Understanding Bitcoin Basics 🌐

Bitcoin operates on a decentralized network known as the blockchain, where transactions are recorded in blocks and secured through cryptography. Unlike traditional currency, Bitcoin is digital and exists solely online, allowing users to send and receive funds without the need for intermediaries like banks or payment processors. Each transaction is verified by a network of computers, ensuring transparency and immutability. The total supply of Bitcoin is capped at 21 million, providing scarcity similar to precious metals like gold. Users store their Bitcoin in digital wallets, which come in various forms such as software, hardware, or even paper. Understanding how Bitcoin works is essential for anyone looking to participate in the growing digital economy, offering new avenues for financial inclusion and empowerment.

Challenges of Cross-border Money Transfers 💸

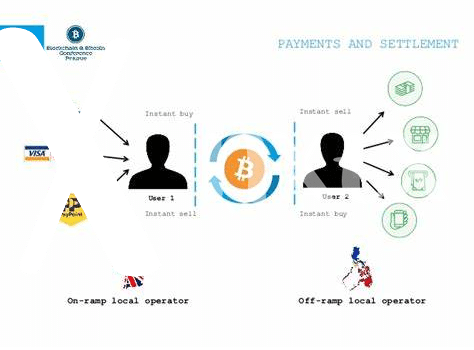

Cross-border money transfers can present a myriad of complexities for individuals and businesses alike. The fluctuations in exchange rates, high transaction fees, and lengthy processing times are just some of the challenges that can impede the smooth transfer of funds across borders. Additionally, the lack of transparency in traditional banking systems often leads to delays and uncertainties in cross-border transactions, making it difficult for senders and recipients to track the progress of their transfers. These challenges can not only result in financial losses but also create frustrations for those relying on timely and efficient money transfers.

In the realm of cross-border money transfers, the obstacles are varied and can significantly impact the overall experience of sending and receiving funds internationally. Finding reliable and cost-effective solutions to navigate these challenges is crucial for individuals and businesses looking to conduct seamless transactions across borders. By exploring alternative options such as digital currencies like Bitcoin, there is potential to overcome some of these hurdles and revolutionize the way cross-border money transfers are executed.

Benefits of Using Bitcoin in Angola 🚀

Using Bitcoin in Angola offers a range of advantages for individuals looking to make cross-border transactions seamlessly. One key benefit is the speed at which Bitcoin transactions can be conducted, especially compared to traditional banking systems. This instantaneous nature of Bitcoin transfers allows individuals to send and receive funds quickly, which is particularly useful in situations requiring urgent money transfers. Additionally, the decentralized nature of Bitcoin means that users have more control over their funds without the need for intermediaries, resulting in lower transaction fees and reduced reliance on third-party financial institutions.

Furthermore, Bitcoin provides a level of financial inclusion to those who may not have access to traditional banking services in Angola. This aspect is crucial in a country where many individuals are unbanked or underbanked, offering them the opportunity to participate in the global financial system. Overall, the benefits of using Bitcoin in Angola extend beyond just convenience, providing a more accessible and cost-effective way for individuals to engage in cross-border money transfers.

Risks and Security Measures 🔐

Bitcoin transactions come with inherent risks and require careful attention to security measures to safeguard your funds. It’s crucial to stay vigilant against potential threats such as hacking, phishing attempts, and unauthorized access to your digital wallet. Implementing strong encryption, using secure and reputable platforms, and regularly updating your security protocols are essential steps in protecting your Bitcoin assets. Additionally, being aware of regulatory requirements, like compliance checklists for sending Bitcoin across borders, can help ensure legality and safety in your transactions. By staying informed and taking proactive security measures, you can mitigate risks and enjoy the benefits of secure cross-border money transfers using Bitcoin. You can check out this comprehensive guide on traveling with Bitcoin: regulations in Equatorial Guinea for further insights on navigating compliance issues (https://wikicrypto.news/compliance-checklist-sending-bitcoin-across-algerias-borders).

Practical Tips for Successful Transactions 💡

For point 5 – Practical Tips for Successful Transactions 💡:

When engaging in cross-border money transfers with Bitcoin in Angola, it’s essential to conduct thorough research on reputable platforms or exchanges that facilitate such transactions. Verify the credibility of the service provider and ensure they have a track record of secure and efficient transactions. Additionally, consider utilizing a secure wallet to store your Bitcoin safely and protect it from potential cyber threats.

When initiating a Bitcoin transfer for cross-border transactions, always double-check the recipient’s wallet address to prevent any errors or potential loss of funds. It’s advisable to start with smaller transaction amounts to ensure familiarity with the process before engaging in more significant transfers. Stay informed about the latest developments in cryptocurrency regulations in Angola to ensure compliance and mitigate any potential risks associated with the evolving landscape of digital assets.

Future Outlook for Bitcoin in Angola 🌍

In recent years, Bitcoin has shown promising potential as a solution for cross-border money transfers in Angola. As the digital currency continues to gain traction globally, there is growing interest in its role within the Angolan financial landscape. With the potential to streamline transactions and reduce costs, Bitcoin could offer a more efficient alternative to traditional banking systems for individuals and businesses alike.

Furthermore, the future outlook for Bitcoin in Angola points towards increased adoption and integration, as more people recognize the benefits it can provide. As regulatory frameworks continue to evolve, it will be crucial to monitor the changing landscape to ensure compliance and security for all parties involved. By staying informed and adapting to emerging trends, stakeholders in Angola can position themselves to leverage the opportunities presented by Bitcoin for cross-border money transfers. For more information on Bitcoin cross-border money transfer laws in Afghanistan, you can refer to the regulations outlined for Algeria by clicking here.