Overview of Bitcoin Anti-money Laundering Regulations 🌐

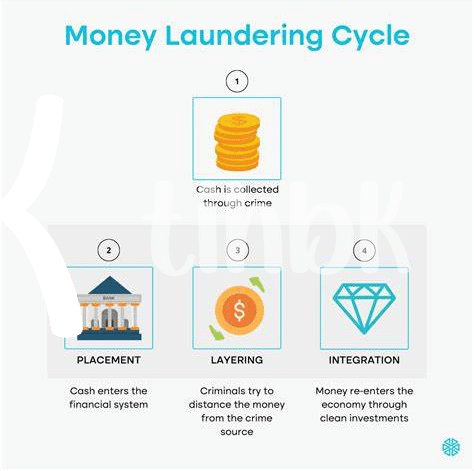

An engaging narrative combined with informative content about Bitcoin anti-money laundering regulations highlights the crucial role of these measures in safeguarding the financial system. These regulations aim to prevent illicit activities such as money laundering and terrorist financing, ensuring transparency and accountability in Bitcoin transactions. By establishing clear guidelines and compliance requirements, these regulations contribute to enhancing trust and credibility within the cryptocurrency industry.

Furthermore, understanding the intricacies of Bitcoin anti-money laundering regulations is essential for all stakeholders involved in cryptocurrency transactions. Compliance with these regulations not only protects the integrity of the financial system but also promotes the legitimacy and adoption of Bitcoin as a reliable form of digital currency. As countries like Morocco navigate the evolving landscape of financial security, staying abreast of anti-money laundering regulations is key to fostering a safe and sustainable environment for Bitcoin users and investors.

Morocco’s Compliance Measures with International Standards 🇲🇦

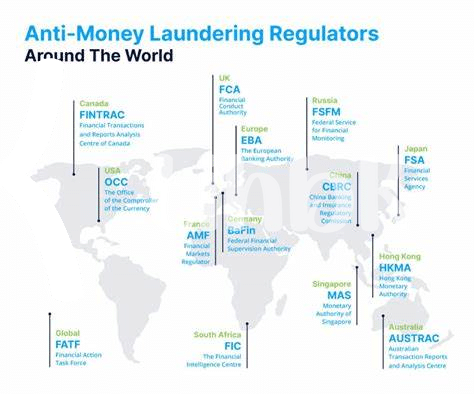

Morocco has actively aligned its financial regulatory framework with international standards to combat money laundering and terrorist financing. By incorporating global best practices, the country has enhanced transparency and accountability in its financial sector. The adoption of stringent policies underscores Morocco’s commitment to upholding the integrity of its financial system, fostering trust, and promoting stability in the digital currency landscape. This proactive approach reflects the government’s dedication to safeguarding the interests of both investors and the public, positioning Morocco as a responsible player in the international fight against illicit financial activities. Collaboration with global stakeholders highlights Morocco’s proactive stance in ensuring a secure environment for financial transactions, reinforcing its position as a key player in the global landscape.

Morocco’s proactive engagement with international regulations demonstrates its commitment to creating a robust anti-money laundering (AML) framework that meets global expectations. The focus on compliance with international standards underscores Morocco’s determination to enhance financial security and combat illicit activities, setting a positive example for other nations to follow. Embracing transparency and accountability in financial transactions, Morocco’s adherence to international standards not only strengthens its position in the global financial community but also enhances trust among investors and the broader public. As Morocco continues to navigate the evolving landscape of digital currencies, its dedication to upholding international standards serves as a beacon of progress and sets a solid foundation for a secure and compliant financial ecosystem.

Impact of Aml Regulations on Bitcoin Users 💰

Bitcoin users in Morocco are finding themselves navigating a new landscape as Anti-Money Laundering (AML) regulations shape the way they engage with digital currency. These regulations have brought about increased transparency in transactions, requiring users to provide more detailed information for verification. While this has bolstered security measures, some users feel a loss of anonymity and privacy in their dealings. Overall, the impact of AML regulations on Bitcoin users is a mixed bag, with enhanced security measures but also a shift in the traditional ethos of anonymity associated with cryptocurrencies.

Challenges Faced in Implementing Aml Frameworks ⚖️

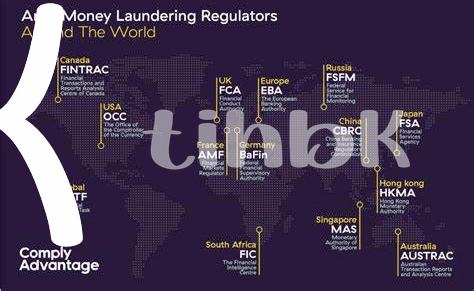

Challenges in implementing Anti-money Laundering (AML) frameworks can pose hurdles for regulatory authorities and businesses alike. The complexity of tracking and verifying Bitcoin transactions, combined with the decentralized nature of cryptocurrencies, creates a unique set of challenges. One major issue is ensuring compliance without stifling innovation or hindering the ease of use for legitimate users. Additionally, the global nature of Bitcoin transactions adds another layer of complexity, as coordinating AML efforts across borders can be challenging. Finding the right balance between security and accessibility is crucial in navigating these obstacles effectively.

Implementing AML frameworks requires coordination and collaboration between relevant stakeholders, including regulators, financial institutions, and technology providers. Additionally, ongoing education and training programs are essential to keep up with the evolving landscape of Bitcoin transactions and money laundering techniques. By addressing these challenges head-on and continuously adapting to new developments in the crypto space, Morocco can strengthen its financial security framework and better protect against illicit activities.

Future Outlook for Bitcoin and Aml in Morocco 🔮

Morocco’s proactive stance on implementing Anti-money Laundering regulations for Bitcoin sets a promising tone for the future landscape in the country. As the regulatory framework evolves to meet international standards, it fosters a secure environment for Bitcoin users to engage in transactions confidently. This alignment with global AML requirements not only enhances financial security locally but also strengthens Morocco’s position in the broader digital economy.

Looking ahead, the synergy between Bitcoin and AML regulations in Morocco is poised to facilitate greater adoption and trust in cryptocurrency transactions. By fostering a compliant ecosystem, the country lays a foundation for sustainable growth and innovation in the evolving landscape of digital finance. The future outlook holds the promise of a harmonious balance between regulatory compliance and technological advancement, paving the way for secure and seamless Bitcoin transactions in Morocco.

Recommendations for Ensuring Financial Security in Bitcoin Transactions 🔒

One crucial aspect to ensure financial security in Bitcoin transactions is to educate users on best practices for safeguarding their assets. Encouraging the use of secure wallets, implementing two-factor authentication, regularly updating software, and monitoring transactions are essential steps individuals can take. Additionally, promoting transparency and compliance with AML regulations not only enhances security but also builds trust within the ecosystem. Collaborating with regulatory bodies and industry stakeholders to stay updated on emerging threats and technological advancements is vital for maintaining a secure environment for Bitcoin transactions.