🏦 Central Banks: Friends or Foes of Bitcoin?

When we think about central banks and Bitcoin, it’s a bit like wondering if cats and dogs can be best friends. Some people believe they can get along and help each other, while others think they’re just too different. Central banks are like the big schools where all the money rules are made. They decide how much money to print and try to keep everything stable. Bitcoin, on the other hand, likes to play by its own rules. It’s digital, moves around the globe without asking permission, and its value can jump up and down like a frog in a rainstorm.

The reaction from central banks to Bitcoin is mixed. Some see it as a futuristic tool that could change how we think about money forever. Others scratch their heads, worried that if Bitcoin becomes too big, it might make their job of keeping money safe and stable a bit tricky. To see how different countries feel about Bitcoin, let’s take a look at this simple table:

| Country | Central Bank’s Stance on Bitcoin |

|---|---|

| USA | Curiously cautious |

| China | Not a fan |

| El Salvador | Big thumbs up |

| Germany | Openly optimistic |

From this, it’s clear that the stance on Bitcoin varies widely. So, are central banks friends or foes of Bitcoin? Well, it looks like the answer depends on where you’re standing.

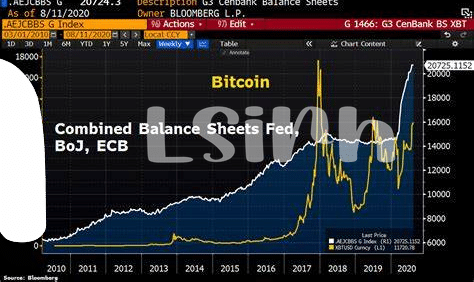

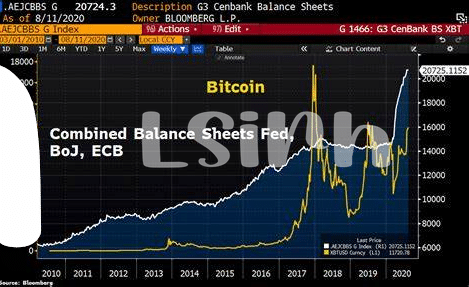

💸 the Ripple Effect on Bitcoin Prices

When central banks decide to either criticize or embrace Bitcoin, it sends waves through the market, somewhat like when you throw a stone into a pond. Picture this: a big bank says something positive, and suddenly, more people want to buy Bitcoin, pushing prices up. Or, if there’s a negative comment, folks might get nervous and sell, causing prices to drop. It’s like a financial game of “follow the leader,” where the bank’s opinion can sway the market. For a deeper dive into how these actions can ripple through not just Bitcoin, but other digital currencies too, there’s an insightful read available. Check it out here. Now, this isn’t just about what one bank says at one time. It’s a pattern that can repeat, influencing how people feel about Bitcoin. Trust plays a big role too. The more people trust Bitcoin, the more they’re willing to invest, and this confidence can also help stabilize prices over time. So, while the central bank’s views can cause immediate ups and downs, the long-term trust and adoption of Bitcoin by everyday folks and investors can help soften these ripples, charting a more steady course ahead.

🌍 a Global Perspective: Different Countries, Different Stances

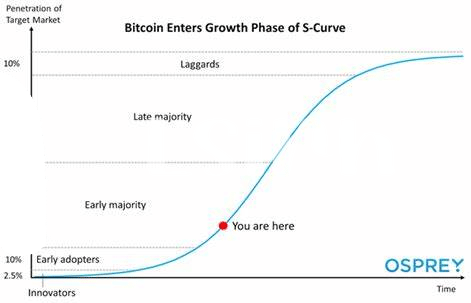

Just like people have different tastes in food, countries have different opinions about Bitcoin. Imagine Bitcoin as a new dish being introduced globally. Some countries are eager to try it, seeing it as a chance to spice up their financial systems. Meanwhile, others are more cautious, worrying it might upset their economic stomachs. For instance, while countries like Japan have welcomed it with open arms, setting up regulations to safely integrate it into their financial menu, others like China have put restrictions, concerned about the potential risks it brings to their economic table. This mix of reactions influences how people view and use Bitcoin, affecting its price like a chef’s reputation influences a restaurant’s success. The more countries get on board, seeing Bitcoin as a positive addition, the more its value tends to rise. However, when countries push it away, it’s like a negative review that can cause its price to drop. This global dance of acceptance and rejection plays a crucial role in Bitcoin’s journey, making its financial story as diverse and complex as the world itself.

