the need for traditional banks. This evolution sparks a financial revolution where control and access to money are decentralized, paving the way for a future where financial services are more inclusive, efficient, and in tune with today’s digital world 🚀.

| DeFi Service | Description | Example Platform |

|---|---|---|

| Lending & Borrowing | Users can lend their Bitcoin or borrow against it, often earning interest or paying lower rates than traditional loans. | MakerDAO |

| International Transactions | Send Bitcoin across the globe instantly and with minimal fees, bypassing traditional banking systems. | Lightning Network |

| Investing | Invest in projects and companies worldwide without hefty fees or intermediaries. | Compound |

The Road Ahead: Predictions and Challenges for Bitcoin 🚀

As we gaze into the horizon, the journey of Bitcoin in the ever-evolving landscape of decentralized finance is both thrilling and fraught with challenges. This digital pioneer, shaping the monetary systems of the future, sails into uncharted waters with the promise of transforming how we view and use money. Yet, it’s not all smooth sailing. Bitcoin faces hurdles such as regulatory scrutiny, market volatility, and the ongoing quest for widespread adoption. These challenges are significant, but they also present opportunities for growth, innovation, and the reinforcement of its underlying technology. As Bitcoin continues to break ground, it inspires a wave of financial decentralization, empowering individuals and reshaping global finance. For those eager to dive deeper into the technical underpinnings of Bitcoin, exploring its consensus mechanisms offers valuable insights. Discover more through a comprehensive guide that demystifies one of its foundational aspects, bitcoin paper wallets for beginners, ensuring you’re well-equipped to navigate the complexities of this digital revolution. Looking ahead, the trajectory of Bitcoin is poised to be as transformative as it is unpredictable, promising an enticing blend of advancements and obstacles on the road to redefining the essence of financial autonomy.