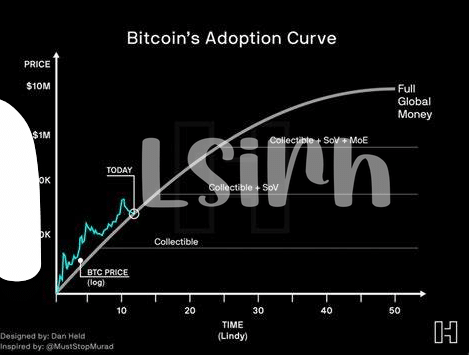

🔒 Safety First: How Trust Shapes Adoption

When we talk about the big digital currency called Bitcoin, a lot of folks wonder whether they can trust it just like they trust the money in their wallets. This trust is a big deal because, without it, people might not feel comfortable using Bitcoin, slowing down its acceptance. Just like we trust that a $10 bill will be accepted at the store, people need to feel sure that their Bitcoin holds value too. This is where safety comes into play. Making sure Bitcoin is safe to use helps build this trust. Think of it like a safety net for your digital money, ensuring that it’s protected just like the cash in your bank.

To learn more about how Bitcoin’s future prices might be affected, especially with events that could shake up its value, you might want to check out what you need to know about bitcoin halving events market trends. Across the globe, the way people feel about the safety of Bitcoin varies a lot. In some places, strong regulations and protective measures make people feel secure in using Bitcoin, boosting its adoption. In other spots, concerns about its safety might hold people back. Understanding and addressing these concerns is vital for getting more folks to jump on the Bitcoin train, making it as regular a part of their lives as online banking or tap-to-pay with their phones.

📈 Charting the Ups and Downs: a Price Analysis

Bitcoin’s journey has been like a thrilling rollercoaster ride; one moment, it’s reaching dizzying heights, and the next, it’s plunging into deep valleys. This volatility is largely influenced by public sentiment, national regulations, and technological advancements. Imagine watching a graph line dance wildly as people react to news or policy changes. It’s this unpredictability that makes Bitcoin stand out in the financial world, offering both high risks and the potential for high rewards.

| Date | Event | Price Impact |

|---|---|---|

| January 1, 2021 | New Year optimism | 📈 Surge |

| April 15, 2021 | Regulatory crackdown rumors | 📉 Drop |

Yet, amid the chaos, a pattern emerges. Periods of innovative breakthroughs and positive regulation see the currency soar, while uncertainty or negative press can cause it to stumble. For potential investors and the curious alike, understanding these patterns doesn’t just offer insights into Bitcoin’s past. It’s like having a crystal ball, offering a peek at possible future trends, and who wouldn’t want a glimpse into tomorrow?

💡 Bitcoin Futures: a Glimpse into Tomorrow

Imagine stepping into a world where you can have a sneak peek at tomorrow’s Bitcoin value. That’s the magic of Bitcoin futures! 🌟 These financial agreements let investors bet on what they think Bitcoin will be worth at a future date. It’s like making a promise today to buy or sell Bitcoin at a predetermined price later on, sort of like a time machine for your investments. This opens up a whole new playground for both the cautious and the daring. But here’s the twist: diving into this world requires understanding the fine balance between opportunity and risk. And speaking of understanding, getting to grips with how to engage in bitcoin futures trading market trends can tremendously boost your crypto journey, making it less about guesswork and more about strategy. So, in a nutshell, Bitcoin futures are not just a speculative adventure; they’re also a window to the future, offering clues about market sentiment and potential price movements. 🚀🔮